Molly Slate deposited $35,000 at Quazi Bank at 6% interest compounded quarterly. What is the effective rate (APY) to the nearest hundredth percent?

Molly Slate deposited $35,000 at Quazi Bank at 6% interest compounded quarterly. What is the effective rate (APY) to the nearest hundredth percent?

Chapter3: Income Sources

Section: Chapter Questions

Problem 59P

Related questions

Question

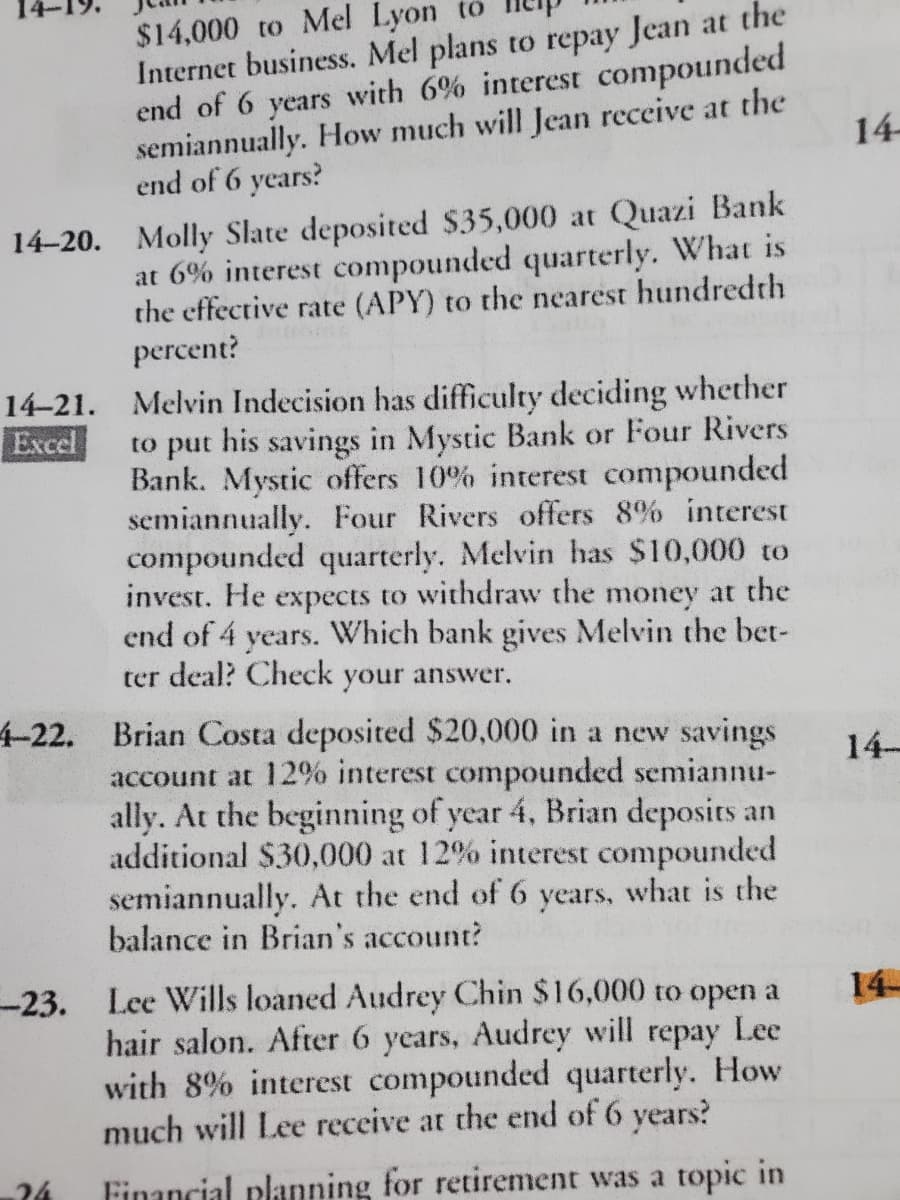

Transcribed Image Text:$14,000 to Mel Lyon to

Internet business. Mel plans to repay Jean at the

end of 6 years with 6% interest compounded

semiannually. How much will Jean receive at the

end of 6 years?

14

14-20. Molly Slate deposited $35,000 at Quazi Bank

at 6% interest compounded quarterly. What is

the effective rate (APY) to the nearest hundredth

percent?

14-21. Melvin Indecision has difficulty deciding whether

Excel

his savings in Mystic Bank or Four Rivers

put

Bank. Mystic offers 10% interest compounded

semiannually. Four Rivers offers 8% interest

compounded quarterly. Melvin has $10,000 to

invest. He expects to withdraw the money at the

end of 4 years. Which bank gives Melvin the bet-

ter deal? Check your answer.

to

4-22.

Brian Costa deposited $20,000 in a new savings

account at 12% interest compounded semiannu-

ally. At the beginning of year 4, Brian deposits an

additional $30,000 at 12% interest compounded

semiannually. At the end of 6 years, what is the

balance in Brian's account?

14-

--23. Lee Wills loaned Audrey Chin $16,000 to open

hair salon. After 6 years, Audrey will repay Lee

with 8% interest compounded quarterly. How

much will Lee receive at the end of 6 years?

14

a

24

Financial planning for retirement was a topic in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning