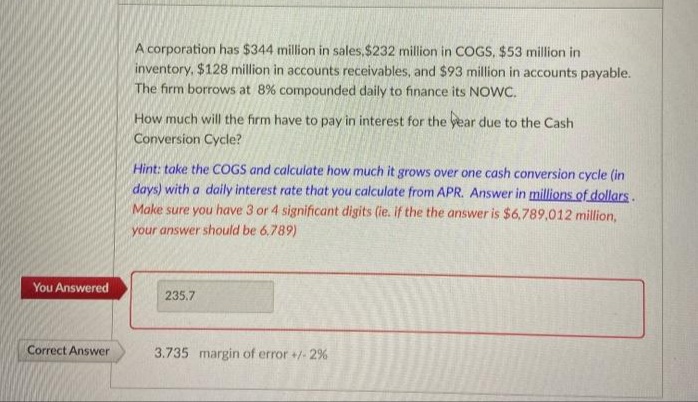

A corporation has $344 million in sales,$232 million in COGS, $53 million in inventory, $128 million in accounts receivables, and $93 million in accounts payable. The firm borrows at 8% compounded daily to finance its NOWC. How much will the firm have to pay in interest for the year due to the Cash Conversion Cycle? Hint: take the CoGS and calculate how much it grows over one cash conversion cycle (in days) with a daily interest rate that you calculate from APR. Answer in millions of dollars. Make sure you have 3 or 4 significant digits (ie. if the the answer is $6,789,012 million, your answer should be 6.789)

A corporation has $344 million in sales,$232 million in COGS, $53 million in inventory, $128 million in accounts receivables, and $93 million in accounts payable. The firm borrows at 8% compounded daily to finance its NOWC. How much will the firm have to pay in interest for the year due to the Cash Conversion Cycle? Hint: take the CoGS and calculate how much it grows over one cash conversion cycle (in days) with a daily interest rate that you calculate from APR. Answer in millions of dollars. Make sure you have 3 or 4 significant digits (ie. if the the answer is $6,789,012 million, your answer should be 6.789)

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:A corporation has $344 million in sales,$232 million in COGS, $53 million in

inventory, $128 million in accounts receivables, and $93 million in accounts payable.

The firm borrows at 8% compounded daily to finance its NOWC.

How much will the firm have to pay in interest for the year due to the Cash

Conversion Cycle?

Hint: take the COGS and calculate how much it grows over one cash conversion cycle (in

days) with a daily interest rate that you calculate from APR. Answer in millions of dollars.

Make sure you have 3 or 4 significant digits (ie. if the the answer is $6789,012 million,

your answer should be 6,789)

You Answered

235.7

Correct Answer

3.735 margin of error +/- 2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning