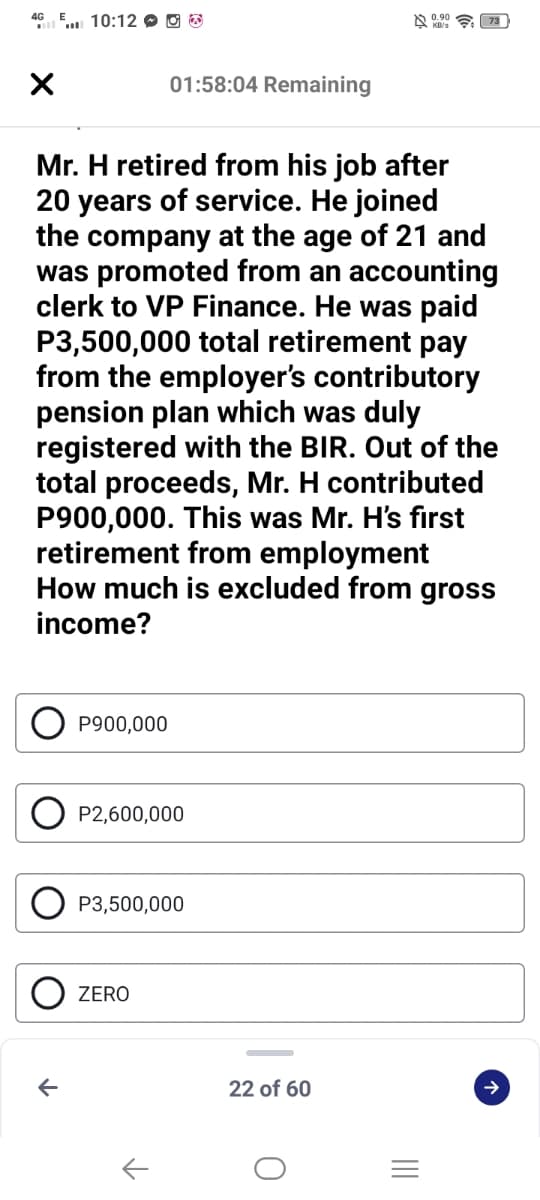

Mr. H retired from his job after 20 years of service. He joined the company at the age of 21 and was promoted from an accounting clerk to VP Finance. He was paid P3,500,000 total retirement pay from the employer's contributory pension plan which was duly registered with the BIR. Out of the total proceeds, Mr. H contributed P900,000. This was Mr. H's first retirement from employment How much is excluded from gross income?

Q: Andrew, who is single, retired from his job this year. He received a salary of $22,000 for the…

A: Adjusted gross income (AGI) is calculated by deducting deductions for AGI from the gross income.

Q: Slava Grichuk is a 58-year-old employee with First Delta Corp. His employment income Is $100,000 in…

A: Introduction:- Slava Grichuk is a 58-year-old employee of First Delta Corp. His employment will pay…

Q: Nicanor, an employee of ABC Corp., suffered an accident at work and died. The following are…

A: (1) Separation pay is Exempted from Income tax u/s 32 (B) of the Tax Code. According to this it…

Q: Ursula, an employee of Ficus Corporation, is 35 years old and plans to retire in 20 years. The…

A:

Q: If Fred also had savings that were not in an ISA, how would interest on this be taxed? What rate of…

A: ISA is an acronym and stands for individual savings account, it is a that type of savings account on…

Q: Richard and Linda are the only two employees of Carolina Company. In January, 2013, Richard's gross…

A: Richard FICA Tax = Richard's gross pay x FICA tax rate = $5500*8% = $440

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well…

A:

Q: usan received £ 15,000 salaries and £ 10,000 bonuses during the tax year 2020-21. Her employer…

A: In United Kingdom an employee has to pay taxes on all the type of benefits or allowances claimed by…

Q: Calculate for Fred the correct amount of employment remuneration that he should include on his tax…

A: Employment remuneration is the amount of money which has been received by the employee for the work…

Q: Alex, single, earns wags of $42,000 in 2021. He also conducts an activity that produces the…

A: Taxable income is a concept that can be easily derived from its name, tax on income earned. Tax is…

Q: government employee at daytime and accepts clients for accounting work after office hours. At the…

A: A self employed individual who registered under VAT and whoes gross receipts or gross sale is not…

Q: During the current income year, George received: salary and wages of $35,000 A bonus of $2500 from…

A: In this question, we will find out the George's assessable income for the current year ended 30 June…

Q: Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help.…

A: At the conclusion of the year, employers must deliver Form W-2, frequently referred to as the Wage…

Q: Stephanie began her consulting business this year, and on April 1 Stephanie received a $9,000…

A: Amount received for three year contract is:::9000$.. Amount of months=36 months ie 3 years...…

Q: ty was $1,500,000. Expenses was $650,000. Capital allowance for this property was $180,000. He…

A: Gross salary =$7,000,000 per year. monthly pension =$75,000

Q: Jim and Bob each own 50% in a hotel building in Bondi. For the last few years, they always split any…

A:

Q: During the current year, Gene, a CPA, performs services as follows: 1,800 hours in his tax practice…

A:

Q: Dr. Mitch earns by offering clinical services to her clients. In 2020, he earned 1,000,000 from his…

A: As per Bartleby policy, only 1 question will be answered. Professional tax as per TRAIN Law will…

Q: Stan, a computer lab manager, earns a salary of $80,000 and receives $25,000 in dividends and…

A: Loss from investment in a passive activity is not allowed against the active income.

Q: Z was an employee with the following information from her employment in 2021. Salaries and wages -…

A: Employment income includes all the salaries and wages paid by the employer as well as the taxable…

Q: Engr. Secula became a full professor when he was hired in a State university at the age of 34.…

A: Monthly payment It is the minimum amount that is required to be paid/withdrawn by an individual…

Q: Donald was killed in an accident while he was on the job. Darlene, Donald's wife, received several…

A: Answer :

Q: Mark resigned in 2021 after 12 years of service. He had the following income during the year:…

A: The separation pay is included in the gross income together with the salary because the separation…

Q: Marta is 52 years of age and expects to retire from her current employer at age 65. Marta’s employer…

A: Qualified Retirement plan: This is an agreement between the employer and the employee regarding the…

Q: Miranda is 63 years old. She has been an employee of Mission Wineries for 18 years and currently…

A: Data Given: Gross Earnings = $62,750…

Q: Heather, an individual, reported the following items of income and expense during the current year:…

A: Working notes :- Alimony , Post -TC…

Q: Allie started her new job in 2020. She received the following payments or benefits paid on her…

A: Allie started her new job in 2020. Payments or benefits paid by her employer are 1. Salary = $84000…

Q: Z was an employee with the following information from her employment in 2021. Salaries and wages -…

A: Net employment income= Salary + Any benefit received from employer- RRSP contribution.

Q: X, a minimum wage earner. In 2018, his salary and overtime pay totaled 200,000 and his hazard pay is…

A: In the context of the given question, we are required to compute the taxable income of X in 2018.…

Q: Nicanor, an employee of ABC Corp., suffered an accident at work and died. The following are…

A: Gross Income: It is all income one earned from the wages, profits, salaries, rents, interest…

Q: Breanna Vail is a self-employed accountant who has one less-than-half-time employee. During 2019,…

A: Introduction Schedule C is tax form filed by sole proprietors, to show profit and loss from…

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well…

A: Given, Mr. Allen is a 65-year-old Jamaican tax resident. a) Gross salary $7,000,000 per year. b) As…

Q: Mang Carding is a minimum wage earner. To augment his earnings, he put up a mini store under his…

A: 1) The income received from 13th and 14th month will not be taken from taxable value , due to that…

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well…

A: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well…

Q: Terese is a director of Connolly Corporation and is paid directors' fees of $6,000.00 quarterly.…

A: The QPP is a mandatory Public Insurance Plan. If a person is paid only for director's fees and no…

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well…

A: Considering Jamaica tax rates citizens who are aged more than or equal to 65 years are given an…

Q: Lynette is the CEO of a publicly traded company TT company and earns a salary of $380,000 in the…

A: After tax cost excluding FICA taxes =Amount of earnings×(1-Marginal tax rate)=$380000×…

Q: Amir, who files single, has AGI of $58,000 and incurred the following miscellaneous itemized…

A: Calculating the value of miscellaneous itemized deduction. We have,Miscellaneous itemized deduction…

Q: Donald was killed in an accident while he was on the job. Darlene, Donald's wife, received several…

A: Gross income of the individual means income without taking any deductions and exemptions. Net…

Q: Richard and Linda are the only two employees of Bush Company. In January, 2013, Richard's gross pay…

A: Richard federal unemployment Tax = Richard's gross pay x federal unemployment Tax tax rate =…

Q: Florence is the newly hired chief financial officer of Hazel Corporation, a publicly traded,…

A: Answer and calculations are given below

Q: Steve worked as a tech supervisor for a computer company. In September of this year, he was laid…

A: Taxation-Taxation means imposing a tax on individuals and different types of organization. Which…

Q: Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2020.…

A: FICA refers to Federal Insurance Contribution Act. As per this act, the employers as well as the…

Q: Andrew, who is single, retired from his job this year. He received a salary of $24,000 for the…

A: Gross income: It is the total of income of the individual from all the sources of income earning.

