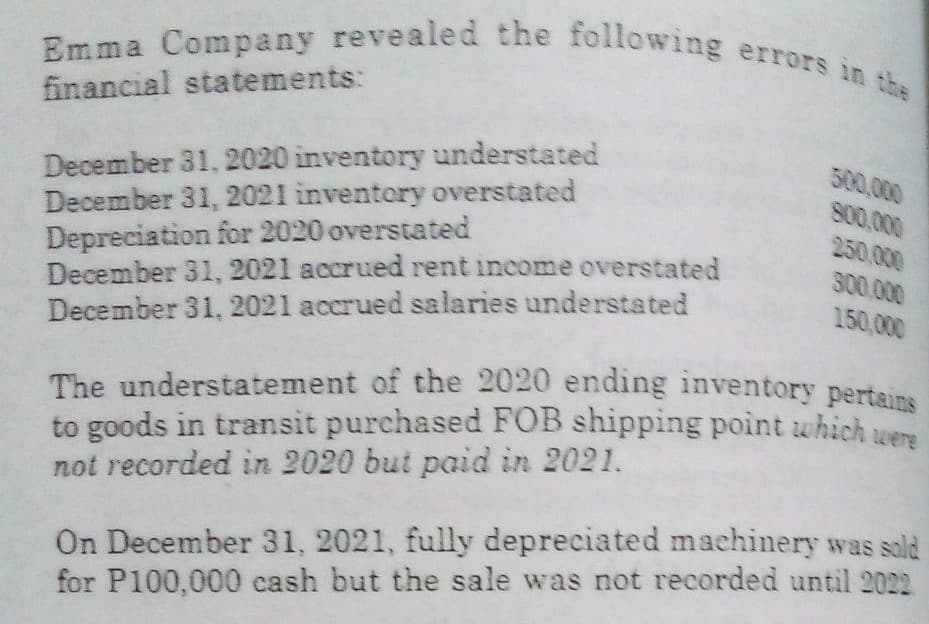

lowing errors in the the Emma Company reveale financial statements: 500,000 800,000 250,000 December 31, 2020 inventory understated December 31, 2021 inventory overstated Depreciation for 2020 overstated 300.000 150,000 December 31, 2021 accrued rent income overstated December 31, 2021 accrued salaries understated The understatement of the 2020 ending inventory pertains to goods in transit purchased FOB shipping point which were not recorded in 2020 but paid in 2021. On December 31, 2021, fully depreciated machinery was sold for P100,000 cash but the sale was not recorded until 2022

lowing errors in the the Emma Company reveale financial statements: 500,000 800,000 250,000 December 31, 2020 inventory understated December 31, 2021 inventory overstated Depreciation for 2020 overstated 300.000 150,000 December 31, 2021 accrued rent income overstated December 31, 2021 accrued salaries understated The understatement of the 2020 ending inventory pertains to goods in transit purchased FOB shipping point which were not recorded in 2020 but paid in 2021. On December 31, 2021, fully depreciated machinery was sold for P100,000 cash but the sale was not recorded until 2022

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 21GI: Indicate the effect of each of the following errors on the following balance sheet and income...

Related questions

Question

What amount should be reported as net effect of the errors on net income for 2020?*

a. 250000 understated

b. 250000 overstated

c. 500000 understated

d. 0

Transcribed Image Text:Emma Company revealed the following errors in the

financial statements:

500,000

800,000

250.000

December 31, 2020 inventory understated

December 31, 2021 inventory overstated

Depreciation for 2020 overstated

300.000

150,000

December 31, 2021 accrued rent income overstated

December 31, 2021 accrued salaries understated

The understatement of the 2020 ending inventory pertains

to goods in transit purchased FOB shipping point which were

not recorded in 2020 but paid in 2021.

On December 31, 2021, fully depreciated machinery was sold

for P100,000 cash but the sale was not recorded until 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,