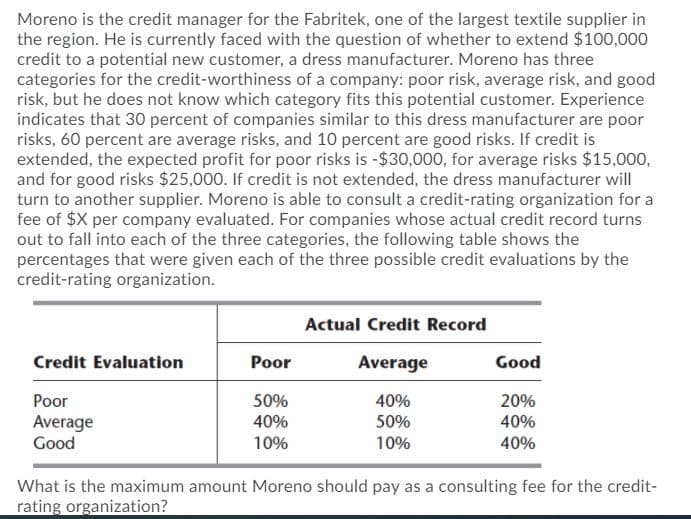

Moreno is the credit manager for the Fabritek, one of the largest textile supplier in the region. He is currently faced with the question of whether to extend $100,000 credit to a potential new customer, a dress manufacturer. Moreno has three categories for the credit-worthiness of a company: poor risk, average risk, and good risk, but he does not know which category fits this potential customer. Experience indicates that 30 percent of companies similar to this dress manufacturer are poor risks, 60 percent are average risks, and 10 percent are good risks. If credit is extended, the expected profit for poor risks is -$30,000, for average risks $15,000, and for good risks $25,000. If credit is not extended, the dress manufacturer will turn to another supplier. Moreno is able to consult a credit-rating organization for a fee of $X per company evaluated. For companies whose actual credit record turns out to fall into each of the three categories, the following table shows the percentages that were given each of the three possible credit evaluations by the credit-rating organization. Actual Credit Record Credit Evaluation Poor Average Good Poor Average Good 50% 40% 10% 40% 50% 10% 20% 40% 40% What is the maximum amount Moreno should pay as a consulting fee for the credit- rating organization?

Moreno is the credit manager for the Fabritek, one of the largest textile supplier in the region. He is currently faced with the question of whether to extend $100,000 credit to a potential new customer, a dress manufacturer. Moreno has three categories for the credit-worthiness of a company: poor risk, average risk, and good risk, but he does not know which category fits this potential customer. Experience indicates that 30 percent of companies similar to this dress manufacturer are poor risks, 60 percent are average risks, and 10 percent are good risks. If credit is extended, the expected profit for poor risks is -$30,000, for average risks $15,000, and for good risks $25,000. If credit is not extended, the dress manufacturer will turn to another supplier. Moreno is able to consult a credit-rating organization for a fee of $X per company evaluated. For companies whose actual credit record turns out to fall into each of the three categories, the following table shows the percentages that were given each of the three possible credit evaluations by the credit-rating organization. Actual Credit Record Credit Evaluation Poor Average Good Poor Average Good 50% 40% 10% 40% 50% 10% 20% 40% 40% What is the maximum amount Moreno should pay as a consulting fee for the credit- rating organization?

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 24PPS

Related questions

Topic Video

Question

The question is in the image

Transcribed Image Text:Moreno is the credit manager for the Fabritek, one of the largest textile supplier in

the region. He is currently faced with the question of whether to extend $100,000

credit to a potential new customer, a dress manufacturer. Moreno has three

categories for the credit-worthiness of a company: poor risk, average risk, and good

risk, but he does not know which category fits this potential customer. Experience

indicates that 30 percent of companies similar to this dress manufacturer are poor

risks, 60 percent are average risks, and 10 percent are good risks. If credit is

extended, the expected profit for poor risks is -$30,000, for average risks $15,000,

and for good risks $25,000. If credit is not extended, the dress manufacturer will

turn to another supplier. Moreno is able to consult a credit-rating organization for a

fee of $X per company evaluated. For companies whose actual credit record turns

out to fall into each of the three categories, the following table shows the

percentages that were given each of the three possible credit evaluations by the

credit-rating organization.

Actual Credit Record

Credit Evaluation

Poor

Average

Good

Poor

Average

Good

50%

40%

10%

40%

50%

10%

20%

40%

40%

What is the maximum amount Moreno should pay as a consulting fee for the credit-

rating organization?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL