Minion, Inc., has no debt outstanding and a total market value of $284,900. Earnings before interest and taxes, EBIT, are projected to be $44,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 29 percent lower. The company is considering a $150,000 debt issue with an interest rate of percent. The proceeds will be used to repurchase shares of stock. There are currently 7,700 shares outstanding. Ignore taxes for questions a) and b). Assume the company has a market-to-book ratio of 1.0 and the stock price remains constant. a-1. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2

Minion, Inc., has no debt outstanding and a total market value of $284,900. Earnings before interest and taxes, EBIT, are projected to be $44,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 29 percent lower. The company is considering a $150,000 debt issue with an interest rate of percent. The proceeds will be used to repurchase shares of stock. There are currently 7,700 shares outstanding. Ignore taxes for questions a) and b). Assume the company has a market-to-book ratio of 1.0 and the stock price remains constant. a-1. Calculate return on equity, ROE, under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter15: Capital Structure Decisions

Section: Chapter Questions

Problem 11P: The Rivoli Company has no debt outstanding, and its financial position is given by the following...

Related questions

Question

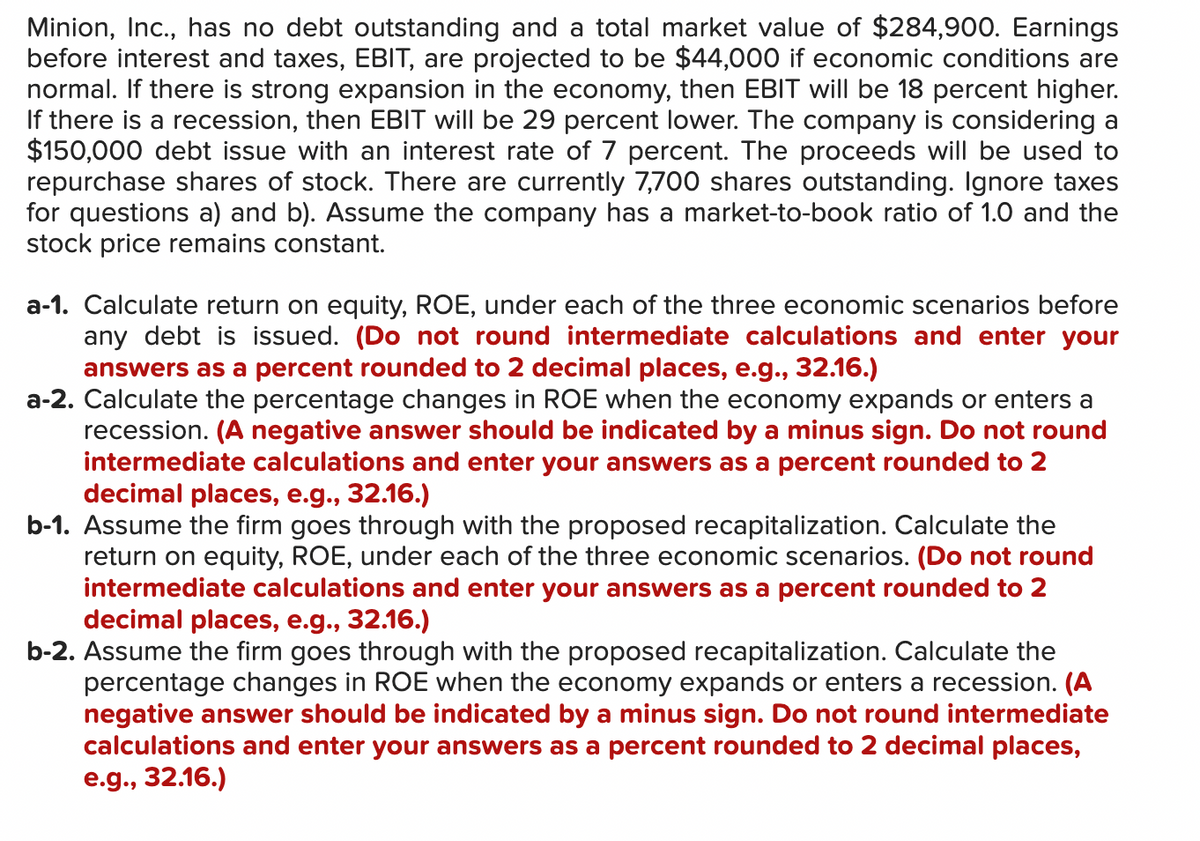

Transcribed Image Text:Minion, Inc., has no debt outstanding and a total market value of $284,900. Earnings

before interest and taxes, EBIT, are projected to be $44,000 if economic conditions are

normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher.

If there is a recession, then EBIT will be 29 percent lower. The company is considering a

$150,000 debt issue with an interest rate of 7 percent. The proceeds will be used to

repurchase shares of stock. There are currently 7,700 shares outstanding. Ignore taxes

for questions a) and b). Assume the company has a market-to-book ratio of 1.0 and the

stock price remains constant.

a-1. Calculate return on equity, ROE, under each of the three economic scenarios before

any debt is issued. (Do not round intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-1. Assume the firm goes through with the proposed recapitalization. Calculate the

return on equity, ROE, under each of the three economic scenarios. (Do not round

intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-2. Assume the firm goes through with the proposed recapitalization. Calculate the

percentage changes in ROE when the economy expands or enters a recession. (A

negative answer should be indicated by a minus sign. Do not round intermediate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning