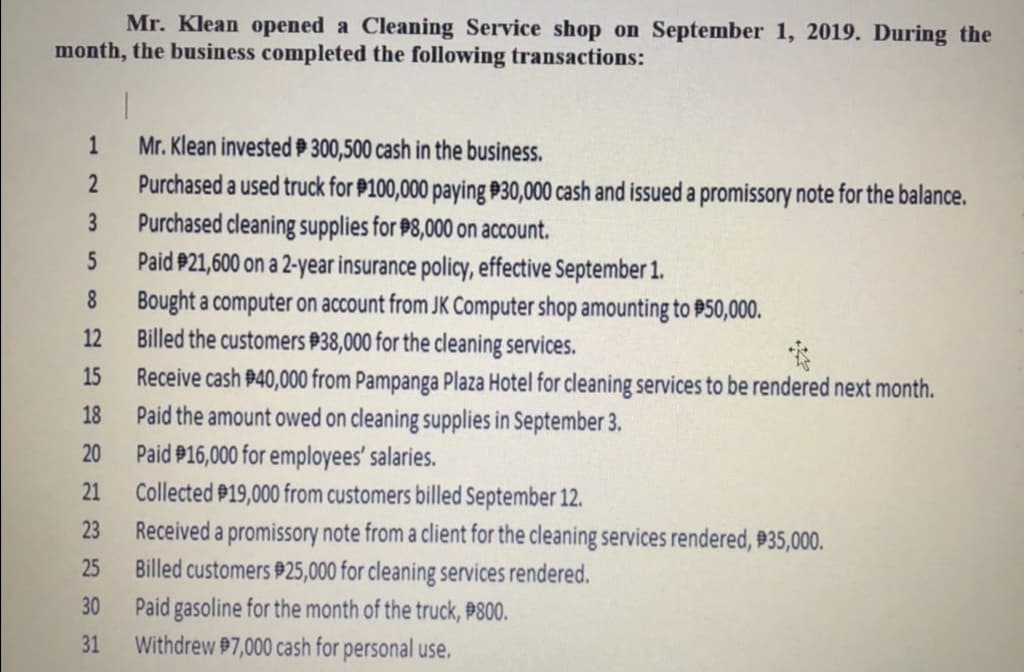

Mr. Klean opened a Cleaning Service shop on September 1, 2019. During the month, the business completed the following transactions: 1 Mr. Klean invested P 300,500 cash in the business. Purchased a used truck for #100,000 paying #30,000 cash and issued a promissory note for the balance. Purchased cleaning supplies for 98,000 on account. Paid P21,600 on a 2-year insurance policy, effective September 1. Bought a computer on account from JK Computer shop amounting to P50,000. Billed the customers #38,000 for the cleaning services. 2 8 12 Receive cash P40,000 from Pampanga Plaza Hotel for cleaning services to be rendered next month. Paid the amount owed on cleaning supplies in September 3. Paid P16,000 for employees' salaries. Collected P19,000 from customers billed September 12. Received a promissory note from a client for the cleaning services rendered, 935,000. Billed customers #25,000 for cleaning services rendered. Paid gasoline for the month of the truck, P800. Withdrew 7,000 cash for personal use. 15 18 20 21 23 25 30 31

Mr. Klean opened a Cleaning Service shop on September 1, 2019. During the month, the business completed the following transactions: 1 Mr. Klean invested P 300,500 cash in the business. Purchased a used truck for #100,000 paying #30,000 cash and issued a promissory note for the balance. Purchased cleaning supplies for 98,000 on account. Paid P21,600 on a 2-year insurance policy, effective September 1. Bought a computer on account from JK Computer shop amounting to P50,000. Billed the customers #38,000 for the cleaning services. 2 8 12 Receive cash P40,000 from Pampanga Plaza Hotel for cleaning services to be rendered next month. Paid the amount owed on cleaning supplies in September 3. Paid P16,000 for employees' salaries. Collected P19,000 from customers billed September 12. Received a promissory note from a client for the cleaning services rendered, 935,000. Billed customers #25,000 for cleaning services rendered. Paid gasoline for the month of the truck, P800. Withdrew 7,000 cash for personal use. 15 18 20 21 23 25 30 31

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 6R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Question

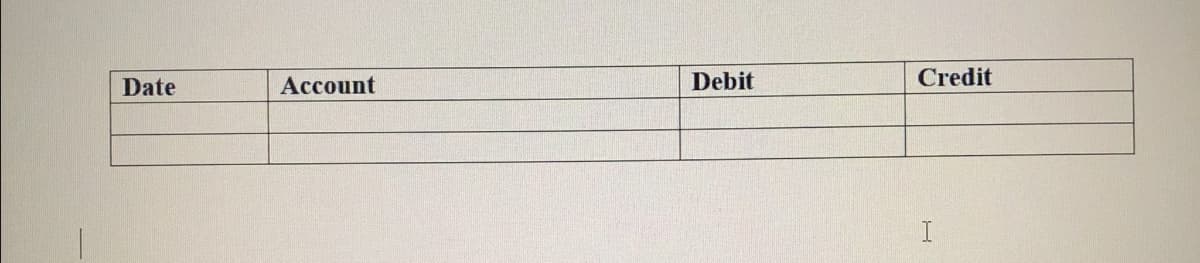

Journalize the given below. Do it nicely. Follow the format given on the second picture.

Transcribed Image Text:Mr. Klean opened a Cleaning Service shop on September 1, 2019. During the

month, the business completed the following transactions:

1

Mr. Klean invested 300,500 cash in the business.

Purchased a used truck for #100,000 paying #30,000 cash and issued a promissory note for the balance.

Purchased cleaning supplies for 98,000 on account.

Paid #21,600 on a 2-year insurance policy, effective September 1.

Bought a computer on account from JK Computer shop amounting to P50,000.

Billed the customers 938,000 for the cleaning services.

8

12

Receive cash #40,000 from Pampanga Plaza Hotel for cleaning services to be rendered next month.

Paid the amount owed on cleaning supplies in September 3.

Paid P16,000 for employees' salaries.

Collected P19,000 from customers billed September 12.

15

18

20

21

Received a promissory note from a client for the cleaning services rendered, 935,000.

Billed customers #25,000 for cleaning services rendered.

Paid gasoline for the month of the truck, P800.

Withdrew #7,000 cash for personal use.

23

25

30

31

Transcribed Image Text:Date

Account

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT