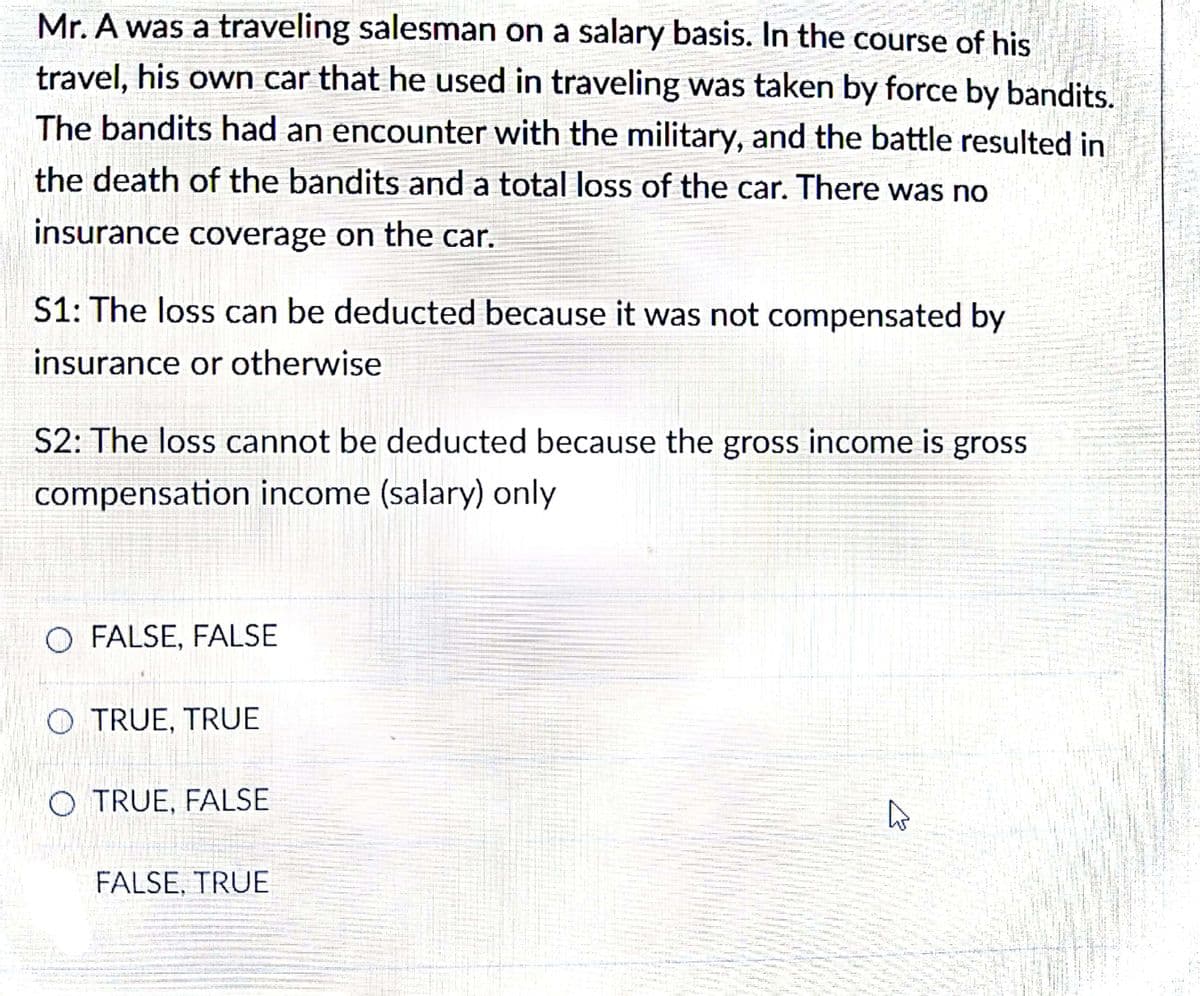

Mr. A was a traveling salesman on a salary basis. In the course of his travel, his own car that he used in traveling was taken by force by bandits. The bandits had an encounter with the military, and the battle resulted in the death of the bandits and a total loss of the car. There was no insurance coverage on the car.

Mr. A was a traveling salesman on a salary basis. In the course of his travel, his own car that he used in traveling was taken by force by bandits. The bandits had an encounter with the military, and the battle resulted in the death of the bandits and a total loss of the car. There was no insurance coverage on the car.

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 8DQ: Holly was injured while working in a factory and received 12,000 as workers compensation while she...

Related questions

Question

#2 PLS ANSWER

Transcribed Image Text:Mr. A was a traveling salesman on a salary basis. In the course of his

travel, his own car that he used in traveling was taken by force by bandits.

The bandits had an encounter with the military, and the battle resulted in

the death of the bandits and a total loss of the car. There was no

insurance coverage on the car.

S1: The loss can be deducted because it was not compensated by

insurance or otherwise

S2: The loss cannot be deducted because the gross income is grss

compensation income (salary) only

O FALSE, FALSE

O TRUE, TRUE

O TRUE, FALSE

FALSE, TRUE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning