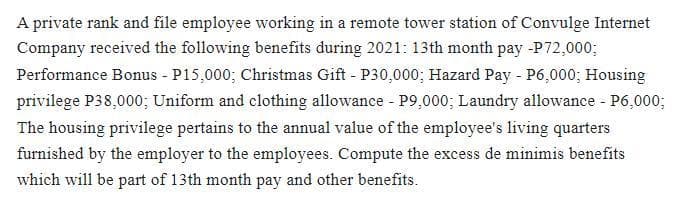

A private rank and file employee working in a remote tower station of Convulge Internet Company received the following benefits during 2021: 13th month pay -P72,000; Performance Bonus - P15,000; Christmas Gift - P30,000; Hazard Pay - P6,000; Housing privilege P38,000; Uniform and clothing allowance - P9,000; Laundry allowance - P6,000; The housing privilege pertains to the annual value of the employee's living quarters furnished by the employer to the employees. Compute the excess de minimis benefits which will be part of 13th month pay and other benefits.

A private rank and file employee working in a remote tower station of Convulge Internet Company received the following benefits during 2021: 13th month pay -P72,000; Performance Bonus - P15,000; Christmas Gift - P30,000; Hazard Pay - P6,000; Housing privilege P38,000; Uniform and clothing allowance - P9,000; Laundry allowance - P6,000; The housing privilege pertains to the annual value of the employee's living quarters furnished by the employer to the employees. Compute the excess de minimis benefits which will be part of 13th month pay and other benefits.

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 69IIP

Related questions

Question

Transcribed Image Text:A private rank and file employee working in a remote tower station of Convulge Internet

Company received the following benefits during 2021: 13th month pay -P72,000;

Performance Bonus - P15,000; Christmas Gift - P30,000; Hazard Pay - P6,000; Housing

privilege P38,000; Uniform and clothing allowance - P9,000; Laundry allowance - P6,000;

The housing privilege pertains to the annual value of the employee's living quarters

furnished by the employer to the employees. Compute the excess de minimis benefits

which will be part of 13th month pay and other benefits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT