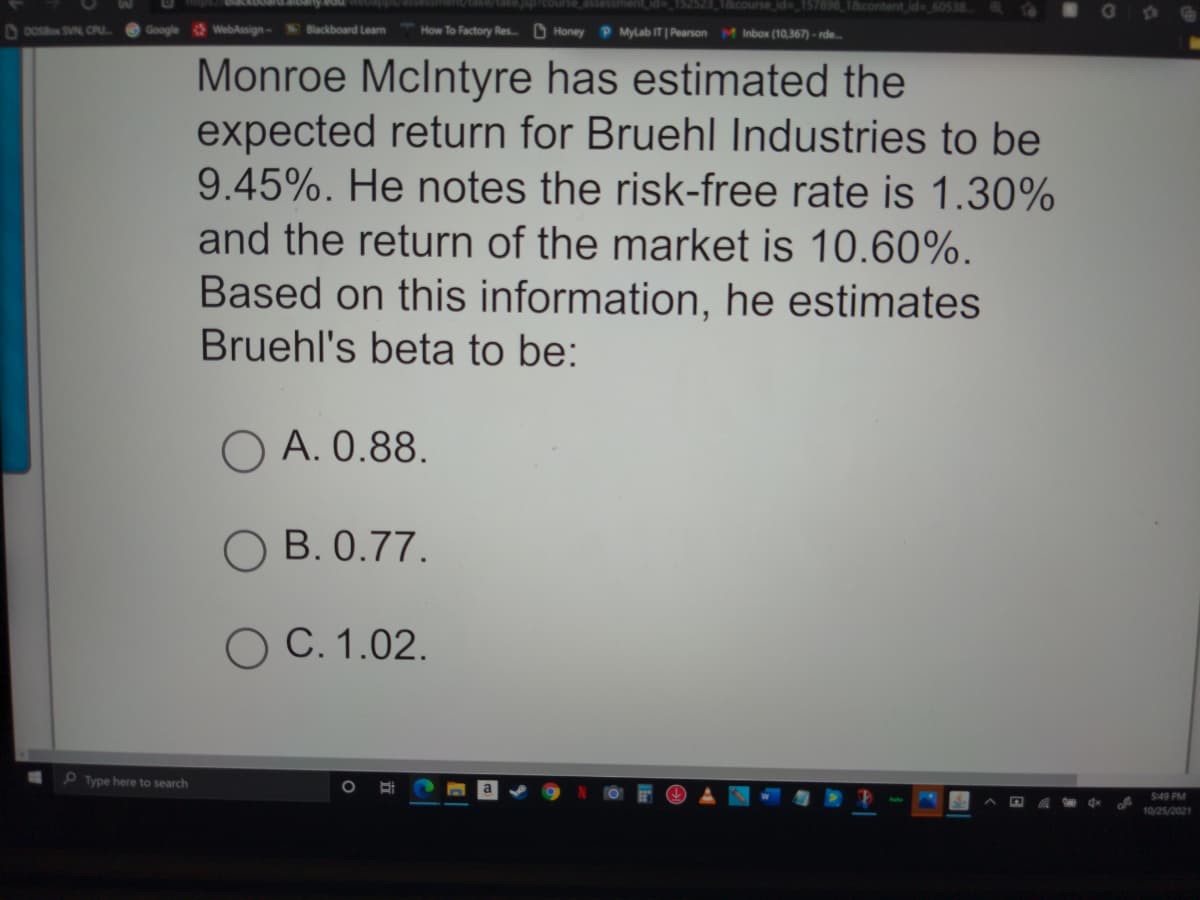

Monroe Mclntyre has estimated the expected return for Bruehl Industries to be 9.45%. He notes the risk-free rate is 1.30% and the return of the market is 10.60%. Based on this information, he estimates Bruehl's beta to be: O A. 0.88. O B. 0.77. O C. 1.02.

Q: Nuka Cola has a beta of 0.85. If the risk-free rate of return is 4% and the expected return on the…

A: Beta = 0.85 Risk free rate of return = 4% Market return = 9%

Q: Given the following holding-period returns, LOADING... , compute the average returns and the…

A: Given: Risk free rate 6% Beta 1.87 Month Zemin Corp Market 1 5% 6% 2 2% 1% 3 2% 0%…

Q: If the market return is 10%, the expected return from SBI is 16 %, and the alpha of the SBI is 2%,…

A: Market return = 10% Expected return = 16% Alpha = 2%

Q: The rate of return on U.S. T-bills is 3.25% and the expected return on the market is 9.50%. J&X,…

A: Systematic risk is the risk of the market volatility, Systematic risk affects entire market not…

Q: The CRT Co. has a beta of 1.6 The expected market return is 9.5 percent and the risk free rate of…

A: Given that;Expected market return is 9.5%Risk free rate is 3.2%Beta is 1.6

Q: Tullow’s recent strategic moves have resulted in its beta going from 1.8 to 1.5. If the risk-free…

A: Beta coefficient refers to the degree of total volatility that security has with respect to the…

Q: Hastings Entertainment has a beta of 0.41. If the market return is expected to be 16.90 percent and…

A: As per CAPM model, Required rate of return = Rf + Beta (Rm- Rf) Rm= Market rate of return Rf= Risk…

Q: Nanometrics, Inc. has a beta of 2.01. If the market return is expected to be 12.50 percent and the…

A: Required Return: It is the rate of return which is the least satisfactory return an investor may…

Q: A company has a beta of .59. If the market return is expected to be 12.9 percent and the risk-free…

A: To solve the question, we need to use the formula of capital asset pricing model (CAPM), it shows…

Q: Fiske Roofing Supplies' stock has a beta of 1.23, its required return is 12.00%, and the risk-free…

A: according to CAPM formula: rs=rf+beta×rm-rf where, rs=required rate of return of stockrf=risk free…

Q: Hastings Entertainment has a beta of 0.65. If the market return is expected to be 11 percent and the…

A: Given: Beta = 0.65 Market return = 11%= 0.11 Risk free rate = 4% = 0.04

Q: A company has a beta of 1.4, the T-bill rate is 2.09%, and the expected return on the market is…

A: Beta = 1.40 Risk free rate = 2.09% Market return = 9.02%

Q: The Treasury bill rate is 6%, and the expected return on the market portfolio is 10%. According to…

A: Expected Return on Market = 10% Risk free Rate = 6%

Q: What is Rewind's beta if the risk-free rate is 6 percent?

A: Expected Return: It is the minimum return for the equity share holders for investing in the…

Q: Kaiser Aluminum has a beta of 0.70. If the risk-free rate (RRF) is 5.0%, and the market risk premium…

A: Following details are given : Beta = 0.70 Risk free rate (RRF) = 5.0% Market risk premium (RPM) =…

Q: the required rate of Enterprises assuming that inv ors expect a 3. riation in the ture. The real…

A: In this we have to calculate the required rate by CAPM formula.

Q: Company XYZ has a CAPM beta of 1.5. The expected return on the market is 20% and the risk-free rate…

A: Expected return can be calculated by using CAPM equation given below Expected return =Risk free…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: according to sml equation: expected return=rf+beta×rm-rfwhere,rf= risk free raterm= market return

Q: A British company Afrox, has a standard deviation of 50% and a correlated of 0.65 with the market.…

A: Formulas: Beta = (Standard deviation of stock * Correlation with market) / Standard deviation of…

Q: Assume that Blast Company has a Beta of 0.85, the Risk Free Rate is 2.0% and the Expected Market…

A: We Require to calculate required rate of return for Blast company in this question. We can calculate…

Q: What is the beta of a firm whose equity has an expected return of 21.3 percent when the risk - free…

A: Beta shows the systematic risk of the asset. The beta of the asset increases the expected rate of…

Q: Cooley Computer Repair and Service Company's stock has a beta of 1.28, the risk-free rate is 2.25%,…

A: According to capm approach required return is equal to risk free rate plus beta times market risk…

Q: Nanometrics, Inc., has a beta of 3.17. If the market return is expected to be 11.35 percent and the…

A: In this question we are given details about nanometrics Inc and we require to calculate the…

Q: You observe the following: ABC Inc. has 1.8 Beta and .2 Expected return ABC Inc. has 1.8 Beta and .2…

A: Given Information ABC Inc. Beta = 1.8 Expected Return of ABC Inc. =0.2 XYZ Inc beta =1.6 Expected…

Q: A company has a beta of 0.6, the T-bill rate is 4.3%, and the expected return on the market is…

A: The required rate of return can be calculated with the help of CAPM equation.

