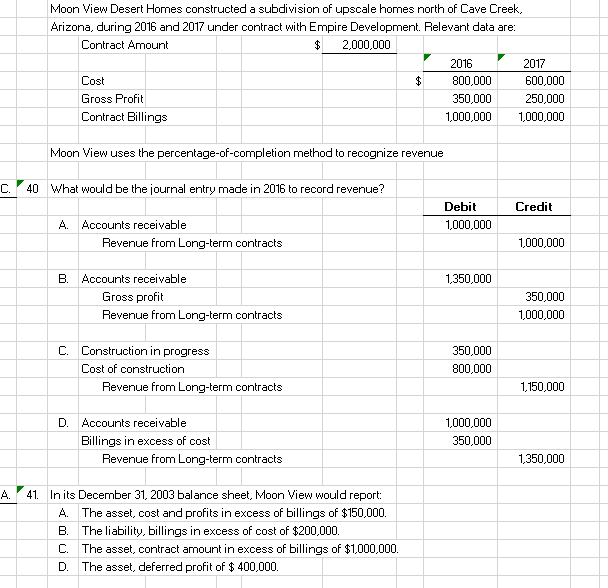

Moon View Desert Homes constructed a subdivision of upscale homes north of Cave Creek, Arizona, during 2016 and 2017 under contract with Empire Development. Relevant data are: Contract Amount $ 2,000,000 2016 2017 Cost $ 800,000 600,000 Gross Profit 350,000 250,000 Contract Billings 1,000,000 1,000,000 Moon View uses the percentage-of-completion method to recognize revenue - 40 What would be the journal entry made in 2016 to record revenue? Debit Credit A Accounts receivable 1,000,000 Revenue from Long-term contracts 1,000,000 B. Accounts receivable 1,350,000 Gross profit Revenue from Long-term contracts 350,000 1,000,000 C. Construction in progress 350,000 Cost of construction 800,000 Revenue from Long-term contracts 1,150,000 D. Accounts receivable 1,000,000 Billings in excess of cost 350,000 Revenue from Long-term contracts 1,350,000 A 41 In its December 31, 2003 balance sheet, Moon View would report: A The asset, cost and profits in excess of billings of $150,000. B. The liability, billings in excess of cost of $200,000. C. The asset, contract amount in excess of billings of $1,000,000. D. The asset, deferred profit of $ 400,000.

Moon View Desert Homes constructed a subdivision of upscale homes north of Cave Creek, Arizona, during 2016 and 2017 under contract with Empire Development. Relevant data are: Contract Amount $ 2,000,000 2016 2017 Cost $ 800,000 600,000 Gross Profit 350,000 250,000 Contract Billings 1,000,000 1,000,000 Moon View uses the percentage-of-completion method to recognize revenue - 40 What would be the journal entry made in 2016 to record revenue? Debit Credit A Accounts receivable 1,000,000 Revenue from Long-term contracts 1,000,000 B. Accounts receivable 1,350,000 Gross profit Revenue from Long-term contracts 350,000 1,000,000 C. Construction in progress 350,000 Cost of construction 800,000 Revenue from Long-term contracts 1,150,000 D. Accounts receivable 1,000,000 Billings in excess of cost 350,000 Revenue from Long-term contracts 1,350,000 A 41 In its December 31, 2003 balance sheet, Moon View would report: A The asset, cost and profits in excess of billings of $150,000. B. The liability, billings in excess of cost of $200,000. C. The asset, contract amount in excess of billings of $1,000,000. D. The asset, deferred profit of $ 400,000.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 34E

Related questions

Question

kindly answer n0. 41, thank you

Transcribed Image Text:Moon View Desert Homes constructed a subdivision of upscale homes north of Cave Creek,

Arizona, during 2016 and 2017 under contract with Empire Development. Relevant data are:

Contract Amount

2,000,000

2016

2017

Cost

$

800,000

600,000

Gross Profit

350,000

250,000

Contract Billings

1,000,000

1,000,000

Moon View uses the percentage-of-completion method to recognize revenue

C. 40 What would be the journal entry made in 2016 to record revenue?

Debit

Credit

A. Accounts receivable

1,000,000

Revenue from Long-term contracts

1,000,000

B. Accounts receivable

1,350,000

Gross profit

350,000

Revenue from Long-term contracts

1,000,000

C. Construction in progress

350,000

Cost of construction

800,000

Revenue from Long-term contracts

1,150,000

D. Accounts receivable

1,000,000

Billings in excess of cost

350,000

Revenue from Long-term contracts

1,350,000

A.

41. In its December 31, 2003 balance sheet, Moon View would report:

A. The asset, cost and profits in excess of billings of $150,000.

B. The liability, billings in excess of cost of $200,000.

C. The asset, contract amount in excess of billings of $1,000,000.

D.

The asset, deferred profit of $ 400,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you