Q: On 1st July 2021, Fred was appointed as a musician in an international hotel chain earning £18,000…

A: Your federal tax liability is the amount of money you owe the United States government in a…

Q: Eve is a physician who earns $400,000 from her practice during the current year. This year, she…

A: solution concept If the modified adjusted gross income is $100000 or less , the maximum allowed…

Q: Jeff has worked as an engineer with Harris Company for five full years to date and has earned annual…

A: Annual Salary for year 1: $65,000 Annual Salary for year 2: $70,000 Annual Salary for year 3:…

Q: curred RM4,800 on entertaining business clie ng these four months. estic servant (reimbursed from…

A: As per taxation rules in Malaysia for salaried employees RM 5000 is exempt limit…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On 12/31/X4, Zoom, LLC, reported a $49,500 loss on its books. The items included in the loss computation were $23,000 in sales revenue, $8,000 in qualified dividends, $15,000 in cost of goods sold, $43,000 in charitable contributions, $13,000 in employee wages, and $9,500 of rent expense. How much ordinary business income (loss) will Zoom report on its X4 return? Multiple Choice ($8,000) ($14,500) ($49,500) ($84,500)E4.17 (LO 2, 3, 5) The following information was taken from the records of Roland Carlson Inc. for the year 2020: Income tax applicable to income from continuing operations $187,000, Income tax applicable to loss on discontinued operations $25,500Gain on sale of equipment $ 95,000 Cash dividends declared $ 150,000Loss on discontinued operations 75,000 Retained earnings January 1, 2020 600,000Administrative expenses 240,000 Cost of goods sold 850,000Rent revenue 40,000 Selling expenses 300,000Loss on write-down of inventory 60,000 Sales revenue 1,900,000 Shares outstanding during 2020 were 100,000. Prepare a multiple step income statement (including earnings per share) and a statement of…6-7A.LO2,3 payroll accounting by Beig and Toland Kip Bowman is owner and sole employee of KB Corporation. He pays himself a salary of $1,500 each week. Additional tax information includes: FICA tax-OASDI...........6.2% on first $128,400 FICA tax-HI..........1.45% on total pay Federal income tax....$232.00 per pay SIT.....22%of the federal income tax withholding FUTA.....0.6% on first $7,000 SUTA.....0.05% on first 14,000 Additional payroll deductions include: 401k plan....3%per pay Child support garnishment......$100 Health insurance premium...$95 per pay Record the payroll entry and payroll tax entry for the pay of the week ended June 7 (his year-to-date pay is $31,500)

- 16.On 12/31/2019, Meet People, LLC, reported a $64,000 loss on its books. The items included in the loss computation were $20,000 in sales revenue, $12,000 in qualified dividends, $14,000 in cost of goods sold, $35,000 in charitable contributions, $33,000 in employee wages, and $14,000 of rent expense. How much ordinary business income (loss) will Meet People report on its 2019 return? Show computation.21- After our business deducted 20% income tax on 48.000 TL, which is the one-year rent of the workplace it rented for one year on 01.03.2020 , the rest was paid to the owner of the real estate from the bank. In accordance with the concept of periodicity, how much is the amount that should be accepted as an expense in the future period? a) 40.000 TL B) 8.000 TL NS) 9,600 TL D) 38,400 TL TO) 48,000 TL3 Glenco in Alberta has four employees with total gross earnings of $322,780.00 and excess earnings of $21,834.00. Calculate the total assessable earnings for Worker's compensation, when the maximum assessable earnings for 2022 are $98,700.00. O $300,946.00 O $322,780.00 O $344,614.00 O $394,800.00

- P20.6 (LO1, 4) (Pension Expense, Journal Entries, and Net Gain or Loss) Aykroyd Inc. has sponsored a non-contributory, defined benefit pension plan for its employees since 1989. Prior to 2019, cumulative net pension expense recognized equaled cumulative contributions to the plan. Other relevant information about the pension plan on January 1, 2019, is as follows. 1. The company has 200 employees. All these employees are expected to receive benefits under the plan. 2. The defined benefit obligation amounted to $5,000,000 and the fair value of pension plan assets was $3,000,000. On December 31, 2019, the defined benefit obligation and the vested benefit obligation were $4,850,000 and $4,025,000, respectively. The fair value of the pension plan assets amounted to $4,100,000 at the end of the year. A 10% discount rate was used in the actuarial present value computations in the pension plan. The present value of benefits attributed by the pension benefit formula to employee…1.The following information is applicable to a weekly paid employee for JQ Ltd Normal working week (5 days) 40hoursNumber of hours worked 45 hours normal remuneration rate R5 Overtime rate R7 Pension Fund (based on remuneration) Employer’s contribution 5%Employee contribution 2%Medial Aid Fund R50 PAYE (based on taxable income) R10%UIF R10 1.1)Calculate employee net salary for the weekPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable 212 Social Security Tax Payable 9,273 213 Medicare Tax Payable 2,318 214 Employees Federal Income Tax Payable 15,455 215 Employees State Income Tax Payable 13,909 216 State Unemployment Tax Payable 1,400 217 Federal Unemployment Tax Payable SOO 218 Retirement Savings Deductions Payable 3,400 219 Medical Insurance Payable 27r000 411 Operations Salaries Expense 950.000 S11 Officers Salaries Expense 600,000 SI 2 Office Salaries Expense 150.000 S19 Payroll Tax Expense 137,951 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2. Issued Check No. 410 for 53,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for 527,046, in payment of 59,273 of social security tax, 2,318 of Medicare tax, and 15,455 of employees federal income tax due. 13 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax. 4,632; Medicare tax, 1,158; state unemployment tax. 350; federal unemployment tax, 125. 16. Issued Check No. 424 to Jay Bank for 27,020. in payment of 9,264 of social security tax, 2,316 of Medicare tax, and 15,440 of employees' federal income tax due. 19. Issued Check No. 429 to Sims-Walker Insurance Company for 31,500, in payment of the semiannual premium on the group medical insurance policy. 27. Journalized the entry to record the biweekly payroll. A summary of the payroll 27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Journalized the entry to record payroll taxes on employees' earnings of December 27: social security tax, 4,668; Medicare tax. 1,167: state unemployment tax, 225; federal unemployment tax, 75. 27. Issued Check No. 543 for 20,884 to State Department of Revenue in payment of employees' state income tax due on December 31. 31. Issued Check No. 545 to Jay Bank for 3400 to invest in a retirement savings account for employees. 31. Paid 45,000 to the employee pension plan. The annual pension cost is 60,000. (Record both the payment and unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600: office salaries, 1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.

- What is the total amount that should be disclosed as compensation to key management personnel for Butane Company? A. 11,700,000 B. 10,000,000 C. 10,500,000 D. 11,100,000Ma1. At the end of 2016 Mustafa left the ABC Company, which is an Egyptian company, after spending many years with it. At the end of 2016 Mustafa calculates all the amounts that he received during the year Commissions and salaries Share in distribution of net profit of the company Severance pay Performance bonuses Total Compensation Required: 120,000 65,000 50,000 12,000 247,000 In 2016, how much tax should ABC retain from this compensation before giving it to Mustafa? In other terms, What is the net salary that Mustafa should get?Module 5 - Practice QuestionMr. Jay Brown is 66 years of age and his 2020 income is made up of employmentincome of $75,800, contributed $6,500 to his RRSP. He also earned interestincome from Guaranteed Investment Certificate (GIC) of $3,700 during 2020 andreceived Old Age Security benefits of $7,400 (because of large business lossesduring the previous two years, no amount was withheld from the OAS payments).Mr. Brown and his family live in Toronto, Ontario. For 2020, Mr. Brown’semployer withheld maximum CPP ($2,898) and EI ($856) contributions. Otherinformation pertaining to 2020 is as follows:1. Mr. Brown’s spouse is 59 years old and qualifies for the disability tax credit.Her income for the year totaled $4,500.2. Mr. and Mrs. Brown have two daughters, Keith, aged 15 and Laura, aged17. Keith had income of $2,700 for the year while Laura had net income of$3,000. In September 2020, Laura began full time attendance at a Canadianuniversity. Mr. Brown paid her tuition fees of $6,000, of…