Q: The expected market return is E(RM)is estimated to be 12% per annum, while the risk-free return (rf)…

A: This question can be answered with the help of Capital Asset Pricing Model(CAPM). Ke=Rf+β(K m -Rf)…

Q: If the firm’s beta is 1.75, the risk-free rate is 8%, and the average return on the market is 12%,…

A: Firm beta (B) = 1.75 Risk free rate (Rf) = 8% Market return (Rm) = 12%

Q: Hastings Entertainment has a beta of 0.70. If the market return is expected to be 16.40 percent and…

A: Required Return: It is the rate of return which is the least satisfactory return an investor may…

Q: A company has a beta of 3.25. If the market return is expected to be 14 percent and the risk-free…

A: Given Data: Market return = 14% Risk-free rate = 5.5% Beta = 3.25

Q: The following data have been developed for the Donovan Company: Probability of State of Nature State…

A: (a) State Probability Market Return, Rm RmxPi Return for the Firm, Rj RjxPi 1 0.10 -0.15 -0.015…

Q: A researcher has determined that a two-factor model is appropriate to determine the return on a…

A: Risk free rate (Rf) = 11% GNP market return (R1) = 13.5% GNP beta (B1) = 1.2 Interest rate return…

Q: The expected return on Mike's Seafood shares is 15.8 per cent. If the expected return on the market…

A: Expected return of a stock can be calculated using Capital Asset Pricing Model (CAPM) as: = Risk…

Q: Compute Bowling Avenue Inc.'s required rate of return given a beta of.9, risk free rate of 3.25%,…

A: Calculation of required rate of return:Answer:The required rate of return is 8.425%

Q: Historically, DeSoto projects have had an average beta of 1.25, which indicates the higher risk…

A: The question can be answered by determining the required return for the "average" DeSoto project…

Q: Stock A has an expected return of 15%, and a standard deviation of 1%. Stock B has an expected…

A: Data given: Stock A:: ER = 15% SD= 1% Stock B: ER=20% SD =2% Correlation coefficient between two…

Q: Suppose the beta of this value based company is 0.85, the risk-free rate is 2 percent, and the…

A: The capital asset pricing model is used for calculation of expected rate of return on the basis of…

Q: Kaiser Aluminum has a beta of 0.70. If the risk-free rate (Rs) is 5.0%, and the market risk premium…

A: The capital asset pricing model is the model of valuing a stock's required rate of return on the…

Q: Paycheck, Inc. has a beta of 1.02. If the market return is expected to be 16.90 percent and the…

A: Risk Premium: It characterizes to the additional return over the risk free rate that an investor…

Q: A manager believes his firm will earn a return of 20.30 percent next year. His firm has a beta of…

A: Required Return: It is the rate of return which is the least satisfactory return an investor may…

Q: Kaiser Aluminum has a beta of 0.70. If the risk-free rate (Res) is 5.0%, and the market risk premium…

A: Capital Asset Pricing Model(CAPM) is the model which shows the relationship between the systematic…

Q: The expected market return is E(RM)is estimated to be 12% per annum, while the risk-free return (rf)…

A: Solution:- Capital Asset Pricing Model (CAPM) is the equity model, which computes required return of…

Q: The estimated beta for Caterpillar Inc. is 135. The risk free rate of return is 3 percent and the…

A: Financial statements are statements which states the business activities performed by the company .…

Q: The Beta Company produces pneumatic equipment. Its beta is 1.8, the market risk premium is 9.5%, and…

A: Following details are given to us regarding Beta company : Beta = 1.8 Market risk premium (Rm-Rf) =…

Q: Solve the following questions If the expected return on a stock is 10 per cent. Risk free rate of…

A: We need to use CAPM equation to solve these problems. The equation is Expected return =Risk free…

Q: A project has a beta of 1.24 and the company beta is 1.45. The risk-free rate is 3.8%, and the…

A: Required return for the project = Risk free rate + ( Market rate of return - Risk free rate ) *…

Q: A manager believes his firm will earn a 14 percent return next year. His firm has a beta of 1.5, the…

A: The expected return is the minimum required rate of return which an investor required from the…

Q: Hastings Entertainment has a beta of 0.65. If the market return is expected to be 11 percent and the…

