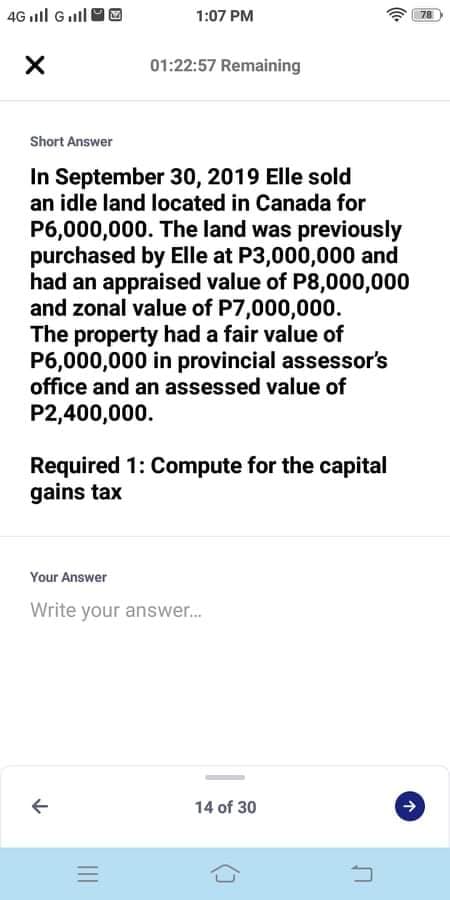

In September 30, 2019 Elle sold an idle land located in Canada for P6,000,000. The land was previously purchased by Elle at P3,000,000 and had an appraised value of P8,000,000 and zonal value of P7,000,000. The property had a fair value of P6,000,000 in provincial assessor's office and an assessed value of P2,400,000. Required 1: Compute for the capital gains tax

Q: On November 5, 2020, BLUE Company purchased a land and a building for a lump-sum amount of…

A: Total fair values of the land and building = ₱1,100,000 + ₱1,650,000 = ₱2,750,000

Q: Momo Company has a single investment property which had originally cost P2,320,000 on January 1,…

A: Valuation of Investment Assets According to PAS 40 the valuation of the investment assets mainly…

Q: On Jan. 1, 2022, ABC Co. sold a machinery to XYZ Co. for P1,900,000. Because of the entity's…

A: The lease liability is a sum of all discounted future lease payments. In this case, only lease…

Q: On January 1, 2021, Globe Company sold a piece of machinery to Troll Company for P2,400,000. Because…

A: The question is related to Accounting for Lease. As per accounting for lease right to use asset…

Q: Form it instead assumes a $100,000 recourse loan on Vee’s land, what are the realized and recognized…

A: Realized value were the value that is adjustable . For Frat $740000 For Van $ 660000 * Recognised…

Q: Cleopatra Company owns a tract of land that it purchased in 2017 for P2,000,000. The land is held as…

A: Note: Since you have asked multiple question, we will solve the first question for you. If you want…

Q: On January 1, 2021, Globe Company sold a piece of machinery to Troll Company for P1,900,000. Because…

A: The question is related to Lease Accounting. The leasee (Global) will record the asset at lower of…

Q: On January 1, 2021, Globe Company sold a piece of machinery to Troll Company for P1,900,000. Because…

A: All amount are in (P).

Q: An entity accounted for land using the revaluation model. On October 1, 2020, the entity classified…

A: Given that: Carrying amount of Land = P5,000,000 Revaluation Surplus = P1,500,000 Fair value of land…

Q: Required: • Explain how B Ltd should classify Alphablock in the financial statements up until 1…

A: As per IAS 40, Investment property is the property held by an individual with the purpose to earn…

Q: Red Company sold to another entity a tract of land costing P5,000,000 for P7,000,000 on January 1,…

A: Journal entry is a primary entry that records the financial transactions initially.

Q: Rover Inc. purchased land for $118,000,000 in 2011. At December 31, 2020, an appraisal determined…

A: "Since you have asked multiple questions, we will solve first question for you. if you want any…

Q: On January 1, 2021, Globe Company sold a piece of machinery to Troll Company for P2,400,000. Because…

A: Lease liability is the present value of lease payments to be made by lessee over the lease term by…

Q: Tanaka Company has land that cost $15,000,000. Its fair value on December 31, 2020, is $20,000,000.…

A: Assets are carried at the fair value on the date of revaluation under revaluation model for…

Q: In 2021 Pony Company purchased land from its subsidiary, Source Sandals, for $10,000,000. The land…

A: Elimination entries are made in the consolidated statement worksheets, these entries eliminate the…

Q: Robust Company purchased an investment property on January 1, 2019, at a cost of P4,000,000. The…

A: A recognized gain occurs when an investment or asset is sold for a price that is larger than what…

Q: On January 1, 2021, an entity purchased a building to be leased to a 3rd party. The cost of the…

A: Depreciation of building (in million) = (Rp 320 - Rp20)/20 years = Rp 15 million per annum…

Q: An entity accounted for land using the revaluation model. On October 1, 2020, the entity classified…

A: The assets held for sale are recognized at FV less cost of disposal. Any revaluation gain on…

Q: An entity accounted for land using the revaluation model. On October 1, 2020, the entity classified…

A: Other comprehensive income: Other comprehensive income is the income that includes the revenue,…

Q: Calculate the amount of the stamp duty.

A: Given, Mr. Mutu purchased a development land = RM3,000,000 The agreement was signed on 29 April…

Q: Masa Khit Nha Company accounted for noncurrent assets using the revaluation model. On August 1,…

A: Here to discuss about the carrying value of the land in the revaluation model. It is always taken…

Q: Don Camilo Company, a real estate entity, had a building in Legarda Rd. with a carrying amount of…

A: Carrying Amount of the Building = P20,000,000 Fair Value of the Building = P35,000,000 Useful life =…

Q: On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated…

A: Depreciation means the amount of expenses written off from the value of fixed assets used in…

Q: Hindi Kho Kaya Corporation is using the cost model for noncurrent assets. On November 1, 2020, the…

A: As per IFRS 5, Non current assets held for sale and discontinued operations, Specifies that an…

Q: An entity accounted for land using the revaluation model. On October 1,2020, the entity classified a…

A: Impairment loss is the permanent diminution in the value of asset. it shows the decrease in the fair…

Q: On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated…

A: As per IAS 16- PPE, A decrease arising as a result of a revaluation should be recognized as an…

Q: Lincon Company owned a building on January 01, 2019, with historical cost of P52,000,000. The…

A: A revaluation excess is a type of equity account that records any gains in the value of capital…

Q: In 2018, Lepanto Mining Company purchased property with natural resources for P28,000,000. The…

A: The financial transactions are initially recorded in the journal form.

Q: As of December 31, 2022, 380 lots were sold and the market value of each lot had increased to…

A: When there is a transfer of inventories to investment property at fair value then the difference…

Q: On 30 June 2021, Wheel Ltd opted to adopt the revaluation model to measu land. According to AASB116,…

A: Answer:- AASB 116:- It is the accounting standard relating to the "Property, Plant &…

Q: Cleopatra Company owns a tract of land that it purchased in 2017 for P2,000,000. The land is held as…

A: When an asset is exchanged at a fair price between knowledgeable and desirous parties, the sum for…

Q: At 30 November 20X3, Joey carried a property in its statement of financial position at its revalued…

A: IFRS-5 "Non-current Assets Held for Sale and Discontinued Operations" deals with the process of…

Q: On July 16, 2019 Logan acquires land and a building for $500,000 to use in his sole proprietorship.…

A: (a) On the acquisition date The adjusted basis for the land and building is Land = purchase price…

Q: Van Industries and Frat Corporation trade land in 2021. Van has an adjusted basis of $740,000 in…

A: Realized value were the value that is adjustable . For Frat $740000 For Van $ 660000 Recognized…

Q: PT Adista owns land that was purchased in cash on January 2, 2018 at a cost of IDR 1,000,000,000.…

A: There are two methods for subsequent accounting of the fixed assets; which are, Cost model and the…

Q: On January 1, 2019, ABC Company purchased land at a cost of P 6M. the entity used the revaluation…

A:

Q: 40 years on a straight-line basis with no residual value. The entity adopted a policy of revaluation…

