Concept explainers

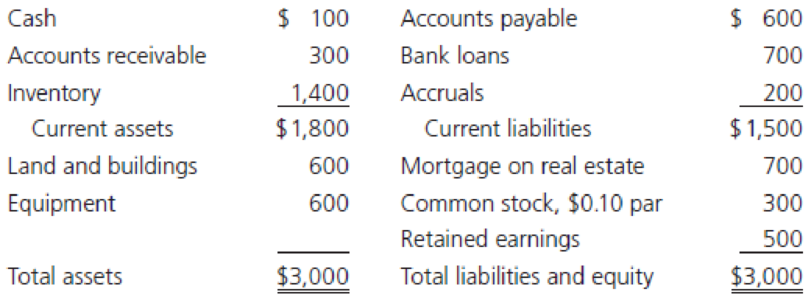

The Raattama Corporation had sales of $3.5 million last year, and it earned a 5% return (after taxes) on sales. Recently, the company has fallen behind in its accounts payable. Although its terms of purchase are net 30 days, its accounts payable represents 60 days’ purchases. The company’s treasurer is seeking to increase bank borrowing in order to become current in meeting its trade obligations (that is, to have 30 days’ payables outstanding). The company’s balance sheet is as follows (in thousands of dollars):

- a. How much bank financing is needed to eliminate the past-due accounts payable?

- b. Assume that the bank will lend the firm the amount calculated in part a. The terms of the loan offered are 8%, simple interest, and the bank uses a 360-day year for the interest calculation. What is the interest charge for 1 month? (Assume there are 30 days in a month.)

- c. Now ignore part b and assume that the bank will lend the firm the amount calculated in part a. The terms of the loan are 7.5%, add-on interest, to be repaid in 12 monthly installments.

- (1) What is the total loan amount?

- (2) What are the monthly installments?

- (3) What is the APR of the loan?

- (4) What is the effective rate of the loan?

- d. Would you, as a bank loan officer, make this loan? Why or why not?

a)

To determine: Size of bank loan.

Explanation of Solution

Calculation of size of bank loan:

Therefore, the size of bank loan is $300,000

Alternatively, one might simply recognize that accounts payable should be cut ½ of its existing result, because 30 days is ½ of 60 days.

b)

To determine: Interest charge per month.

Explanation of Solution

Calculation of simple interest per day:

Hence, simple interest per day is 0.000222222

Calculation of interest charge per month:

Hence, interest charge per month is $2,000

c)

1)

To determine: Total loan amount

Explanation of Solution

Calculation of total loan amount:

Hence, interest is $22,500

Therefore, total loan amount is $322,500

2)

To determine: Monthly instalments.

Explanation of Solution

Calculation of monthly instalments:

Hence, monthly instalments is $26,875

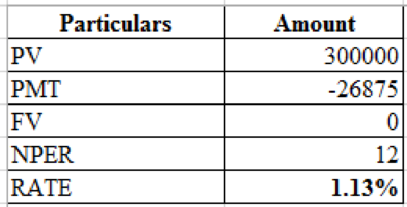

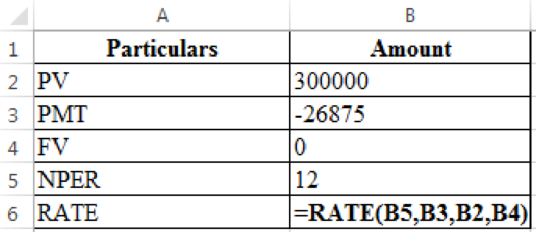

3)

To determine: APR (Annual percentage rate) of the loan.

Explanation of Solution

Calculation of APR on loan:

Working note:

Monthly rate is 1.13% so,

For 12 months,

Hence, APR on loan is 13.57%

4)

To determine: Effective rate on loan.

Explanation of Solution

Calculation of effective rate on loan:

Hence, Effective rate on loan is 14.44%

d)

To discuss: Whether person X as a bank officer to make this loan or not.

Explanation of Solution

The decision should be based on rule-of-thumb comparison,

Debt ratio: The debt ratio is 73% as compared to typical debt ratio of 50% so the company appears is to be undercapitalized.

Current ratio: The current ratio seems to be low, however current assets might cover current liabilities if all assets are collected and if inventory can be liquidated at its book value.

Quick ratio: Quick ratio indicates current assets, and excluding inventory, are solely adequate to cover 27% of current liabilities which is considered as worse.

Therefore, the company seems to be carrying additional inventory and financing extensively with debt. Bank borrowings are already high and therefore the liquidity situation is poor. Based on these observations the loan could be unused, and therefore, the treasurer should be suggested to seek permanent capital, particularly equity capital.

Want to see more full solutions like this?

Chapter 21 Solutions

Intermediate Financial Management (MindTap Course List)

- Historically, Ragman Company has had no significant bad debt experience with its customers. Cash sales have accounted for 20 percent of total sales, and payments for credit sales have been received as follows: 40 percent of credit sales in the month of the sale 35 percent of credit sales in the first subsequent month 20 percent of credit sales in the second subsequent month 5 percent of credit sales in the third subsequent month The forecast for both cash and credit sales is as follows. Required: 1. What is the forecasted cash inflow for Ragman Company for May? 2. Due to deteriorating economic conditions, Ragman Company has now decided that its cash forecast should include a bad debt adjustment of 2 percent of credit sales, beginning with sales for the month of April. Because of this policy change, what will happen to the total expected cash inflow related to sales made in April? (CMA adapted)arrow_forwardJames Inc. currently has P750,000 in accounts receivable, and its day sales outstanding (DSO) is 55 days. It wants to reduce its DSO to 35 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year.arrow_forwardABC Corp. has net credit sales of P1,440,000 yearly with credit terms of n/30, which is also the average collection period. BECK does not offer discounts for early payment; thus, customers take the full 30 days to pay. (Use 360 days/year) If BECK offered 2% discount for payment in 10 days and every customer took advantage of the new terms, what would the new averagereceivable balance be? Continuing from the situation in (1), if BECK reduces its bank loans which cost 10%, by the cash generated from reduced receivables, what will be the net gain/loss to the firm?arrow_forward

- Last year, the sales of OSP Inc. Amounted to R5 million and its most recent statement of financial position revealed trade receivables of R822 000. All sales were on 30 days’ credit to customers. In order to encourage customers to pay in time, the management accountant of OSR Inc has proposed introducing an early settlement discount of 1% for payment within 30 days, while increasing its normal credit period to 45 days. It is expected that, on average, 60% of customers will take the discount and pay within 30 days. 30% of the customers will pay after 45 days, and the rest of the customers will not change their current paying behaviour, OSP Inc. Is charge interest of 12% per annum on its overdraft facility Required: Determine the net benefit (cost) of the proposed changes in trade receivables policy A. Net cost of approximately R7 000 B. Net benefit of approximately R 13000 C. Net cost of approximately R 13 000 D. Net benefit of approximately R 7 000arrow_forwardHarrelson Inc. currently has $750,000 in accounts receivable, and its days sales outstanding (DSO) is 55 days. It wants to reduce its DSO to 35 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company’s average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year.arrow_forwardThe Dire Corporation has an inventory conversion period of 75 days, a receivables collection period of 38 days, and a payables deferral period of 30 days. What is the length of the firm’s cash conversion cycle? If Dire’s annual sales are $3,421,875 and all sales are on credit, what is the firm’s investment in accounts receivable? How many times per year does Dire turn over its inventory?arrow_forward

- Campbell Computing Inc. expects to have sales this year of $30 million under its current credit policy. The company offers a credit term of 2/8, net 20. Currently, 60 percent of paying customers take the discount and rest are paying on time. The bad debt loss is 2 percent. The company has a profit margin of 20%, and uses a 5% short-term bank loan to finance its accounts receivables. With 365-day a year assumption, please calculate the following items: a. The bad debt loss of the company this year b. The annual discount given to customers c. The accounts receivables level d. The financing cost of accounts receivablesarrow_forwardTaylor Glass has annual sales of $1,790,000. Although it extends credit for 30 days (n30), the receivables are 20 days overdue. What is the average accounts receivable outstanding, and how much could the company save in interest expense if customers paid on time and if it costs Taylor Glass 9 percent to carry its receivables? Assume 360 days in a year. Round your answers to the nearest cent. Accounts receivable: $ Interest saved: $arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning