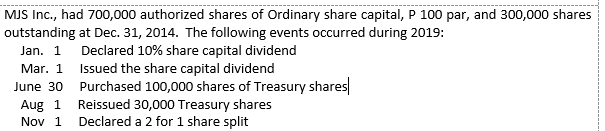

MJS Inc., had 700,000 authorized shares of Ordinary share capital, P 100 par, and 300,000 shares outstanding at Dec. 31, 2014. The following events occurred during 2019: Jan. 1 Declared 10% share capital dividend Mar. 1 Issued the share capital dividend June 30 Purchased 100,000 shares of Treasury shares Aug 1 Reissued 30,000 Treasury shares Nov 1 Declared a 2 for 1 share split

MJS Inc., had 700,000 authorized shares of Ordinary share capital, P 100 par, and 300,000 shares outstanding at Dec. 31, 2014. The following events occurred during 2019: Jan. 1 Declared 10% share capital dividend Mar. 1 Issued the share capital dividend June 30 Purchased 100,000 shares of Treasury shares Aug 1 Reissued 30,000 Treasury shares Nov 1 Declared a 2 for 1 share split

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

100%

1. Using the given data below, (there was a typo error, the date December 31, 2014 should be December 31, 2018). The question is, at December 31, 2019, how many shares were authorized?

2. at December 31, 2019, how many shares are issued

3. at December 31, 2019, how many shares are outstanding?

Transcribed Image Text:MJS Inc., had 700,000 authorized shares of Ordinary share capital, P 100 par, and 300,000 shares

outstanding at Dec. 31, 2014. The following events occurred during 2019:

Jan. 1 Declared 10% share capital dividend

Mar. 1 Issued the share capital dividend

June 30 Purchased 100,000 shares of Treasury shares

Aug 1 Reissued 30,000 Treasury shares

Nov 1 Declared a 2 for 1 share split

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning