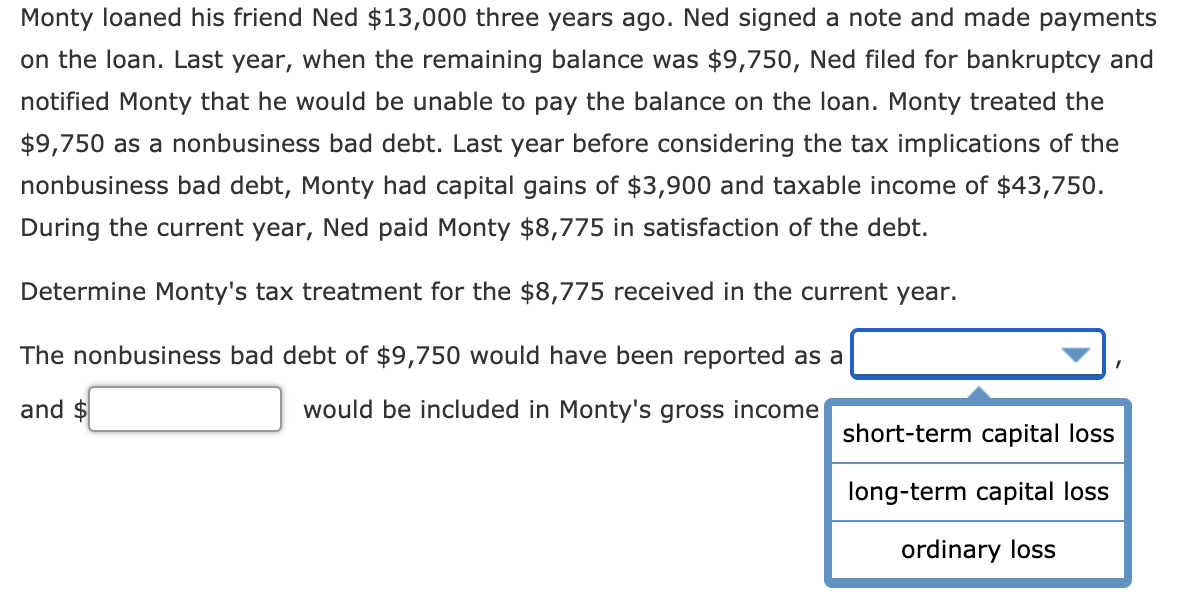

Monty loaned his friend Ned $13,000 three years ago. Ned signed a note and made payments on the loan. Last year, when the remaining balance was $9,750, Ned filed for bankruptcy and notified Monty that he would be unable to pay the balance on the loan. Monty treated the $9,750 as a nonbusiness bad debt. Last year before considering the tax implications of the nonbusiness bad debt, Monty had capital gains of $3,900 and taxable income of $43,750. During the current year, Ned paid Monty $8,775 in satisfaction of the debt. Determine Monty's tax treatment for the $8,775 received in the current year. The nonbusiness bad debt of $9,750 would have been reported as a and $ would be included in Monty's gross income short-term capital loss long-term capital loss ordinary loss

Monty loaned his friend Ned $13,000 three years ago. Ned signed a note and made payments on the loan. Last year, when the remaining balance was $9,750, Ned filed for bankruptcy and notified Monty that he would be unable to pay the balance on the loan. Monty treated the $9,750 as a nonbusiness bad debt. Last year before considering the tax implications of the nonbusiness bad debt, Monty had capital gains of $3,900 and taxable income of $43,750. During the current year, Ned paid Monty $8,775 in satisfaction of the debt. Determine Monty's tax treatment for the $8,775 received in the current year. The nonbusiness bad debt of $9,750 would have been reported as a and $ would be included in Monty's gross income short-term capital loss long-term capital loss ordinary loss

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 29P

Related questions

Question

Could you please show me how to solve this?

Transcribed Image Text:Monty loaned his friend Ned $13,000 three years ago. Ned signed a note and made payments

on the loan. Last year, when the remaining balance was $9,750, Ned filed for bankruptcy and

notified Monty that he would be unable to pay the balance on the loan. Monty treated the

$9,750 as a nonbusiness bad debt. Last year before considering the tax implications of the

nonbusiness bad debt, Monty had capital gains of $3,900 and taxable income of $43,750.

During the current year, Ned paid Monty $8,775 in satisfaction of the debt.

Determine Monty's tax treatment for the $8,775 received in the current year.

The nonbusiness bad debt of $9,750 would have been reported as a

and $

would be included in Monty's gross income

short-term capital loss

long-term capital loss

ordinary loss

Expert Solution

Step 1

Non business debt is a debt that is unrelated to taxpayer's business. Bad debts from the non business will always be recorded as short term capital loss of the business.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT