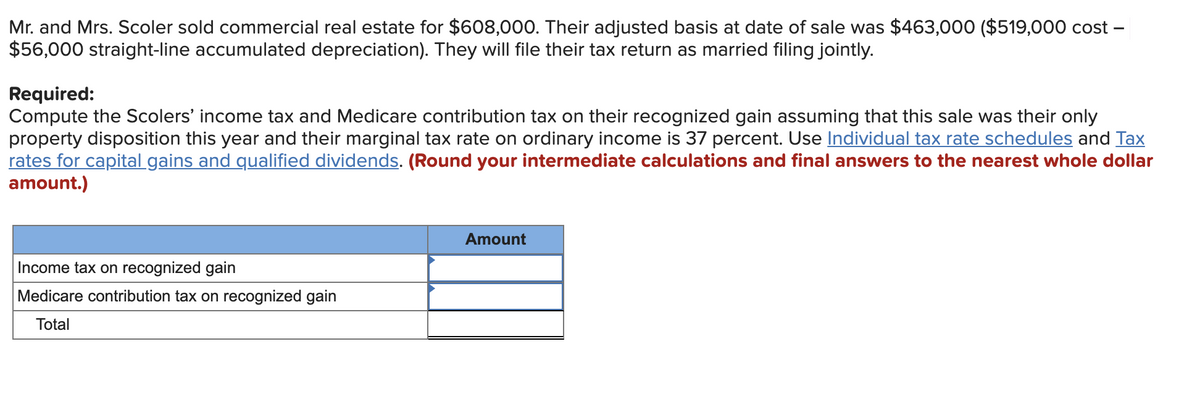

Mr. and Mrs. Scoler sold commercial real estate for $608,000. Their adjusted basis at date of sale was $463,000 ($519,000 cost – $56,000 straight-line accumulated depreciation). They will file their tax return as married filing jointly. Required: Compute the Scolers' income tax and Medicare contribution tax on their recognized gain assuming that this sale was their only property disposition this year and their marginal tax rate on ordinary income is 37 percent. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Amount Income tax on recognized gain Medicare contribution tax on recognized gain Total

Mr. and Mrs. Scoler sold commercial real estate for $608,000. Their adjusted basis at date of sale was $463,000 ($519,000 cost – $56,000 straight-line accumulated depreciation). They will file their tax return as married filing jointly. Required: Compute the Scolers' income tax and Medicare contribution tax on their recognized gain assuming that this sale was their only property disposition this year and their marginal tax rate on ordinary income is 37 percent. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Amount Income tax on recognized gain Medicare contribution tax on recognized gain Total

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 65P

Related questions

Question

Transcribed Image Text:Mr. and Mrs. Scoler sold commercial real estate for $608,000. Their adjusted basis at date of sale was $463,000 ($519,000 cost –

$56,000 straight-line accumulated depreciation). They will file their tax return as married filing jointly.

Required:

Compute the Scolers' income tax and Medicare contribution tax on their recognized gain assuming that this sale was their only

property disposition this year and their marginal tax rate on ordinary income is 37 percent. Use Individual tax rate schedules and Tax

rates for capital gains and qualified dividends. (Round your intermediate calculations and final answers to the nearest whole dollar

amount.)

Amount

Income tax on recognized gain

Medicare contribution tax on recognized gain

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT