The following information is taken from Tanaka Bhd for the year ended 31 December

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.9BE

Related questions

Question

The following information is taken from Tanaka Bhd for the year ended 31 December

2020.

Preference dividend declared and fully paid in 2020: RM100,000

Ordinary dividend declared and fully paid in 2020: RM3,960,000

Ordinary share marketable price per unit at 31 December 2020: RM9.00

REQUIRED,

From the industry average, identify and comment on Tanaka Bhd’s profitability and shortterm liquidity.

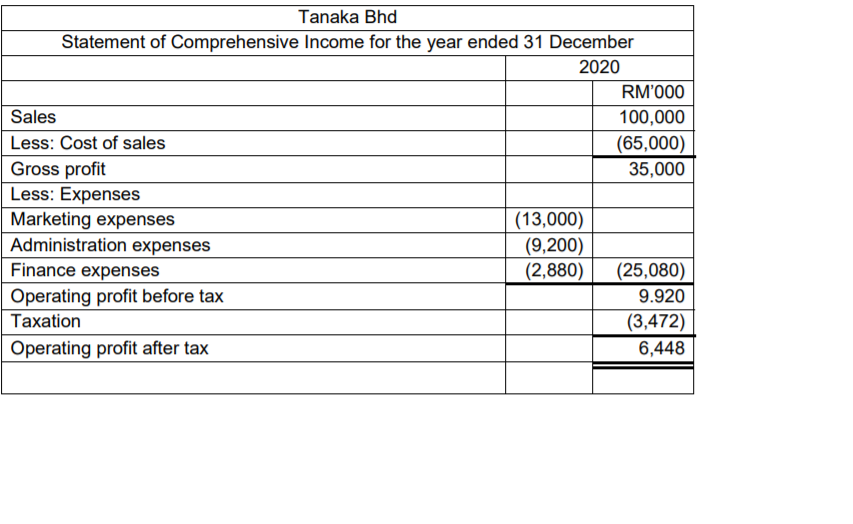

Transcribed Image Text:Tanaka Bhd

Statement of Comprehensive Income for the year ended 31 December

2020

RM'000

Sales

100,000

Less: Cost of sales

(65,000)

35,000

Gross profit

Less: Expenses

Marketing expenses

Administration expenses

(13,000)

(9,200)

(2,880)

Finance expenses

Operating profit before tax

(25,080)

9.920

Taxation

(3,472)

Operating profit after tax

6,448

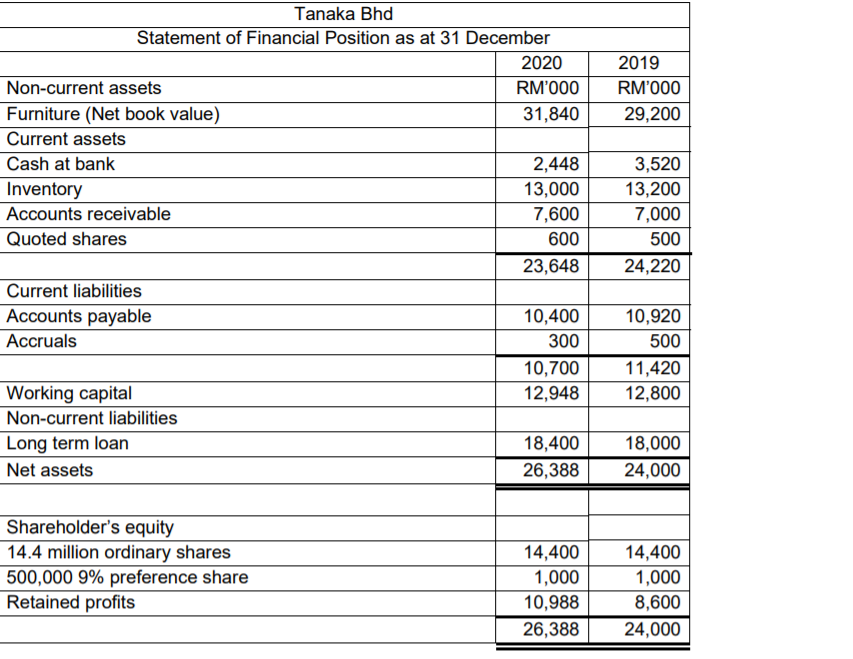

Transcribed Image Text:Tanaka Bhd

Statement of Financial Position as at 31 December

2020

2019

Non-current assets

RM'000

RM'000

Furniture (Net book value)

31,840

29,200

Current assets

Cash at bank

2,448

3,520

Inventory

13,000

13,200

Accounts receivable

7,600

7,000

Quoted shares

600

500

23,648

24,220

Current liabilities

Accounts payable

10,400

10,920

Accruals

300

500

10,700

11,420

12,948

Working capital

Non-current liabilities

12,800

Long term loan

18,400

18,000

Net assets

26,388

24,000

Shareholder's equity

14,400

14.4 million ordinary shares

500,000 9% preference share

Retained profits

14,400

1,000

1,000

10,988

8,600

26,388

24,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning