mpensation expense for the current year

Q: Popoy Corporation (PC) purchased all the common shares of Sia Company (SC) on January 1, 20X1, for…

A:

Q: Using the sum of the years digit method, how much would be the book value of the asset on the year…

A: Solution Concept Under straight line method of depreciation , annual depreciation expense is charged…

Q: es Shown here is an income statement in the traditional format for a firm with a are shown: Revenues…

A: Since we answer up to three subparts, we will answer the first three. Please resubmit the question…

Q: Soft drinks Coffee Hot dogs Hamburgers Misc. Snacks Break-even sales per unit P100 P100 P250 P50…

A: Break-even is the point which every business wants to calculate so that it is better known by the…

Q: 4. Should the management of a company purposely alter its Depreciation estimates for the sole…

A: financial statement are considered to be statements that produce and present the companies current…

Q: Can you help me with 2,3 and 4? On November 1, 20Y9, Lexi Martin established an interior decorating…

A: GIVEN On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage…

Q: 1.) Explain one difference between manufacturing and merchandising business. 2.) Why is it that…

A: Solution:- 1) Explanation of one difference between manufacturing and merchandising business as…

Q: A vendor is running a promotion whereby a consumer who purchases three boxes of golf balls at P20…

A: In order to increase the sale of a product, a firm may follow different types of promotional…

Q: Analytical procedures are one of many financial audit processes which help an auditor understand the…

A: Introduction:- Analytical procedures are one of many financial audit processes which help an auditor…

Q: Required:1. Calculate the cost per unit for each product using direct labor hours to assign all…

A: Activity based costing is more popular and better way to allocate the overhead and cost. In case of…

Q: Inventory costing method that treats all mfg cost, direct and indirect, FC or VC, as inventoriable…

A: The treatment relating to direct and indirect costs varies for different costing methods.

Q: . _______ An invoice in the amount of $200 carries cash terms of “2/10, net 30.” If the buyer takes…

A: Credit terms 2/10, net 30 means if payment is being made in 10 days, then 10% discount will be…

Q: 1. How is it possible for a firm to be profitable and still go bankrupt? Select one: a. The firm…

A: Current ratio=Current assetsCurrent liabilities

Q: During 2019, Carol, Inc.’s net income was $2,450,000. Its common stockholders’ equity was $3,240,000…

A: Return on common stockholders' equity indicates the rate of return earned by the common…

Q: What is the function of a cash budget? A capital budget?

A: Cash budget is estimated figures of cash inflow and cash outflow. It determines the net cash…

Q: What is the main source of the US fiscal imbalance and what are the painful choices we must face?

A: Income Taxes- Federal, state, and local governments levy taxes on the gross income of individuals…

Q: Annuity payments received by a taxpayer represent a part which is taxable and non taxable. Which of…

A: Annuity means a series of payments being paid or received in particular period of time and a fixed…

Q: 1. Determine the weighted average number of shares outstanding for computing the current earnings…

A: 1. oustanding Shares Months Weighted Average Beginning Balance 270000 2 Months…

Q: A purchase invoice shows 10 items priced at $120 less trade discount 20%. A cash discount of 2%2% is…

A: Formula: Amount paid = Invoice amount - Discount amount

Q: 1. Which of the following formulas is used to calculate break-even units? 1. Fixed Costs + Unit…

A: Introduction: Break even point: The point where there is no profit or loss of the units sold. Below…

Q: lowing errors in the the Emma Company reveale financial statements: 500,000 800,000 250,000 December…

A: Net income is the amount which is calculated by subtracting expenses from the incomes. Understated…

Q: An entity, a grocery retailer, operates a customer loyalty program. The entity grants program…

A: revenue during 2022 Particulars Amount Sales from stand alone selling price 7000000 Add:…

Q: Who may institute action for annulment of voidable contracts? Briefly discuss.

A: Contract Act- The Indian Contract Act of 1872 lays out the groundwork for forming a legally binding…

Q: Provide the objectives for a successful audit program according to ISO9001:2015

A: An audit program according to ISO 9001:2015 is the one which involves commitments, responsibility…

Q: Company A wants to earn $5,000 profit in the month of January. If their fixed costs are $10,000 and…

A: Lets understand the basics. For calculating target sales unit to achieve target profit, we need to…

Q: 12. Jane Company has granted 200 share appreciation rights to each of its 300 employees on January…

A: Share appreciation rights means where the company has granted a right to its employees to purchase…

Q: QUESTION 7 Using the following information, calculate the monthly net profit Sales for the month…

A: Net profit = Total revenues - Total expenses Profit margin = Net profit / Total revenues

Q: QUESTION 5 In an organization of 4000 employees, a foodservice department has nths. What is the…

A: Number of employees = 4,000 Positions = 90 Employees terminated = 23

Q: On September 1, the balance of the Accounts Receivable control account in the general ledger of…

A: The subsidiary ledger for account receivables provides details for account for all customers, with…

Q: At the beginning of the year, Cullumber had beginning inventory of 1680 scooters. Cullumber…

A: The sales budget is prepared to record the sales revenue earned during the period.

Q: At the beginning of 2019, Hardin Company had 340,000 shares of $10 par common stock outstanding.…

A: 1. oustanding Shares Months Weighted Average Beginning Balance 340000 2 Months…

Q: Statement 1: Consolidated operating expenses will not be affected, in any capacity, by an…

A: An intercompany transaction occurs when one category, department, or unit within an organization…

Q: A property was purchased on January 1 20x0 for $2 million (estimated depreciable amount $1…

A: IAS 16 describes two methods of recording PPE in the books; Cost basis and the revaluation model.…

Q: Refer to the following information from a long term care facility for questions 6-10. April May June…

A: Cost of food used in June = Beginning inventory of June + Foods purchased in June - Ending inventory…

Q: Emma Company revealed the following errors in the financial statements: 500,000 800,000 250.000…

A: Computation of effect of the errors on net income for 2020: Amount 2020 inventory understated…

Q: During 2021, JJJ Co. introduced a new line of machines that carry a three-year warranty against…

A: Solution:- Calculation of the amount should JJJ report as a liability at December 31, 2023 as…

Q: Company contains (2) production centers (A, B), and (2) services centers (Maintenance and Fuel), and…

A: Overhead means the cost incurred indirect in factory for the production of goods. Manufacturing…

Q: A moral or legal obligation to ensure the safety or well-being of others Could be defined as duty of…

A: The auditors has no duty to Resolve the client's staffing issues because it is in now way related…

Q: Tyler Hawes and Piper Albright formed a partnership, investing $210,000 and $70,000, respectively.…

A: The profits are distributed among partners on the basis of ratio as mentioned in partnership deed.…

Q: FRT Company sells each unit for $ 60, variable costs for each unit $ 25, Fixed costs $ 200000 Wants…

A: Contribution means the difference between the selling price and variable cost . Fixed cost remain…

Q: Intercompany sale of inventory a.should be eliminated only if the inventories are sold to third…

A: Any form of transaction between two firms that are members of the same consolidated group, such as a…

Q: Consolidated inventory balance is composed of the book values of the parent’s and the subsidiary’s…

A: The answer is d i.e and nothing else.

Q: Carol, the accountant for Cool Pte. Ltd. recorded insurance expense transaction as follows: DR…

A: Lets understand the basics. For recording correct amount of revenue and expenses, adjusting entries…

Q: nology and maintenance issues, it is no longer a useful asset.) ms of the lease include: ive year…

A: Lease Accounting

Q: Jack is a policeman tasked to arrest a group of drug pushers. The drug pushers see Jack approach and…

A: Justifying Circumstances Justifying Circumstances which was described as the activities of the…

Q: Question Owing to perennial complaints by students about the lack of accommodation problems on…

A: NPV stand for Net present value which refers to the difference between the present value of cash…

Q: Ngo Company purchased a truck for $54,000. Sales tax amounted to $5,400; shipping costs amounted to…

A: Introduction: Expenditure are of two types: 1 ) Capital Expenditure 2 ) Revenue Expenditure

Q: At what amount should the warranty expense and premium expense be shown in the December 31, 2022…

A: Warranty is a form of assurance being provided by the seller to the buyer that in case product will…

Q: Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing.…

A: Profit Variance analysis- Gross profit analysis is determining the reasons for the change in gross…

Q: FIXED COSTS One (1) Game Fixed Cost for Food (P100,000) Space (P240,000) Booth Space (P1,750) Total…

A: In the context of the given question, we compute the break-even point using the given table's data.…

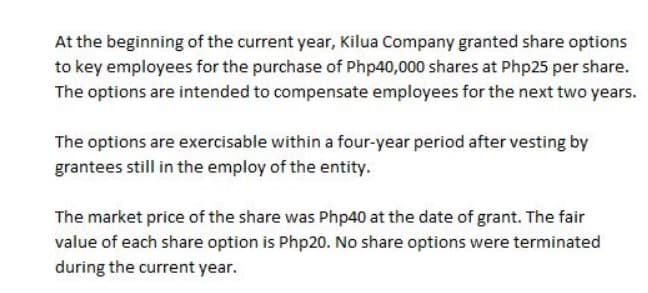

What amount should be recognized as compensation expense for the current year?

*see attached

a. 600,000

b. 300,000

c. 800,000

d. 400,000

Step by step

Solved in 3 steps

- On January 2, 2019, Brust Corporation grants its new CFO 2,000 restricted share units. Each of the time-vested restricted share units entitles the CFO to receive one share of Brust common stock if she remains an employee of the company for 4 years. On January 2, 2019, shares of Brusts 1 par value common are trading at 29.50 per share. The company estimates that the CFO will complete all 4 years of required service with the company. Prepare the journal that Brust should make each year to account for the restricted share units.On January 1, 2019, Phoenix Corporation adopts a performance-based share option plan for 25 executives, with the number of shares based on the yearly increase in sales. At the end of 2019, based on a 10% increase in sales, it expects that each executive will be granted 150 options and that the fair value of an option expected to vest is 15.75. Phoenix expects a turnover rate of 15% over the 3-year service period. Determine the compensation expense for 2019 for this plan.At the beginning of Year 4, ABC Corp. grants to a senior executive 3,000 share options, conditional upon the executive's remaining in the entity's employ until the end of Year 6. The exercise price is P40. However, the exercise price drops to P30 if the entity's earnings increase by at least an average of 10% per year over the three-year period. On grant date, the entity estimates that the fair value of the share options, with an exercise price of P30, is P15 per option. If the exercise price is P40, the entity estimates that the share options have a fair value of P12 per option. During Year 4, the entity's earnings increased by 12%, and the entity expects that earnings will continue to increase at this rate over the next two years. The entity therefore expects that the earnings target will be achieved, and hence the share options will have an exercise price of P30. During Year 5, the entity's earnings increased by 13%, and the entity continues to expect that the earnings target will…

- On January 1, Year 1, Spaghetti Corp. granted 100 share options each to 500 employees, conditional upon the employee’s remaining in the entity’s employ during the vesting period. The share options vest at the end of a three-year period. On grant date, each share option has a fair value of P30. The par value per share is P100 and the option price is P120. On December 31, Year 2, 30 employees have left and it is expected that on the basis of a weighted average probability, a further 30 employees will leave before the end of the three-year period. On December 31, Year 3, only 20 employees actually left and all of the share options are exercised on such date. What is the compensation expense for Year 3? A. 880,000 B. 470,000 C. 380,000 D. 500,000On January 1, Year 1, Sisig Corp. granted 60,000 share options to employees. The share options will vest at the end of three years provided the employees remain in service until then. The option price is P60 and the par value per share is P50. At the date of grant, the entity concluded that the fair value of the share options cannot be measured reliably. The share options have a life of 4 years which means that the share options can be exercised within one year after vesting. The share prices are P62 on December 31, Year 1, P66 on December 31, Year 2, P75 on December 31, Year 3 and P85 on December 31, Year 4. All share options were exercised on December 31, Year 4. What is the compensation expense for Year 4? A. 660,000 B. 0 C. 600,000 D. 900,000On January 1, Year 1, Jenny Corp. granted 60,000 share options to employees. The share options will vest at the end of three years provided the employees remain in service until then. The option price is P60 and the par value per share is P50. At the date of grant, the entity concluded that the fair value of the share options cannot be measured reliably. The share options have a life of 4 years which means that the share options can be exercised within one year after vesting. The share prices are P62 on December 31, Year 1, P66 on December 31, Year 2, P75 on December 31, Year 3 and P85 on December 31, Year 4. All share options were exercised on December 31, Year 4. 1. What is the compensation expense for Year 4? A. 0 B. 900k C. 600k D. 660k

- On January 1, 2022, Jade Corporation granted share options to each of the 300 employees working in the sales department. The share options vest at the end of a three-year period provided that the employees remain in the entity’s employ and provided the volume of sales will increase by more than 10% per year. The fair value of each share option on grant date is P20. If the sales increase by more than 10%, each employee will receive 200 share options. If the sales increase by more than 15%, each employee will receive 300 share options. On December 31, 2022, the sales increased by more than 10%, and no employees have left the entity. On December 31, 2023, the sales increased by more than 15% and 20 employees left the entity. What amount of compensation expense should be recognized for 2023? 400,000 720,000 560,000 800,000On July 1, 2016, Tools Company granted share options to key employees for the purchase of 20,000 of the company’s ordinary share capital at P25 per share. Based on option-pricing model used by the company, the fair value of each share option on this date was P9. The options are intended to compensate employees for the next two years. The options are exercisable within a four-year period beginning July 1, 2018 by grantees still in the employ of the company. The market price of Tools’ ordinary share was P33 per share at the date of grant. No share options were terminated during the year. How much should Tools charge to compensations expense for the year ended December 31, 2016?On July 1, 2016, Task Company granted share options to key employees for the purchase of 20,000 of the company's ordinary share capital at P25 per share. Based on option-pricing model used by the company, the fair value of each share option on this date was P9. The options are intended to compensate employees for the next two years. The options are exercisable within a four-year period beginning July 1, 2018 by grantees still in the employ of the company. The market price of Tasks' ordinary share was P33 per share at the date of grant. No share options were terminated during the year. 1. How much should Task charge to compensations expense for the year ended December 31, 2016?

- On January 1, 2011, Svetlana Company granted to employees a share-basedpayment with cash and share alternative. The provisions include the right to a cash paymentequal to the value of 10,000 phantom shares or 15,000 ordinary shares with a par value ofP40. The grant is conditional upon the completion of three years' service. If the employees choose the share alternative, the shares must be held for three years after vesting date. At grant date, the share price is P60. At the end of 2011, 2012 and 2013, the share prices areP63, P65 and P72, respectively. Svetlana does not expect to pay dividends in the next three years. After taking into account the effect of post vesting transfer restrictions, Svetlana Company estimated that the grant date fair value of the share alternative is P46. On January 1, 2014, the employees selected the share alternative. What is the share premium if the employee has chosen the share alternative on December 31, 2013?On January 1, 2018, Red Inc. grants to an employee the right to choose either 1,000 phantom shares (i.e. a right to a cash payment equal to the fair value of 1,000 shares) or 1,200 shares with a par value of P10 per share. The grant is conditional upon the completion of three years' service. If the employee chooses the share alternative, the shares must be held for three years after the vesting date. At the date of grant, the entity's share price is P50 per share. At the end of year 2018, 2019 and 2020, the share price is P52, P55 and P60, respectively. The entity does not expect to pay dividends in the next three years. After taking into account the effects of the post-vesting transfer restrictions, the entity estimates that the grant date fair value of the share alternative is P48per share. If the employee has chosen the cash alternative, the amount to be paid at the end of 2020 should be A.P60,000B.P52,000C.P55,000D.P67,600On January 1, 2020, the entity granted share options of 100,000 ordinary shares (with par value of P30 per share) at an option price of P38 per share as compensation to its officers for services to be rendered in the next three years. These options are exercisable within two years from January 1, 2023, provided that the officers remain in the employ of the company. The fair value of the share options on date of grant is P12, and the market price of the share on grant date is P47 per share. During 2023, all share options are exercised. How much should be recognized as share premium upon exercise of the share options in 2023? A. P 2,000,000 B. P 1,200,000 C. P 800,000 D. Zero E. Option 2