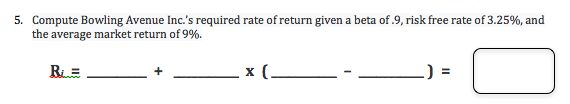

Compute Bowling Avenue Inc.'s required rate of return given a beta of.9, risk free rate of 3.25%, and the average market return of 9%. 5. х ( ) =

Q: The estimated beta (β) of a firm is 1.7. The market return (rm) is 14 %, and the risk-free rate (rf)…

A: Cost of equity refers to the firm’s compensation rate of bearing ownership. It is the return that…

Q: Your estimate of the market risk premium is 5%. The risk-free rate of return is 4%, and JB Hi Fi has…

A: Market Risk Premium = 5% Risk Free Rate = 4% Beta = 1.5

Q: Company X has a beta of 1.45. The expected risk-free rate of interest is 2.5% and the expected…

A: Given, Beta = 1.45 Risk-free rate (Rf) = 2.5% Expected return on the market (Rm) = 10%

Q: If the market return is 10%, the expected return from SBI is 16 %, and the alpha of the SBI is 2%,…

A: Market return = 10% Expected return = 16% Alpha = 2%

Q: The CRT Co. has a beta of 1.6 The expected market return is 9.5 percent and the risk free rate of…

A: Given that;Expected market return is 9.5%Risk free rate is 3.2%Beta is 1.6

Q: Asset P has a beta of 0.9. The risk-free rate of return is 8 percent, while the return on the market…

A: The asset required rate of return can be calculated with the help of CAPM equation

Q: a. Calculate the required rate of return for an asset that has a beta of 1.8, given a risk-free rate…

A: Given details are : Risk free rate = 5% Beta = 1.8 Market return = 10% From above details we need to…

Q: You estimate of the market risk premium is 7%. The risk-free rate of return is 3.1 % and General…

A: In the given question we are require to calculate the expected return of General Motors from the…

Q: Tullow’s recent strategic moves have resulted in its beta going from 1.8 to 1.5. If the risk-free…

A: Beta coefficient refers to the degree of total volatility that security has with respect to the…

Q: Hastings Entertainment has a beta of 0.41. If the market return is expected to be 16.90 percent and…

A: As per CAPM model, Required rate of return = Rf + Beta (Rm- Rf) Rm= Market rate of return Rf= Risk…

Q: Nanometrics, Inc. has a beta of 2.01. If the market return is expected to be 12.50 percent and the…

A: Required Return: It is the rate of return which is the least satisfactory return an investor may…

Q: Monroe Mclntyre has estimated the expected return for Bruehl Industries to be 9.45%. He notes the…

A: The Capital Asset Pricing Model (CAPM) refers to the model which tells us how the financial markets…

Q: A company has a beta of .59. If the market return is expected to be 12.9 percent and the risk-free…

A: To solve the question, we need to use the formula of capital asset pricing model (CAPM), it shows…

Q: You have estimated a firm's beta value to be 1.2. The expected return of the market portfolio is 12%…

A: We require to calculate the required rate of return for the firm in this question. We can solve this…

Q: the required rate of Enterprises assuming that inv ors expect a 3. riation in the ture. The real…

A: In this we have to calculate the required rate by CAPM formula.

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: according to sml equation: expected return=rf+beta×rm-rfwhere,rf= risk free raterm= market return

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: Hai there! Thanks for the question. Question has multiple sub parts. As per company guidelines…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: 4. SML equation : expected return =rf+beta×rm-rfwhere,rf= risk free raterm= market return

Q: Assume that Blast Company has a Beta of 0.85, the Risk Free Rate is 2.0% and the Expected Market…

A: We Require to calculate required rate of return for Blast company in this question. We can calculate…

Q: Suppose the current risk -free rate of return is 5 percent and the expected market risk premium is 7…

A: As per CAPM, cost of retained earnings = risk free rate + beta * market risk premium

Q: a.) Using Capital Asset Pricing Model (CAPM) to compute an appropriate rate of return for Intel…

A: In this question we are required to calculate rate of return of Intel common stock using CAPM: As…

Q: The expected return on Share X is 15.75% while the risk-free rate of return is 7%. If the expected…

A: Expected return =Rf + beta * ( Rm- Rf) Rf = Risk free rate Rm =Expected return on market

Q: Nanometrics, Inc., has a beta of 3.17. If the market return is expected to be 11.35 percent and the…

A: In this question we are given details about nanometrics Inc and we require to calculate the…

Q: You observe the following: ABC Inc. has 1.8 Beta and .2 Expected return ABC Inc. has 1.8 Beta and .2…

A: Given Information ABC Inc. Beta = 1.8 Expected Return of ABC Inc. =0.2 XYZ Inc beta =1.6 Expected…

Q: The risk-free rate of return is 2.5%, the required rate of return on the market is 11.5%, and ABC…

A: The Capital Asset Pricing Model (CAPM) is the model which shows the relationship between the…

Q: The expected market return is E(RM)is estimated to be 12% per annum, while the risk-free return (rf)…

A: This question can be answered with the help of Capital Asset Pricing Model(CAPM). Ke=Rf+β(K m -Rf)…

Q: The rate of return on T-bills is 3.25% and the expected return on the market is 9.50%. J&X, Inc. had…

A: The risk-free rate of return is the ideal rate of return on a risk-free investment. In principle,…

Q: If the firm’s beta is 1.75, the risk-free rate is 8%, and the average return on the market is 12%,…

A: Firm beta (B) = 1.75 Risk free rate (Rf) = 8% Market return (Rm) = 12%

Q: Hastings Entertainment has a beta of 0.70. If the market return is expected to be 16.40 percent and…

A: Required Return: It is the rate of return which is the least satisfactory return an investor may…

Q: The risk-free rate of return is currently 0.03, whereas the market risk premium is 0.04. If the beta…

A: Following details are given in the question: Risk free rate of return = 0.03 = 3% Market Risk…

Q: A project with a beta of 1.50, risk-free rate 7%, and the return on the market portfol ually…

A: In this we need to find out the required rate by capital asset pricing model.

Q: A company has a beta of 3.25. If the market return is expected to be 14 percent and the risk-free…

A: Given Data: Market return = 14% Risk-free rate = 5.5% Beta = 3.25

Q: An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate…

A: A single factor APT can be extended further to contain more number of independent risk factors that…

Q: Historically, DeSoto projects have had an average beta of 1.25, which indicates the higher risk…

A: The question can be answered by determining the required return for the "average" DeSoto project…

Q: Security A has an expected rate of return of 6%, a standard deviation ofreturns of 30%, a…

A: Beta coefficient: Beta coefficient measures the propensity of an assumed security’s anticipated…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: The question is based on calculation of security market line and Capital asset pricing model. The…

Q: Suppose the beta of this value based company is 0.85, the risk-free rate is 2 percent, and the…

A: The capital asset pricing model is used for calculation of expected rate of return on the basis of…

Q: the capital asset pricing model.

A: The Capital Asset Pricing Model (CAPM) is a very popular model used in finance to describe the…

Q: Security X has an expected rate of return of 13% and a beta of 1.15. The risk-free rate is 5%, and…

A: In the given we need to analyze whether the security X is Under-valued or over-valued. For this we…

Q: Suppose CAPM holds. Pfizer has a beta of 0.7, the average return on the market is 12% per year and…

A: Before investing in any asset, possible return from the investment is computed. CAPM compute the…

Q: Find the market return for an asset with a required return of 15.996% and a beta of 1.10 when the…

A: Given information: Required return = 15.996% Beta = 1.10 Risk free rate = 9%

Q: The estimated beta for Caterpillar Inc. is 135. The risk free rate of return is 3 percent and the…

A: Financial statements are statements which states the business activities performed by the company .…

Q: Kollo Enterprises has a beta of 0.70, the real risk-free rate is 2.00%, investors expect a 3.00%…

A: Given, Beta = 0.7 Risk-free rate = 2% Future inflation rate = 3% Market risk premium (Rm) = 4.7%…

Q: The risk-free rate of return is currently 0.04, whereas the market risk premium is 0.06. If the beta…

A: In this question we need to compute the expected return on RKP. We can solve this que with CAPM…

Q: A project has a beta of 1.24 and the company beta is 1.45. The risk-free rate is 3.8%, and the…

A: Required return for the project = Risk free rate + ( Market rate of return - Risk free rate ) *…

Q: ABC Corp’s beta is 1.4, risk-free rate is 3%, and the market return is 9%. If the risk-free rate…

A: The Capital Asset Pricing Model (CAPM) is a link between necessary return and systematic risk that…

Q: What is the required return on an investment with a beta of 1.3 if the riskfree rate is 2.0 percent…

A: CAPM evolved as a way to measure this systematic risk. Sharpe found that the return on an individual…

Q: Assume that the risk-free rate, RF, is currently 8%, the market return, RM, is 12%, and asset A has…

A: Security market line (SML) is a graphical representation of how the approach of the capital asset…

Q: Hastings Entertainment has a beta of 0.65. If the market return is expected to be 11 percent and the…

A: Required rate of return of stock can be found from the CAPM model using risk free rate and market…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Security A has an expected return of 7%, a standard deviation of returns of 35%, a correlation coefficient with the market of −0.3, and a beta coefficient of −1.5. Security B has an expected return of 12%, a standard deviation of returns of 10%, a correlation with the market of 0.7, and a beta coefficient of 1.0. Which security is riskier? Why?Security A has an expected rate of return of 6%, a standard deviation of returns of 30%, a correlation coefficient with the market of −0.25, and a beta coefficient of −0.5. Security B has an expected return of 11%, a standard deviation of returns of 10%, a correlation with the market of 0.75, and a beta coefficient of 0.5. Which security is more risky? Why?APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. What are the betas of Stocks X and Y? What are the required rates of return on Stocks X and Y? What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y?Breckenridge, Inc., has a beta of 0.97. If the expected market return is 12.0 percent and the risk-free rate is 6.0 percent, what is the appropriate expected return of Breckenridge (using the CAPM)?

- Given an expected market risk premium of 12.0%, a beta of 0.75 for Benson Industries, and a risk-free rate of 4.0%, what is the expected return for Benson Industries?If X-Co has a Beta of 1.6, and the risk-free rate is 4.5%, and the average market risk premium is 6%, what is X-Co’s estimated required return per the CAPM? (show calculations)Suppose the beta of PetrolCom is 0.75, the risk - free rate is 3 percent, and the market risk premium is II percent. Calculate the expected rate of return on PertrolCom.

- Suppose the beta of this value based company is 0.85, the risk-free rate is 2 percent, and the expected market rate of return is 10 percent. Calculate the expected rate of return. The answer is closest to: Group of answer choices 10.5 percent 13.1 percent 6.5 percent 9.0 percentHastings Entertainment has a beta of 0.65. If the market return is expected to be 11 percent and the risk-free rate is 4 percent, what is Hastings' required return?The CRT Co. has a beta of 1.6 The expected market return is 9.5 percent and the risk free rate of return is 3.2 percent. What is the required rate of return for the CRT Co.?