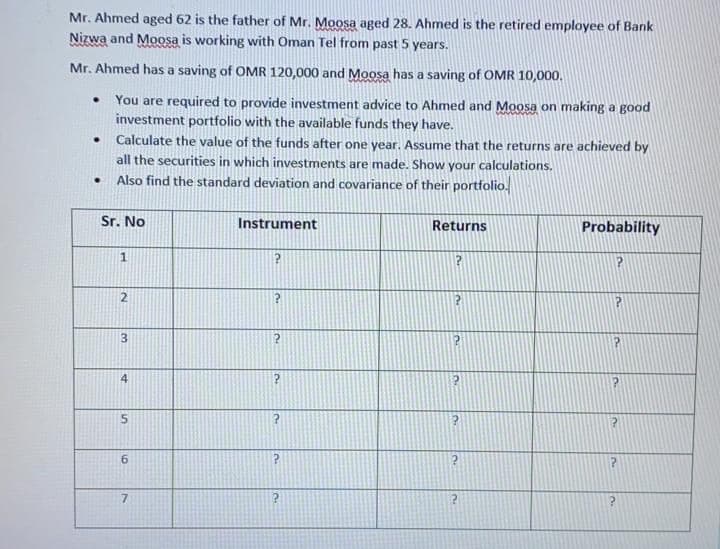

Mr. Ahmed aged 62 is the father of Mr. Moosa aged 28. Ahmed is the retired employee of Bank Nizwa and Moosa is working with Oman Tel from past 5 years. Mr. Ahmed has a saving of OMR 120,000 and Moosa has a saving of OMR 10,000. You are required to provide investment advice to Ahmed and Moosa on making a good investment portfolio with the available funds they have. Calculate the value of the funds after one year. Assume that the returns are achieved by all the securities in which investments are made. Show your calculations. Also find the standard deviation and covariance of their portfolio. Sr. No Instrument Returns Probability 2

Mr. Ahmed aged 62 is the father of Mr. Moosa aged 28. Ahmed is the retired employee of Bank Nizwa and Moosa is working with Oman Tel from past 5 years. Mr. Ahmed has a saving of OMR 120,000 and Moosa has a saving of OMR 10,000. You are required to provide investment advice to Ahmed and Moosa on making a good investment portfolio with the available funds they have. Calculate the value of the funds after one year. Assume that the returns are achieved by all the securities in which investments are made. Show your calculations. Also find the standard deviation and covariance of their portfolio. Sr. No Instrument Returns Probability 2

Chapter15: Mutual And Exchange Traded Funds

Section: Chapter Questions

Problem 1FPC

Related questions

Question

Transcribed Image Text:Mr. Ahmed aged 62 is the father of Mr. Moosa aged 28. Ahmed is the retired employee of Bank

Nizwa and Moosa is working with Oman Tel from past 5 years.

Mr. Ahmed has a saving of OMR 120,000 and Moosa has a saving of OMR 10,000.

You are required to provide investment advice to Ahmed and Moosa on making a good

investment portfolio with the available funds they have.

Calculate the value of the funds after one year. Assume that the returns are achieved by

all the securities in which investments are made. Show your calculations.

Also find the standard deviation and covariance of their portfolio.

Sr. No

Instrument

Returns

Probability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you