A: Required rate of return of stock can be found from the CAPM model using risk free rate and market…

Step by step

Solved in 3 steps

- 9. Assuming the management chooses the first option, which amount the product lines will be eliminated?a. La-Lisab. Jenniec. Jisood. Rose_____ 10. Assuming the management chooses to discontinue the unprofitable product line, what is the net impact to the Company’s overall profit?a. P 7,000b. P 17,000c. P 13,000d. P 23,000CH11_HW_QA3_PIR Required 1: Compute the company’s return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. (Round your intermediate calculations and final answer to 2 decimal places.) Margin not attempted % Turnover not attempted ROI not attempted % Required 2: Using Lean Production, the company is able to reduce the average level of inventory by $96,000. (The released funds are used to pay off short-term creditors.) (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin % Turnover ROI % Required 3: The company achieves a cost savings of $14,000 per year by using less costly materials. (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin % Turnover ROI % Required 4: The…CH11_HW_QA3_LA Required 1: Compute the company’s return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. (Round your intermediate calculations and final answer to 2 decimal places.) Margin % Turnover ROI % Required 2: Using Lean Production, the company is able to reduce the average level of inventory by $95,000. (The released funds are used to pay off short-term creditors.) (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin % Turnover ROI % Required 3: The company achieves a cost savings of $14,000 per year by using less costly materials. (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin % Turnover ROI % Required 4: The company issues bonds and uses the proceeds to…

- Match the following measurements with the terms below: Question 15 options: 12345 cash conversion efficiency ratio 12345 economic ordering quantity 12345 credit terms 12345 net working capital 12345 days of working capital 1. 5.1% 2. 47.2 days 3. 1/10, n/30 4. $200,000 5. 700 unitsOperating leverage is 7 and financial leverage is 2.2858. How much change in sales will be required to bring 70% change in EBIT? O a. 10% O b. 11.429% O C. 30% O d. 70%E6.14 (LO 4), AN The single-column CVP income statements shown below are available for Armstrong Company and Contador Company. Armstrong Co. Contador Co.Sales $500,000 $500,000Variable costs 240,000 50,000Contribution margin 260,000 450,000Fixed costs 160,000 350,000Net income $100,000 $100,000Instructions Compute the degree of operating leverage for each company and interpret your results.Assuming that sales revenue increases by 10%, restate the single-column CVP income statement from above for each company.Discuss how the cost structure of these two companies affects their operating leverage and profitability.Compute degree of operating leverage and evaluate impact of alternative cost structures on net income and margin of safety.

- 13. How do I graph this? Laurel, Inc. Hardy Corp. Price Today $1,000.00 $1,000.00 Price @ 7.8% YTM $947.41 $799.09 Price @ 3.8 YTM $1,056.20 $1,278.41 % change in price if rates rise -5.26% -20.09% % change in price if rates fall 5.62% 27.84%can u make like this in excel, and correct this two highlighted digit should have the same result COST AD (annual) F&F = 119,000 12760 M&E = 112,120 13390Adams Inc. has the following data, rRF = 5%, RPm = 6% and Beta = 1.05. What is the firms cost of common from reinvested earning using CAPM? (11.30%, 12.72%, 11.64%, 11.99%, and 12.35%)

- IF the profit are 50% of operating cost, it is ……………. of invoice price a. 20% b. 25% c. 16.66667% d. 33.33334%control risk, inherent risk, detection risk, RMM? Explain why? IR/CR yes or no? RMM and DR increase,decrease or no effect? Factor IR Factor CR Factor Why? Comments Impact on RMM Impact on DR 1 Apollo advanced $1.25 million to Larry Lancaster’s secretary. 2 Apollo does not have adequate documentation supporting customer returns of product. 3 Apollo has maintained a positive trend in net income over the past several years, and has a strategic emphasis on meeting profitability targets. 4 Apollo has not allowed your firm to speak with the predecessor auditor about their withdrawal after last year’s engagement. 5 Apollo installed a new computer system mid-year.(J) disclosed the following information for November: Sales: $ 408,000Contribution margin: $ 108,800Net operating incone : $ 20,900 The company's margin of safety as a peroentage of its sales is closest to: (Do not round intermediate calculations.)Multiple choice 12.85% 24.46% 29.02% 19.21%