A:

Q: On January 1, 2019, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in…

A: As per International accounting standard 21, translating the trial balance or balance sheet of the…

Q: On October 7, 2020, Grace Gems purchased a basket of assets for the lump-sum price of $150,000. The…

A: Basis in asset Generally, the basis in the asset is the amount spent on purchasing the asset. It…

Q: On April 30, 2019, Min

A:

Q: On January 1, 2020, Marshall acquired an investment for P500,000 plus a purchase commission of…

A: Under FTOCI investment should be measured at fair value on year end

Q: Panama Company acquired 60 % of Samoa Corporation on 1/2018. Fair values of Samoa's assets and…

A: d. Calculate excess depreciation.

Q: Nona Co. purchased land worth P20,000,000 on January 1, 2021. The company uses the revaluation model…

A: Under revaluation model, Property plant and equipment is measured at an estimated fair value of the…

Q: Rhino Company, a real estate entity, had a building with a The building was used as offices of the…

A: Given information, Carrying amount of building =P20,000,000 Fair value of building =P35,000,000…

Q: On December 31, 2021, an entity has a building with cost of Rp500 million and accumulated…

A: Disclaimer: Since you have asked multiple questions we only answer the first question for you to…

Q: Jessie Company purchased an investment property on January 1, 2020 at a cost of P2,200,000. The…

A: Given information, Cost of the property =P2,200,000 Fair value of the property =P3,000,000 Useful…

Q: On July 16, 2020, Logan acquires land and a building for $500,000 to use in his sole proprietorship.…

A: The adjusted basis for land and building at the acquisition date is Land : $100,000 Building :…

Q: . In 2018, Delta Corporation bought a condominium unit on installment for the use of its executive.…

A: GIVEN In 2018, Delta Corporation bought a condominium unit on installment for the use of its…

Q: An entity accounted for land using the revaluation model. On October 1, 2020, the entity classified…

A: The assets held for sale are recognized at FV less cost of disposal. Any revaluation gain on…

Q: Ben Company purchased an investment property on January 1, 2020 at a cost of P250.000. The property…

A: The investment property refers to the asset that is not used in production and providing goods and…

Please answer asap. Thank you

Step by step

Solved in 2 steps

- LO.7 On October 1, 2019, Priscilla purchased a business. Of the purchase price, 60,000 is allocated to a patent and 375,000 is allocated to goodwill. Calculate Priscillas 2019 197 amortization deduction.Q4 Dhofar LLC acquired an asset on 1st January 2019 for OMR 500,000 and the rate of depreciation is 10%p.a. Under Straight line method. Replacement cost of the asset on 31st December 2019 was OMR 700,000 and on 31st December 2020 was OMR 1,000,000. You are required to calculate for 2020 assuming switch year is made in the current year, the value of additional depreciation. a. OMR 15,000 b. None of these are correct c. OMR 50,000 d. OMR 35,000Q42 Dhofar LLC acquired an asset on 1st January 2019 for OMR 500,000 and the rate of depreciation is 10%p.a. Under Straight line method. Replacement cost of the asset on 31st December 2019 was OMR 700,000 and on 31st December 2020 was OMR 1,000,000. You are required to calculate for 2020 assuming switch year is made in the current year, the value of Backlog depreciation. a. OMR 50,000 b. None of these are correct c. OMR 85,000 d. OMR 15,000

- Q5. PK Ltd acquires a block of land on 1 January 2017 for $200 000 in cash. Due to increased housing demand in the area, the land has a fair value of $290 000 on 1 January 2018.However, the market value falls to $140 000 on 30 June 2019. Write the journal entries needed.P10.1 (LO 1 ) (Classification of Acquisition and Other Asset Costs) At December 31, 2019, certain accounts included in the property, plant, and equipment section of Reagan Company's balance sheet had the following balances. Land $230,000 Buildings 890,000 Leasehold improvements 660,000 Equipment 875,000 During 2020, the following transactions occurred. 1.Land site number 621 was acquired for $850,000. In addition, to acquire the land Reagan paid a $51,000 commission to a real estate agent. Costs of $35,000 were incurred to clear the land. During the course of clearing the land, timber and gravel were recovered and sold for $13,000. 2.A second tract of land (site number 622) with a building was acquired for $420,000. The closing statement indicated that the land value was $300,000 and the building value was $120,000. Shortly after acquisition, the building was demolished at a cost of $41,000. A new building was constructed for $330,000 plus the…Aa.18. Mikkeli OY acquired a brand name with an indefinite life in 2021 for 42,600 markkas. At December 31, 2020, the brand name could be sold for 35,600 markkas, with zero costs to sell. Expected cash flows from the continued use of the brand are 44,870 markkas, and the present value of this amount is 34,600 markkas. Assume that Mikkeli OY is a foreign company using IFRS and is owned by a company using U.S. GAAP. Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for this brand name for the year ending December 31, 2020, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020 conversion worksheet to convert IFRS balances to U.S. GAAP.

- Hw.27. Entity A entered into a sale and repurchase agreement for its head office on 1 January 2022, selling the office to Bank B for $78,560,000. On the same date, the head office had a fair value of $97,800,000. Entity A will continue to use the head office for the next 2 years and has the option to buy back the property for $93,765,779, based on an effective interest rate of 9.25% per year over the next 2 years. Property prices are expected to increase over the next 2 years. REQUIRED: Measure the net amount to be shown in the Statement of Profit or Loss for the year ended 31 December 2022. 1. $7,938,979 Expense 2. $19,240,000 Expense 3. $0 4. $7,266,800 Expense 5. None of them.Property 1This property was purchased at a cost of R4 500 000 on 1 January 2019. An upfront payment ofR450 000 was made on this date and the remaining R4 050 000 is payable on 31 December 2019.A discount rate of 10% is applicable. The present value factor for R1 at 10% per annum is 0.909.5% of the property is used by the company as its sales and administration office. This isconsidered to be an insignificant portion of the property. The remaining 95% is leased to thirdparties under operating leases. The property cannot be apportioned off and sold separately.Transfer duties of R328 000 plus other abnormal costs of labour amounting to R50 000 wereincurred in getting the property ready to be let out to third parties.During the year, rentals of R775 000 were earned and repairs and maintenance expenses ofR65 000 were paid.The fair value of the property at year end on 31 December 2019 was R5 400 000. Q.2.2 If the company chooses to use the fair value model for measurement after recognition…G5. Q. During fiscal 2019, Kroger sold its Turkey Hill Dairy business for a gain. What was the book value of Turkey Hill Dairy’s net assets that Kroger disposed of?

- P12.1B (L0 1,2,3,5) (Correct Intangible Asset Account) Dolphin Co., organized in 2019, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2020 and 2021: Instructions 3/1/2020 3/1/2020 4/1/2020 6/30/2020 9/1/2020 12/31/2020 6/30/2021 9/1/2021 Intangible Assets 10-year franchise agreement; expires 2/28/28 Organization costsAdvance payment for 2 years for office space Purchased a patent (8-year life) Cost to develop a patent (10-year life) Net operating loss for 2020Research and development costsLegal fee to successfully defend internally developed patent $ 60,000 7,000 24,000 80,000 40,000 61,000 265,000 13,500 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2021, recording any necessary amortization and reflecting all balances accurately as of that date. (Ignore…Q6. Land was acquired for $200 000 on 1 July 2017. On 30 June 2018 it has a fair value of $150 000. On 30 June 2020, due to increased population, the land is considered to have a fair value of $270 000. Write the journal entries needed.Question 25 B's basis in the property received is m $10,000 m $20,000 m $30,000 m None of these_ Question 26 Z Co.'s recognized gain or loss on the distribution to A is m None of these_ m S35.000 capital gain m $<40,000> ordinary loss m 0 Question 27 Z Co.'s recognized gain or loss On the distribution to B is m None of these_ m $2O,0OO capital gain m $10,000 capital gain m 0 Question 28 Z Co.'s recognized gain or loss on the distribution to C is $70,000 capital gain None of these_ $20,000 capital gain $40,000 gain Question 29 Z Co.'s recognized gain or loss on the distribution to D is m <$1,600> capital loss m 0 m <$400> capital loss m None of these