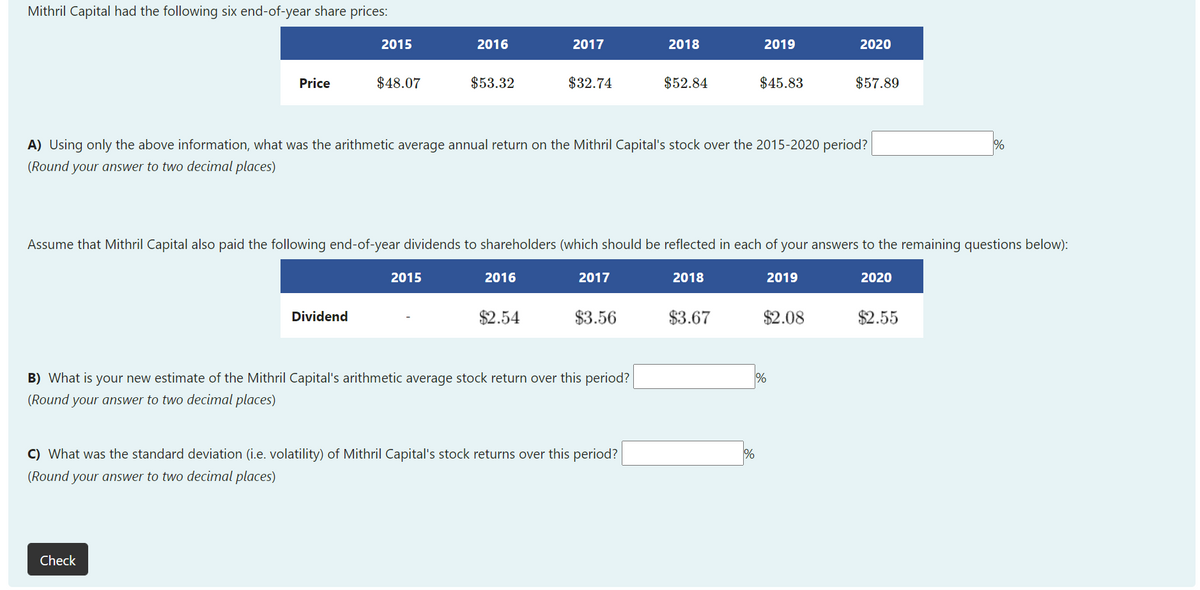

Mithril Capital had the following six end-of-year share prices: 2015 2016 2017 2018 2019 2020 Price $48.07 $53.32 $32.74 $52.84 $45.83 $57.89 A) Using only the above information, what was the arithmetic average annual return on the Mithril Capital's stock over the 2015-2020 period? (Round your answer to two decimal places) Assume that Mithril Capital also paid the following end-of-year dividends to shareholders (which should be reflected in each of your answers to the remaining questions below): 2015 2016 2017 2018 2019 2020 Dividend $2.54 $3.56 $3.67 $2.08 $2.55 B) What is your new estimate of the Mithril Capital's arithmetic average stock return over this period? (Round your answer to two decimal places) C) What was the standard deviation (i.e. volatility) of Mithril Capital's stock returns over this period? (Round your answer to two decimal places) Check

Mithril Capital had the following six end-of-year share prices: 2015 2016 2017 2018 2019 2020 Price $48.07 $53.32 $32.74 $52.84 $45.83 $57.89 A) Using only the above information, what was the arithmetic average annual return on the Mithril Capital's stock over the 2015-2020 period? (Round your answer to two decimal places) Assume that Mithril Capital also paid the following end-of-year dividends to shareholders (which should be reflected in each of your answers to the remaining questions below): 2015 2016 2017 2018 2019 2020 Dividend $2.54 $3.56 $3.67 $2.08 $2.55 B) What is your new estimate of the Mithril Capital's arithmetic average stock return over this period? (Round your answer to two decimal places) C) What was the standard deviation (i.e. volatility) of Mithril Capital's stock returns over this period? (Round your answer to two decimal places) Check

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Question is in the screen shot

Transcribed Image Text:Mithril Capital had the following six end-of-year share prices:

2015

2016

2017

2018

2019

2020

Price

$48.07

$53.32

$32.74

$52.84

$45.83

$57.89

A) Using only the above information, what was the arithmetic average annual return on the Mithril Capital's stock over the 2015-2020 period?

(Round your answer to two decimal places)

Assume that Mithril Capital also paid the following end-of-year dividends to shareholders (which should be reflected in each of your answers to the remaining questions below):

2015

2016

2017

2018

2019

2020

Dividend

$2.54

$3.56

$3.67

$2.08

$2.55

B) What is your new estimate of the Mithril Capital's arithmetic average stock return over this period?

%

(Round your answer to two decimal places)

C) What was the standard deviation (i.e. volatility) of Mithril Capital's stock returns over this period?

%

(Round your answer to two decimal places)

Check

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning