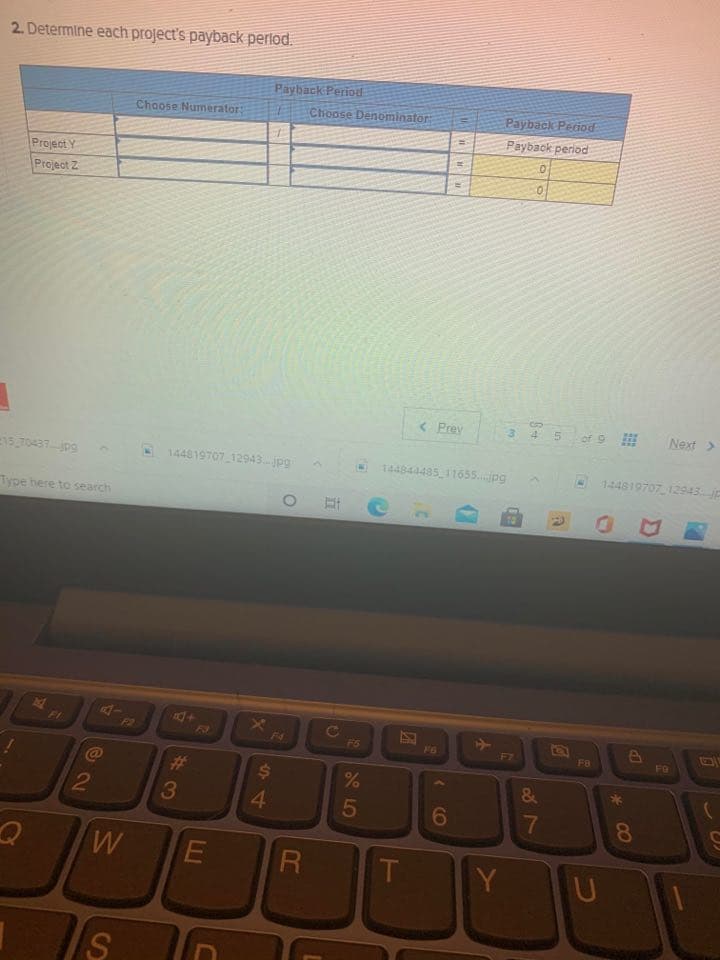

Most Company has an opportunity to invest in one of two new projects. Project Y requires a $325,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $325,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project Y Project Z Sales $ 370,000 $ 296,000 Expenses Direct materials 51,800 37,000 Direct labor 74,000 44,400 Overhead including depreciation 133,200 133,200 Selling and administrative expenses 26,000 26,000 Total expenses 285,000 240,600 Pretax income 85,000 55,400 Income taxes (38%) 32,300 21,052 Net income $ 52,700 $ 34,348

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Most Company has an opportunity to invest in one of two new projects. Project Y requires a $325,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $325,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line

| Project Y | Project Z | |||||||

| Sales | $ | 370,000 | $ | 296,000 | ||||

| Expenses | ||||||||

| Direct materials | 51,800 | 37,000 | ||||||

| Direct labor | 74,000 | 44,400 | ||||||

| Overhead including depreciation | 133,200 | 133,200 | ||||||

| Selling and administrative expenses | 26,000 | 26,000 | ||||||

| Total expenses | 285,000 | 240,600 | ||||||

| Pretax income | 85,000 | 55,400 | ||||||

| Income taxes (38%) | 32,300 | 21,052 | ||||||

| Net income | $ | 52,700 | $ | 34,348 | ||||

Trending now

This is a popular solution!

Step by step

Solved in 2 steps