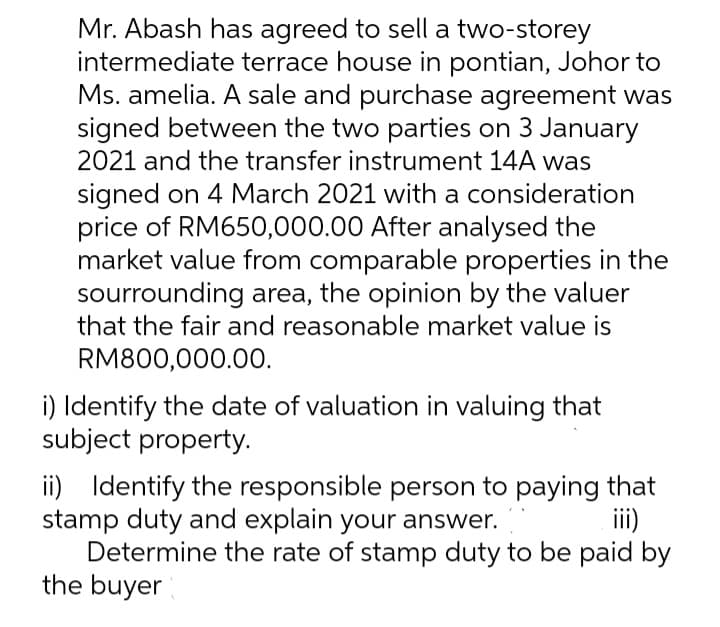

Mr. Abash has agreed to sell a two-storey intermediate terrace house in pontian, Johor to Ms. amelia. A sale and purchase agreement was signed between the two parties on 3 January 2021 and the transfer instrument 14A was signed on 4 March 2021 with a consideration price of RM650,000.00 After analysed the market value from comparable properties in the sourrounding area, the opinion by the valuer that the fair and reasonable market value is RM800,000.00O. i) Identify the date of valuation in valuing that subject property. ii) Identify the responsible person to paying that stamp duty and explain your answer. Determine the rate of stamp duty to be paid by the buyer iii)

Mr. Abash has agreed to sell a two-storey intermediate terrace house in pontian, Johor to Ms. amelia. A sale and purchase agreement was signed between the two parties on 3 January 2021 and the transfer instrument 14A was signed on 4 March 2021 with a consideration price of RM650,000.00 After analysed the market value from comparable properties in the sourrounding area, the opinion by the valuer that the fair and reasonable market value is RM800,000.00O. i) Identify the date of valuation in valuing that subject property. ii) Identify the responsible person to paying that stamp duty and explain your answer. Determine the rate of stamp duty to be paid by the buyer iii)

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 37CE

Related questions

Question

plz solve all parts within 30-40 mins I'll give you multiple upvote

Transcribed Image Text:Mr. Abash has agreed to sell a two-storey

intermediate terrace house in pontian, Johor to

Ms. amelia. A sale and purchase agreement was

signed between the two parties on 3 January

2021 and the transfer instrument 14A was

signed on 4 March 2021 with a consideration

price of RM650,000.00 After analysed the

market value from comparable properties in the

sourrounding area, the opinion by the valuer

that the fair and reasonable market value is

RM800,000.0O.

i) Identify the date of valuation in valuing that

subject property.

ii) Identify the responsible person to paying that

stamp duty and explain your answer.

Determine the rate of stamp duty to be paid by

the buyer

ii)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you