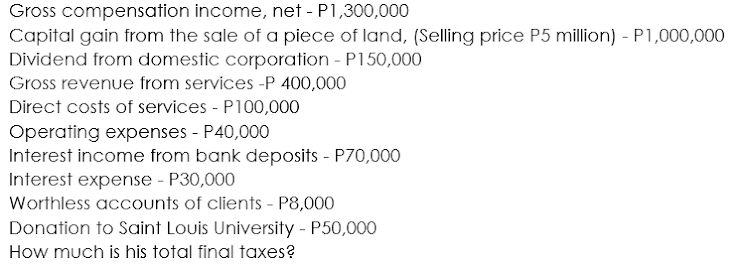

Mr. Mark, Filipino resident and living with his adopted minor son, shows the following financial data for taxable year 2018

Q: Mr. B, a resident Filipino, married having 5 dependent children, reported the following income and…

A: Mr. B, a resident Filipino and married having 5 dependent children. For taxable year 2019, 1. Net…

Q: Rex, a Filipino residing in Laguna, has the following income for 2021: Compute the income subject…

A: To determine the income of REX which will be subject to regular tax, the very first step is to…

Q: Johanna resides in Saskatchewan and has taxable income of $85,000 for the current year. Determine…

A: The amount of tax payable means the amount of tax that the taxpayer needs to pay. the amount of tax…

Q: Mary is age 33 and a single taxpayer with adjusted gross income for 2020 of $29,400. Mary maintains…

A: Taxable income:-These is that income that is liable for tax payment after providing deductions as…

Q: a. What is the minimum amount of income Stephanie should recognize for tax purposes this year if she…

A: Accrual Method of Accounting means that revenue should be recognized when it is earned but not when…

Q: Andrea has a taxable income of $46,760 and does not have a spouse. What is Andrea's gross tax…

A: Gross tax refers to the amount which is determined grounded on the aggregate amount of money the…

Q: Hayabusa is a resident citizen earning compensation and business income for 2021 as follows:

A: working note tax computation. 250,000 tax rate 0% 250,000 to 400,000 tax rate 20% 400,000 to…

Q: Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she…

A: Amount of AMT Deduction phases out or decreases 25% for every increase in AMTI above $1,047,200…

Q: nswer to 2 decimal places.) A. Her $44,600 of taxable income includes $3,600 of qualified…

A: Calculation of tax liability in A. Qualified dividend are taxed as capital gains. Therefore, total…

Q: Melissa and Whitney are married taxpayers with taxable income of $106,000 and file a joint tax…

A: Tax Liability: Tax liability is the amount of money you owe to tax authorities, such as your local,…

Q: a) Maryanne is a non-Scottish taxpayer and received the following incomes during the tax year…

A: Many Thanks for Question: Bartleby Guideline: “Since you have asked multiple question, we will solve…

Q: Lacy is a single taxpayer. In 2021, her taxable income is $46,400. What is her tax liability in each…

A: Taxable Income $46,400 Less: Qualified Dividend ($9,400) Income Taxed at ordinary rates $37,000…

Q: Olga is married and files a joint tax return with her husband. What amount of AMT exemption may she…

A: In the given case, Olga is married and files joint return with her Husband. Hence the phase out…

Q: Carlos, a non-resident citizen, died abroad intestate (without a last will and testament) during the…

A: The correct answer for the above question is given in the following steps for your reference.

Q: Lacy is a single taxpayer. In 2021, her taxable income is $44,600. What is her tax liability in each…

A: All amounts are in dollar ($).

Q: xable Year 2023

A: Tax is the liability of an individual owing to the government. The government collects the tax from…

Q: Assuming ABC is a resident citizen with two dependents including her senior citizen mother, how much…

A: Taxable Income:- It is an income that is liable to pay tax to the government bodies as per the rules…

Q: Ross is single with an adjusted gross income of $68,100, and he uses the standard deduction for…

A: Income tax: It implies to a financial levy or charge that is imposed on the income of taxpayer by…

Q: Your uncle has a taxable income of $85,142 last year. If he files as a head of household, what is…

A: As per 2021 tax rates Tax liability if status is head of household = $ 6220 + (85142-54201)*22% = $…

Q: A. . Her $44,600 of taxable income includes $3,600 of qualified dividend B. Her $44,600 of taxable…

A: Qualified dividend are taxed as capital gains. Therefore, total tax liability: On non dividend…

Q: Y received the following items of income during the taxable year: If Y is a resident citizen, how…

A: Taxable income is the amount of income computed to measure the amount of taxes to be paid to the…

Q: Your uncle has a taxable income of $96,412 last year. If he files as a head of household, what is…

A: Since the Taxable year is not mentioned in the question we are considering the last year 2020 as the…

Q: Henry files as a single taxpayer. In 2020 his taxable income was $95,525. Using the tax rate…

A: Income tax is a financial charge imposed by a country’s revenue department for funding the security,…

Q: Christina, a 50-year-old American, is married to a Singaporean, and the couple has 2 children who…

A: Qualifying Child Relief and Working Mother Child Relief are two benefits for assessee to reduce…

Q: Within without Business Income 400,000.00 200,000.00 Professional Fees 200,000.00 100,000.00 Rent…

A: a person who is not a citizen of Philippines is recognised as alien. it is regardless of whether…

Q: Elijah and Anastasia are husband and wife who have six married children and eight minor…

A: Tax: Tax refers to a compulsory payment or a contribution to the state revenue, levied by the…

Q: is she required to file a tax return

A: Given: Helen, a single taxpayer, earns an interest income of $ 8750.

Q: Considering the information below, calculate Jane tax liability (including Medicare Levy and…

A: Assessable Income is the total amount of revenues generated by an individual/corporation in…

Q: What tax forms should be used for the following tax return? Tim is a self-employed business person…

A: Introduction A Tax Return is tax form used to file the income, expenses etc to tax authorities. Tax…

Q: Y received the following items of income during the taxable year: If Y is a resident citizen, how…

A: The quesrion is related to taxable total income of a resident individual in Philippines. In case an…

Q: During the year ended 30 jun 2020, melissa, a resident of Australia, has received rents of $5946 and…

A: 1. Gross Income = it is the total income received by the individual. 2. Deduction: These are the…

Q: Y received the following items of income during the taxable year: If Y is a resident alien, how much…

A: The question is related to taxation. In the given question Y is a resident of Philippines and his…

Q: Lacy is a single taxpayer. In 2021, her taxable income is $44,600. What is her tax liability in each…

A: Tax brackets were created by the IRS to determine how much money you need to pay the IRS…

Q: Marvin Miller, who is claimed as a dependent by his parents, received income of $3,100 from a trust…

A: Income: Income includes all the income that belong to the taxpayer, both taxable and non-taxable.…

Q: nnie, age 70 and single, is claimed as a dependent on her daughter's tax return. During 2021, she…

A: Taxable Income = Gross Income - Deductions

Q: Josie is a resident citizen who earned the following during the current taxable year: (1) Royalty…

A: Regular income tax or Ordinary income tax refers to the tax levied on: Income from wages or salary…

Q: Simon is a resident for tax purposes. During the year he derived gross wages of $50,000 from his…

A: The taxable income is the income on which the taxpayers has to pay the income tax yearly. The…

Q: According to the contributions of Puerto Rico: Indicate the items of income that are part of the…

A: Tax is the amount which is to be paid by the taxpayer on the taxable income and this taxable income…

Q: 53. Goyo, a non-resident citizen, returned to the Philippines on July 1 with the intention of…

A: Non- resident is defined as the individual who resides in one jurisdiction mainly but has interest…

Q: William is not married, nor does he have any dependents. He does not itemize deductions. His taxable…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Jane, a resident taxpayer, has a taxable income of $19,500 for the income tax year ended 30 June…

A: Assuming that the question pertains to Australian Income Tax (since Australia follows a July 1 to…

Q: Nicanor is a non-VAT taxpayer. During the year, he opted to change his status to VAT. His…

A: Answer: VAT rate applicable is 12% When there is transition any VAT from registered can be used as…

Q: Niles

A:

Q: Courtney is a single taxpayer with modified adjusted gross income of $140000 and an active…

A: Rental loss allowance is allowed for active participation in rental activities and no rental…

Q: Clarita is a single taxpayer that lives in the U.S. with two dependent children, ages 10 and 12.…

A: Child and dependent care credit: According to IRS, the person ( who incurred any expenses for the…

Q: Ms Rivera with four qualified dependent children had a net taxable compensation income of P 450,000…

A: Tax is a tax that individuals and businesses must pay to the government in order for the government…

Q: William is not married, nor does he have any dependents. He does not itemize deductions. His taxable…

A: Income Tax: Income tax is a tax paid by the individual depending on earnings or gains of the…

Q: Steven is a thirty-year-old Australian resident for tax purposes. He is single with no dependant and…

A: Tax can only be applied on profits if the person is incurring loss , there is no taxable income.

Mr. Mark, Filipino resident and living with his adopted minor son, shows the

following financial data for taxable year 2018

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for extraordinary repairs If all transactions were recorded properly, what amount did Jada capitalize for the year, and what amount did Jada expense for the year?For each of the following transactions, state whether the cost would be capitalized (C) or recorded as an expense (E). A. Purchased a machine, $100,000; gave long-term note B. Paid $600 for ordinary repairs C. Purchased a patent for $45,300 cash D. Paid $200,000 cash for addition to old building E. Paid $20,000 for monthly salaries F. Paid $250 for routine maintenance G. Paid $16,000 for major repairsCash- $52,000 Land- $190,000 Building- $180,000 Liabilities- $42,000 Adams Capital- $120,500 Baker Capital- $45,000 Carvil Capital- $84,000 Dobbs Capital- $130,500 Assume that profits and losses are allocated to Adams, Baker, Carvil, and Dobbs on a 1:3:4:2 basis, respectively. How much money must the firm receive from selling the land and building to ensure that Carvil receives a portion?

- 12. Sand Corp exchanged equip used in its operations and pay $2,000 cash to Dake Corp for similiar equip used and its operations. The following is true: FMV of equip given up by Sand Corp is $13,500 (for Dake its $15,500) Cost of equip given up for Sand corp and Dake is $28,000; Accumulated Depr for Sand Corp is $19,000 (for Dake is $10,000) How many dollars is the basis of the new asset received by Sand if the exchange is thought to have No commercial substance? Thank you BrendaOn 1 November 2020, Bermuda Ltd acquired all the assets and liabilities (other than cash) of Triangle Ltd. The details on the assets and liabilities of Triangle Ltd were as follows: Carrying Amount Fair Value Cash 30,000 30,000 Equipment 120,000 140,000 Accounts Receivable 25,000 25,000 Furniture 35,000 25,000 Accounts Payable 10,000 10,000 Income tax Payable 19,000 19,000 Annual Leave Payable 14,000 14,000 In addition to the above items, Triangle Ltd had an internally generated brand name with a fair value of $75,000 that was not recognized in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition-related costs. The tax rate is 30%. Required: Conduct an acquisition analysis for BermudaOn 1 November 2020, Bermuda Ltd acquired all the assets and liabilities (other than cash) of Triangle Ltd. The details on the assets and liabilities of Triangle Ltd were as follows: Carrying Amount Fair Value Cash 30,000 30,000 Equipment 120,000 140,000 Accounts Receivable 25,000 25,000 Furniture 35,000 25,000 Accounts Payable 10,000 10,000 Income tax Payable 19,000 19,000 Annual Leave Payable 14,000 14,000 In addition to the above items Triangle Ltd had an internally generated brand name with a fair value of $75,000 that was not recognised in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition related costs. Tax rate is 30%.

- Lala Company reported the following information in 2021:· Sales revenue- P500,000· Cost of Goods Sold- P350,000· Operating Expenses- P55,000· Unrealized translation gain- P20,000· Cash dividends received on investment in equity securities- P2,000Ignore income tax, for 2021, Lala Company would report total comprehensive income before tax of? A. P97,000 B. P117,000 C. P115,000 D. P20,000Taxpayer: Domestic Corporation engaged in manufacturing business Taxable period data: Item IN Sales 8,000,000 Cost of sales 3,000,000 Incidental income 500,000 Other income (non-operating) 200,000 Allowable operating expenses 1,800,000 Allowable NOLCO 300,000 Total assets, excluding land on which business plant, equipment, and office are situated 80,000,000 How much is the net taxable income using itemized deductions? How much is the regular corporate income tax using itemized deductions?. How much is the net taxable income using OSD? How much is the regular corporate income tax using OSD? Assuming that all conditions are met, how much is the minimum corporate income tax (MCIT)?a. Identify the following transactions as either Capital Expenditure or RevenueExpenditure.i). Pay salary and wages for November 2020 amounting to RM6,200.ii). Purchase vehicle for business use amounting to RM145,000.iii). Depreciation expense for financial year ended 2020 amounting to RM21,000.iv). Purchase stationery for office use amounting to RM450.v). Acquire a building amounting to RM520,000.vi). Repair office door amounting to RM800.

- A mixed income earner realized P920,000 from compensation, P2,000,000 in sales, P100,000 other income subject to tax and incurred P480,000 in expenses. A. What is the total compensation income subject to income tax? B. What is the income tax due from compensation? C. What is the total income from Business subject to income tax?13. Sand Corp exchanged equip used in its operations and pay $2,000 cash to Dake Corp for similiar equip used and its operations. The following is true: FMV of equip given up by Sand Corp is $13,500 (for Dake its $15,500) Cost of equip given up for Sand corp and Dake is $28,000; Accumulated Depr for Sand Corp is $19,000 (for Dake is $10,000) What is the basis for the new asset received by Dake in dollars if there is commercial substance in the exchange? Thank you BrendaA Corp., a domestic corporation, has the following data in 2022:Gross receipts from services, P800,000Cost of services, P200,000Long term capital gain, P15,000Short term capital loss, P5,000Dividend from a domestic corporation, P15,000Interest income from bank deposits, P10,000Operating expenses, P120,000Compute the optional standard deduction. a. P366,000 b. P364,500 c. P280,000 d. P244,000