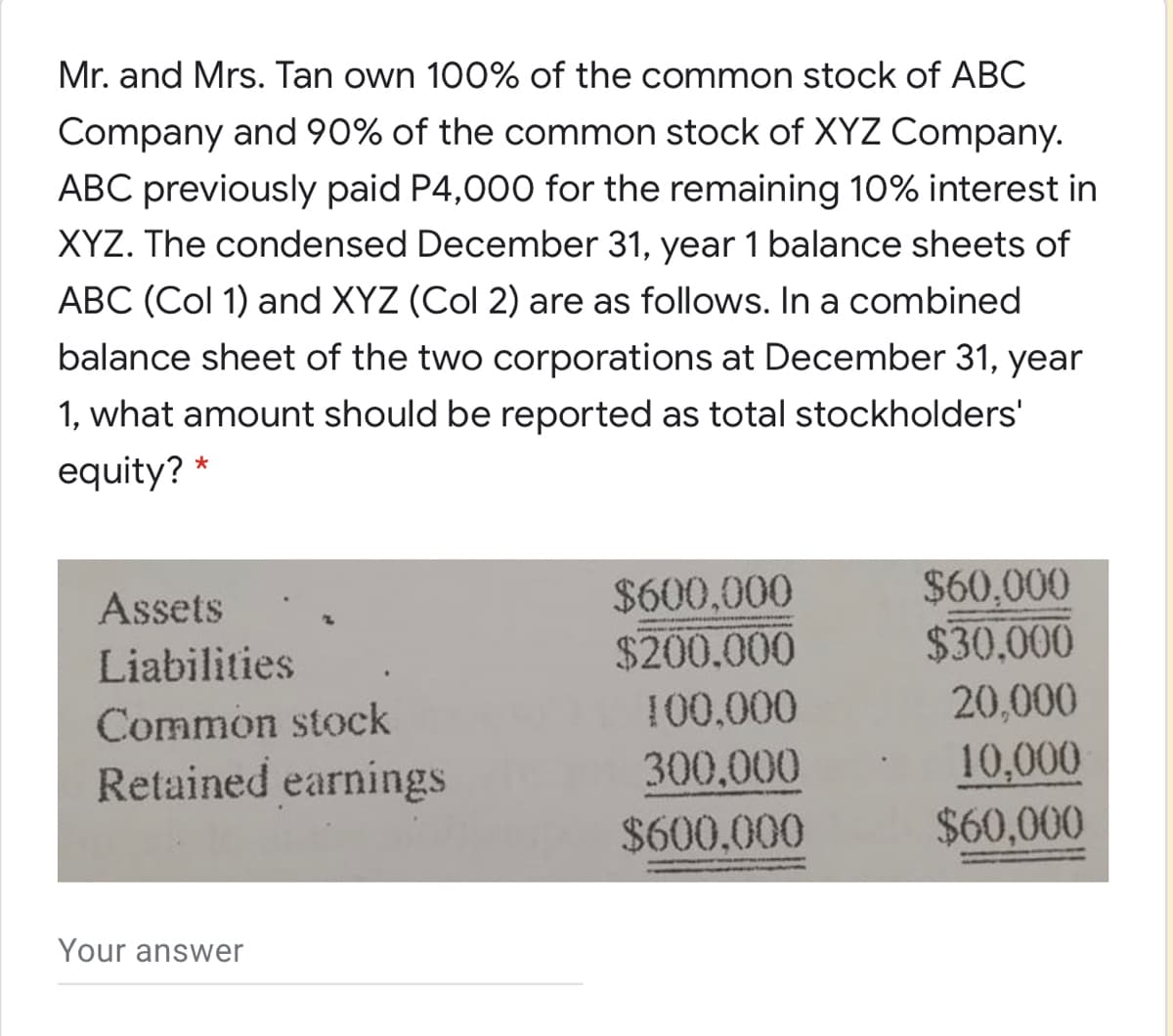

Mr. and Mrs. Tan own 100% of the common stock of ABC Company and 90% of the common stock of XYZ Company. ABC previously paid P4,000 for the remaining 10% interest in XYZ. The condensed December 31, year 1 balance sheets of ABC (Col 1) and XYZ (Col 2) are as follows. In a combined balance sheet of the two corporations at December 31, year 1, what amount should be reported as total stockholders' equity? * $600,000 $200.000 $60,000 $30,000 Assets Liabilities 100,000 20,000 Common stock 10,000 $60,000 Retained earnings 300,000 $600,000 Your answer

Mr. and Mrs. Tan own 100% of the common stock of ABC Company and 90% of the common stock of XYZ Company. ABC previously paid P4,000 for the remaining 10% interest in XYZ. The condensed December 31, year 1 balance sheets of ABC (Col 1) and XYZ (Col 2) are as follows. In a combined balance sheet of the two corporations at December 31, year 1, what amount should be reported as total stockholders' equity? * $600,000 $200.000 $60,000 $30,000 Assets Liabilities 100,000 20,000 Common stock 10,000 $60,000 Retained earnings 300,000 $600,000 Your answer

Chapter22: S Corporations

Section: Chapter Questions

Problem 8BCRQ

Related questions

Question

Transcribed Image Text:Mr. and Mrs. Tan own 100% of the common stock of ABC

Company and 90% of the common stock of XYZ Company.

ABC previously paid P4,000 for the remaining 10% interest in

XYZ. The condensed December 31, year 1 balance sheets of

ABC (Col 1) and XYZ (Col 2) are as follows. In a combined

balance sheet of the two corporations at December 31, year

1, what amount should be reported as total stockholders'

equity? *

$60,000

$30,000

20,000

10,000

$60,000

$600,000

$200.000

Assets

Liabilities

Common stock

100,000

Retained earnings

300,000

$600,000

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you