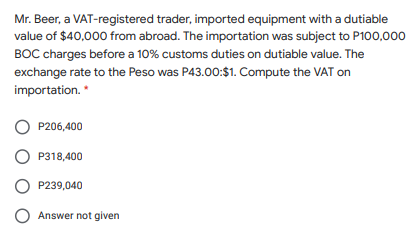

Mr. Beer, a VAT-registered trader, imported equipment with a dutiable value of $40,000 from abroad. The importation was subject to P100,000 BOC charges before a 10% customs duties on dutiable value. The exchange rate to the Peso was P43.00:$1. Compute the VAT on importation. P206,400 O P318,400 P239,040 O Answer not given

Q: On April 1, A.C. Corporation a calendar-year U.S. electronics manufacturer, buys 460000 Yen worth of…

A: As per foreign exchange rate the monetary foreign currency is recognized at the closing exchange…

Q: Spindler, Inc. (a U.S.-based company), imports surfboards from a supplier in Brazil and sells them…

A: Foreign exchange fluctuation loss/gain: Foreign exchange fluctuation loss/gain is occurred if…

Q: On April 1, A.C. Corporation a calendar-year U.S. electronics manufacturer, buys 770000 Yen worth of…

A: In the international exchange market, exposure refers to the condition in which the international…

Q: The White Dove company, whose year ends 31 December, buys some goods from Ranka of France on 30…

A: The question is based on the concept of Financial Accounting.

Q: An investor enters into a short forward contract to sell ¥50,000 for U.S. dollars at an exchange…

A: A forward contract is a kind of financial derivative contract which is a customized contract between…

Q: . Mr. Beer, a VAT-registered trader, imported equipment with a dutiable value of $40,000 from…

A: Vat 12% the dutiable value of $40,000 from abroad BOC charges 100000 customs duties 10%

Q: On December 1, Y1, AAA, a US based company, entered into a three months forward contract to purchase…

A: The price of Forward contract is determined in such a way that the value of the contract at the…

Q: On September 1, 2020, Creed Co. sold merchandise to a foreign entity for 250,000 francs. Terms of…

A: The recording of transactions in the form of currencies outside the functional currency is known as…

Q: Timson Ltd sold goods on credit on 5th June 2020 to a New Zealand company for $NZ 45,000 when the…

A: Foreign exchange difference is the difference that results in gain or loss to the entity due to an…

Q: ara Corporation issued a promissory note denominated in foreign currency for the purchase made from…

A: Solution Concept in respect of the monetary assets and liabilities , there shall be initial and…

Q: Q10. On June 1, a calendar year U.S. manufacturer sells, on 60-day credit, goods to Oman importer…

A: Journal entry: Journal entry refers to an entry that is made to record the transactions which are…

Q: April 10, 2019, when the spot rate is $1.10/€, a U.S. company sells merchandise to a customer in…

A: Ans. In this question the U. S. company sold the merchandise at $1.10 per euro. The payment is…

Q: On March 1, 20x1, ABC Co. sold inventory to a foreign company for FC 1,000,000 (FC meansforeign…

A: A Forward contract is used hedge the risk of fluctuation is prices of an asset such as currency or…

Q: On March 1, 2012, Westfield Corporation received an order for parts from a foreign customer at a…

A: Fair value of forward contract = ( 0.120 - 0.118 ) x 500,000…

Q: A U.S. exporter has a Thai baht account receivable resulting from an export sale on June 1 to a…

A: The US exporter signed a forward contract on June 1. The spot Rate was $ 0.022 on that date The…

Q: During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington,…

A:

Q: During December of the current year, Exide company based in America, entered into the following…

A:

Q: 46-Mr. Ahmed has to make a payment of 5 million GBP to a UK company after 30 days for the purchase…

A: Currency forward are used for hedging the foreign currency payment.

Q: On 12 August, a Commonwealth Bank dealer in Melbourne concluded a transaction with a Citibank dealer…

A: Given, Contract amount = USD5,000,000 Exchange rate AUD/USD = 0.50 Delivery date = August 14…

Q: Vava Corp. imported an article from Japan. The invoice value of the imported articles was $ 7,000…

A: Please check the next step for the solution

Q: Al-Huda Corporation is an Omani firm offering different services. However, its main activity focuses…

A: The transaction exposure is the level of uncertainties faced by entities due to volatile foreign…

Q: An importer wishes to withdraw its importation from the Bureau of Customs. The imported goods are…

A: Customs Duty Custom duty is the important source income for the Philippines while clearing the goods…

Q: HH Inc. had the following transactions: • On May 1, HH purchased parts from a foreign company (FC1)…

A: 1.

Q: July 15, 2XX6, Liz converts 627,000 U.S. dollars to Japanese yen in the spot foreign exchange market…

A:

Q: Crane Pharma just received revenues of $3,164,400 in Australian dollars (A$). Management has the…

A: The exchange rates refer to the rate at which the currency of one country can be exchanged for that…

Q: On March 1, Derby Corporation (a U.S.-based company) expects to order merchandise from a supplier in…

A: Cost of goods sold = forward contract rate - foreign exchange loss

Q: Matthias Corp. had the following foreign currency transactions during 2020: Purchased…

A: Gain on payment of merchandise purchased = Amount paid on April 20 - Value on January 20 = 51,400…

Q: Imp entered into the second forward contract to hedge a commitment to purchase equipment being…

A: Solution:- Given, On December 12, year 1, Imp Co. entered into three forward exchange contracts,…

Q: An investor enters a short forward contract to sell 100,000 British pounds for US dollars at an…

A: Forward Contract refers to the contract or agreement that is customized and private in nature made…

Q: On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for…

A: International trade includes the trade of the company with the company which is located outside the…

Q: JJ Fashion Wholesalers Ltd, an Indian clothing manufacturer, has a contract to purchase cotton from…

A: Exchange rate quotations are basically the rate at which two different country's currency can be…

Q: Blowfast Corporation, a U.S. exporter, sold wind turbines to a Mexican customer at a price of…

A: Foreign Exchange loss/gain: Foreign Exchange loss /gain is the result due to currency…

Q: What amount of foreign exchange gain or loss should be recognized on May 8 ?

A: Given information is: ABC Corp., a US corporation, purchased goods on credit from a British company…

Q: (b) White Cliffs Co, whose year-end is 31 December, buys some goods from Rinka SA of France on 30…

A: IN THE BOOKS OF WHITE CLIFFS CO. DATE PARTICULARS DEBIT AMOUNT CREDIT AMOUNT 30th…

Q: Leigh of New York sells its products to customers in the United States and the United Kingdom. On…

A: Prepare journal entries on the given dates as follows: result:

Q: Clark Co., a U.S. corporation, sold inventory on December 1, 2021, with payment of 12,000 British…

A: Sales is the revenue proceeds from sale of goods and services. It should be recorded when goods and…

Q: Almira, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Almira made its first…

A: Foreign exchange risk is the possibility of financial loss as a result of fluctuating exchange…

Q: On August 1, Ling-Harvey Corporation (a U.S.-based importer) placed an order to purchase merchandise…

A: a.

Q: Vitamin, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Vitamin made its first…

A: PLEASE LIKE THE ANSWER, YOUR RESPONSE MATTERS A) JOURNAL ENTRY FOR 10/15/20*1 Customer account…

Q: During December of the current year, Exide company based in America, entered into the following…

A: The following Snip shows the entries to record.

Q: Banana, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Banana made its first…

A: As per IAS 21, " The Effect of Changes in Foreign Exchange Rates " The difference between the…

Q: Fiona, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Fiona made its first…

A: Foreign exchange risk refers to the risk of appreciating or depreciating the value of home currency…

Q: An Italian exporter exported sports apparel worth €300,000 to the UK, where the exchange rate is…

A: Billed amount = €300,000 Amount received = €270,000

Q: Vitamin, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Almira made its first…

A: Hedging is the most important aspect of eliminating foreign exchange risk. A manufacturer or…

Q: On March 1, Forward Import-Export Company purchased merchandise costing 70,100 Mexican pesos.…

A: Financial Accounting: It refers to the process of recording the financial transactions of the…

Setting: Philippines 2021

Step by step

Solved in 2 steps

- J, VAT registered taxpayer, had the following data on importation in 2022:Invoice cost (exchange rate $1: P46), $56,500Custom duties, 12%Freight, P200,000Insurance, P280,000Other charges before release from customs house, P70,000Facilitation fee, P100,000Freight from customs house to warehouse (net of VAT), P120,000The imported goods were sold for P6,650,000 (inclusive of VAT) 10 days after itsdelivery to the warehouse.How much is the VAT Payable?Local Corp imported a heavy machine from the US for US$50,000 on October 10, 2019. A letter of credit was opened with a Makati branch based on the commercial invoice for US$50,000, on which Local Corpl made a 100% deposit cover based on the exchange rate of $1.00 to P27.50. Shipment of the heavy machine was effected on December 30, 2019, at which time the exporter collected the proceeds of the letter of credit when the prevailing exchange rate was $1.00 to P28.00. From the exchange rate fluctuation, Local Corp realized: Group of answer choices A. P25,000 gain B.P25,000 loss C. P5,000 gain D. No gain, No lossOn September 22, Year 2, Yumi Corp. purchased merchandise from an unaffiliated foreign company for 10,000 units of the foreign company’s local currency. On that date, the spot rate was $.55. Yumi paid the bill in full on March 20, Year 3, when the spot rate was $.65. The spot rate was $.70 on December 31, Year 2. What amount should Yumi report as a foreign currency transaction loss in its income statement for the year ended December 31, Year 2?

- During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington, entered into the following transactions: Dec. 10 Sold seven office computers to a company located in Colombia for 8,229,000 pesos. On this date, the spot rate was 390 pesos per U.S. dollar. 12 Purchased computer chips from a company domiciled in Taiwan. The contract was denominated in 420,000 Taiwan dollars. The direct exchange spot rate on this date was $0.0428. (a) Your answer is correct. Prepare journal entries to record the transactions above on the books of Teletex Systems, Inc. The company uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit…During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington, entered into the following transactions: Dec. 10 Sold seven office computers to a company located in Colombia for 8,229,000 pesos. On this date, the spot rate was 390 pesos per U.S. dollar. 12 Purchased computer chips from a company domiciled in Taiwan. The contract was denominated in 420,000 Taiwan dollars. The direct exchange spot rate on this date was $0.0428. (a) Prepare journal entries to record the transactions above on the books of Teletex Systems, Inc. The company uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit CreditHonesty Company purchased merchandise worth a total of 100,000 foreign currency on April 1, 2022 from its foreign supplier, payable within 30 days. On April 30, 2022, Honesty paid the note. The following information of spot rates is provided (see image below). Answer the following subquestion(s): a. How much is the foreign exchange gain (loss)? _________________

- ABC Corp. imported a machine from the US for $50,000 on October 10, 20x1. A letter of credit was opened with a local bank based on the commercial invoice for $50,000, on which ABC Corp. made a 100% deposit cover based on the exchange rate of $1 to P27.50. Shipment of the machine was effected on December 3, 20x1, at which time the exporter collected the proceeds of the letter of credit when the prevailing exchange rate was $1 to P28.00. From the exchange rate fluctuation, ABC Corp. realized how much gain or loss or no gain, no loss? AU Co. acquired a fixed asset for $36,000 on November 1, 20x1 when the exchange rate was $1 = P23.00. At December 31, 20x1, the entity's year-end, the supplier of the fixed asset has not been paid and the exchange rate at that time was $1 = P25.00. On the December 31, 20x1 statement of financial position, what will be the values for the fixed asset and the creditor who was unpaid? On January 1, 20x6, the Riza Co. purchased equipment for P300,000. The…During December of the current year, Exide company based in America, entered into the following transactions; Dec 10 Sold machinery to company located in Colombia for 6,500,000 pesos. On this date, the spot rate was 365 pesos per U.S. Dollar. Dec 12 Purchased Machine parts from a company domiciled in Japan. The contract was denominated in 600,000 Japan yen. The direct exchange spot rate on this date was $.0392. Required: Prepare journal entries to record the transactions above on the books of Exide company. The company uses a periodic inventory system. Prepare journal entries necessary to adjust the accounts as of December 31. Assume that on December 31 the direct exchange rates were as follows: Colombia peso $.00265 Japan yen .0353 Prepare journal entries to record settlement of both open accounts on January 10. Assume that the direct exchange rates on the settlement dates were as follows:…Thomas who lives in Vancouver purchased a piece of equipment from Australia for A$44,230. She was charged 11% duty, 5% GST, and 7% PST to import it. Calculate the total cost of the equipment. Assume that the exchange rate was C$1 = A$1.0291. Tax is charged on the price of the equipment after applying the duty. What was the total cost of the equipment?

- Vitamin, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Vitamin made its first international sale. They sold $450,000 of products to a non-U.S. customer. Vitamin, Inc. agreed to allow the customer to pay for the purchase in its own currency, the FC. To avoid a penalty, the foreign buyer must make payment to Vitamin by February 2, 20x2. At the time of the sale, the FC/$ spot rate was FC1.97=$1 Vitamin, Inc. has a December 31 year-end. At 12/31/20x1, the foreign currency spot rate was FC1.95 = $1. Required: For Vitamin, Inc., Give the journal entries for the 10/15/20x1 sale. Give the journal entries for the foreign currency sale at 12/31/ 20x1, when the company closes its books and prepares its financial statements. Give the journal entries for the receipt of payment on the sale on 2/2/20x2. At that date, the foreign currency spot rate was FC 2.00 = $1.On July 15, 2XX6, Liz converts 627,000 U.S. dollars to Japanese yen in the spot foreign exchange market (¥109.92/$) and purchase a six-month forward contract (¥100.89/$) to convert yen into dollars. What is Liz's profit or loss in U.S. dollars at the end of six months? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16). Use a negative sign to denote a loss.)Blowfast Corporation, a U.S. exporter, sold wind turbines to a Mexican customer at a price of 5,000,000 U.S. dollars. In order to close the sale, however, Blowfast needed to agree to make its invoice payable in Mexican pesos, thus agreeing to take on the exchange rate risk for the transaction. The USDMXN exchange rate on the day of the sale was 20.0000, making the cost to the customer (per the invoice) 100,000,000 pesos. The terms of payment were: net, 6 months. If the value of the peso fell against the U.S. dollar such that one dollar would buy 22.0000 pesos by the date the invoice needed to be paid, what dollar amount would Blowfast receive assuming that it exchanged the recently received pesos for U.S. dollars in a foreign exchange transaction on the payment date? How much money did Blowfast gain or lose because of the change in the exchange rate?