Multiple Choice 1. Which statement about joint arrangement is correct? a. There is only one party that can control the joint arrangement. b. The percentage of ownership of each party in joint arrangement is equally. c. All parties have joint control in joint arrangement. d. Every party has different right and obligation to the joint arrangement. 2. Under IFRS 11 or PSAK 66, there are two types of joint arrangement. a. Joint operation and joint assets b. Joint assets and joint venture c. Joint venture and joint control d. Joint operation and joint venture 3.The difference between the two types of joint arrangement is determined by: a. The percentage of ownership of each party in joint arrangement. b. Right and obligation of the parties to the joint arrangement c. Legal form of the joint arrangement d. Intention of the joint arrangement management 4. Which one is the most appropriate accounting for each party at each type of joint arrangement a. Equity method for each party of joint venture b. Equity method for each party of joint operation c. Identifiable asset, liabilities, revenues, and expenses for each party of joint assets d. Identifiable asset, liabilities, revenues, and expenses for each party of joint venture

Multiple Choice 1. Which statement about joint arrangement is correct? a. There is only one party that can control the joint arrangement. b. The percentage of ownership of each party in joint arrangement is equally. c. All parties have joint control in joint arrangement. d. Every party has different right and obligation to the joint arrangement. 2. Under IFRS 11 or PSAK 66, there are two types of joint arrangement. a. Joint operation and joint assets b. Joint assets and joint venture c. Joint venture and joint control d. Joint operation and joint venture 3.The difference between the two types of joint arrangement is determined by: a. The percentage of ownership of each party in joint arrangement. b. Right and obligation of the parties to the joint arrangement c. Legal form of the joint arrangement d. Intention of the joint arrangement management 4. Which one is the most appropriate accounting for each party at each type of joint arrangement a. Equity method for each party of joint venture b. Equity method for each party of joint operation c. Identifiable asset, liabilities, revenues, and expenses for each party of joint assets d. Identifiable asset, liabilities, revenues, and expenses for each party of joint venture

Chapter21: Partnerships

Section: Chapter Questions

Problem 4RP

Related questions

Question

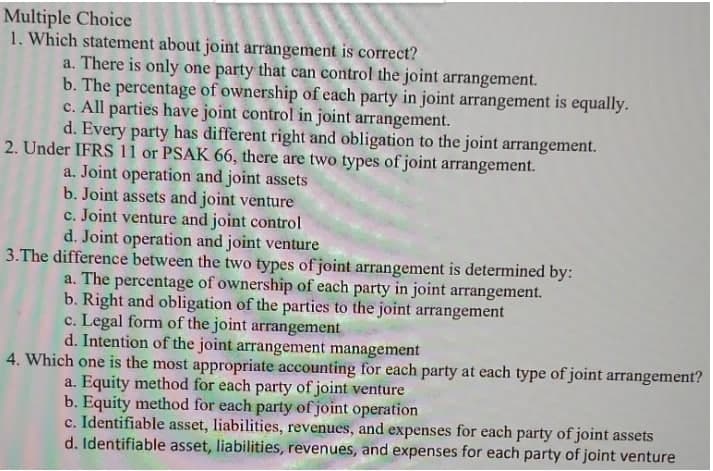

Transcribed Image Text:Multiple Choice

1. Which statement about joint arrangement is correct?

a. There is only one party that can control the joint arrangement.

b. The percentage of ownership of each party in joint arrangement is equally.

c. All parties have joint control in joint arrangement.

d. Every party has different right and obligation to the joint arrangement.

2. Under IFRS 11 or PSAK 66, there are two types of joint arrangement.

a. Joint operation and joint assets

b. Joint assets and joint venture

c. Joint venture and joint control

d. Joint operation and joint venture

3.The difference between the two types of joint arrangement is determined by:

a. The percentage of ownership of each party in joint arrangement.

b. Right and obligation of the parties to the joint arrangement

c. Legal form of the joint arrangement

d. Intention of the joint arrangement management

4. Which one is the most appropriate accounting for each party at each type of joint arrangement?

a. Equity method for each party of joint venture

b. Equity method for each party of joint operation

c. Identifiable asset, liabilities, revenues, and expenses for each party of joint assets

d. Identifiable asset, liabilities, revenues, and expenses for each party of joint venture

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT