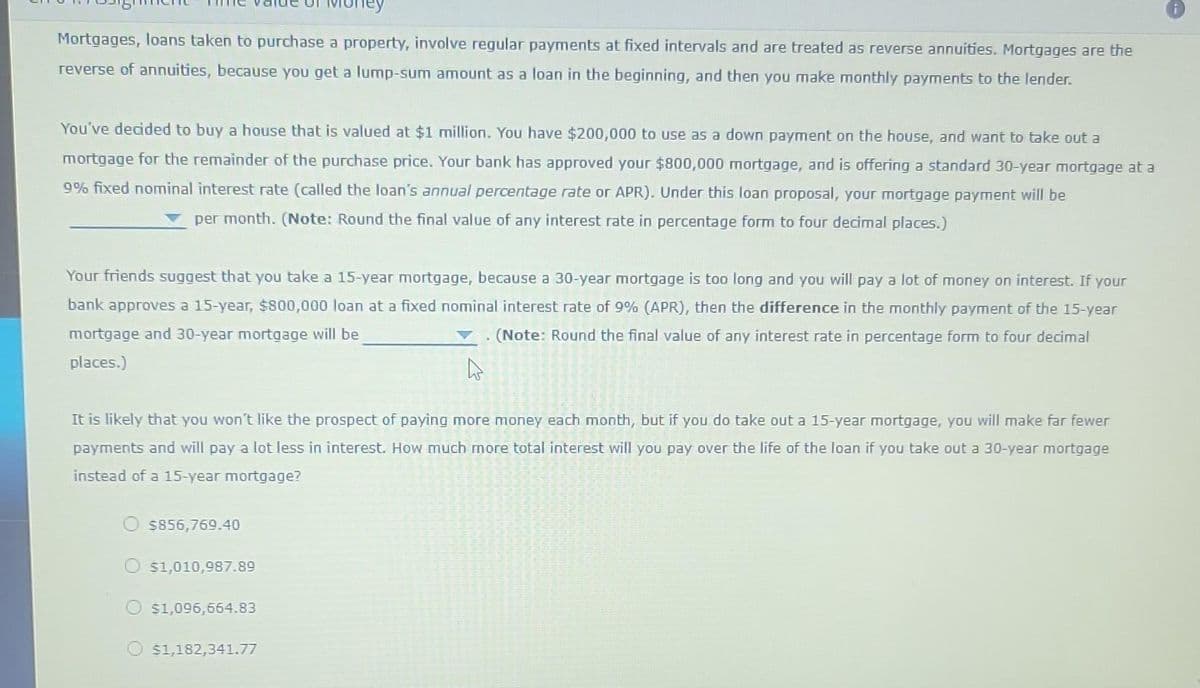

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $200,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $800,000 mortgage, and is offering a standard 30-year mortgage at a 9% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month. (Note: Round the final value of any interest rate in percentage form to four decimal places.) Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $800,000 loan at a fixed nominal interest rate of 9% (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be (Note: Round the final value of any interest rate in percentage form to four decimal places.) It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage instead of a 15-year mortgage? O $856,769.40 $1,010,987.89 O $1,096,664.83 O $1,182,341.77

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. You've decided to buy a house that is valued at $1 million. You have $200,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $800,000 mortgage, and is offering a standard 30-year mortgage at a 9% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month. (Note: Round the final value of any interest rate in percentage form to four decimal places.) Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $800,000 loan at a fixed nominal interest rate of 9% (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be (Note: Round the final value of any interest rate in percentage form to four decimal places.) It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage instead of a 15-year mortgage? O $856,769.40 $1,010,987.89 O $1,096,664.83 O $1,182,341.77

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

100%

f1.

Subject:- finance

Transcribed Image Text:Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. Mortgages are the

reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender.

You've decided to buy a house that is valued at $1 million. You have $200,000 to use as a down payment on the house, and want to take out a

mortgage for the remainder of the purchase price. Your bank has approved your $800,000 mortgage, and is offering a standard 30-year mortgage at a

9% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be

per month. (Note: Round the final value of any interest rate in percentage form to four decimal places.)

Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your

bank approves a 15-year, $800,000 loan at a fixed nominal interest rate of 9% (APR), then the difference in the monthly payment of the 15-year

mortgage and 30-year mortgage will be

(Note: Round the final value of any interest rate in percentage form to four decimal

places.)

$856,769.40

It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer

payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage

instead of a 15-year mortgage?

$1,010,987.89

$1,096,664.83

4

$1,182,341.77

.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning