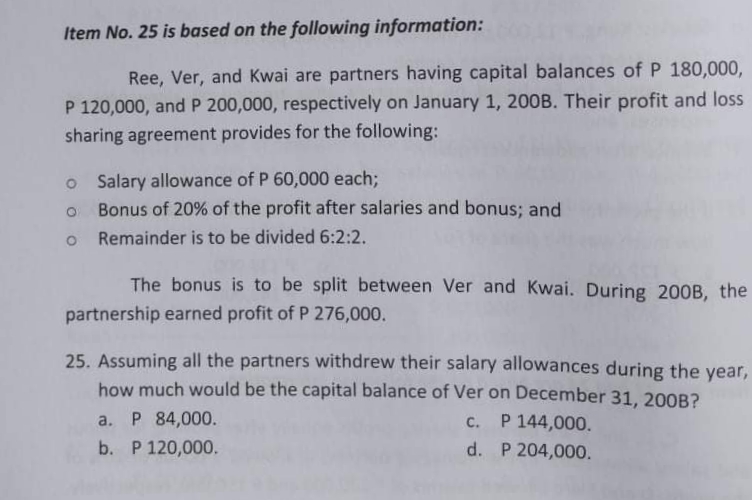

Item No. 25 is based on the following information: Ree, Ver, and Kwai are partners having capital balances of P 180,000, P 120,000, and P 200,000, respectively on January 1, 200B. Their profit and loss sharing agreement provides for the following: o Salary allowance of P 60,000 each; Bonus of 20% of the profit after salaries and bonus; and Remainder is to be divided 6:2:2. The bonus is to be split between Ver and Kwai. During 200B, the partnership earned profit of P 276,000. 25. Assuming all the partners withdrew their salary allowances during the year how much would be the capital balance of Ver on December 31, 200B? a. P 84,000. c. P 144,000. b. P 120,000. d. P 204,000.

Item No. 25 is based on the following information: Ree, Ver, and Kwai are partners having capital balances of P 180,000, P 120,000, and P 200,000, respectively on January 1, 200B. Their profit and loss sharing agreement provides for the following: o Salary allowance of P 60,000 each; Bonus of 20% of the profit after salaries and bonus; and Remainder is to be divided 6:2:2. The bonus is to be split between Ver and Kwai. During 200B, the partnership earned profit of P 276,000. 25. Assuming all the partners withdrew their salary allowances during the year how much would be the capital balance of Ver on December 31, 200B? a. P 84,000. c. P 144,000. b. P 120,000. d. P 204,000.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Transcribed Image Text:Item No. 25 is based on the following information:

Ree, Ver, and Kwai are partners having capital balances of P 180,000,

P 120,000, and P 200,000, respectively on January 1, 200B. Their profit and loss

sharing agreement provides for the following:

o Salary allowance of P 60,000 each;

Bonus of 20% of the profit after salaries and bonus; and

o Remainder is to be divided 6:2:2.

The bonus is to be split between Ver and Kwai. During 200B, the

partnership earned profit of P 276,000.

25. Assuming all the partners withdrew their salary allowances during the year,

how much would be the capital balance of Ver on December 31, 200B?

a. P 84,000.

c. P 144,000.

b. P 120,000.

d. P 204,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning