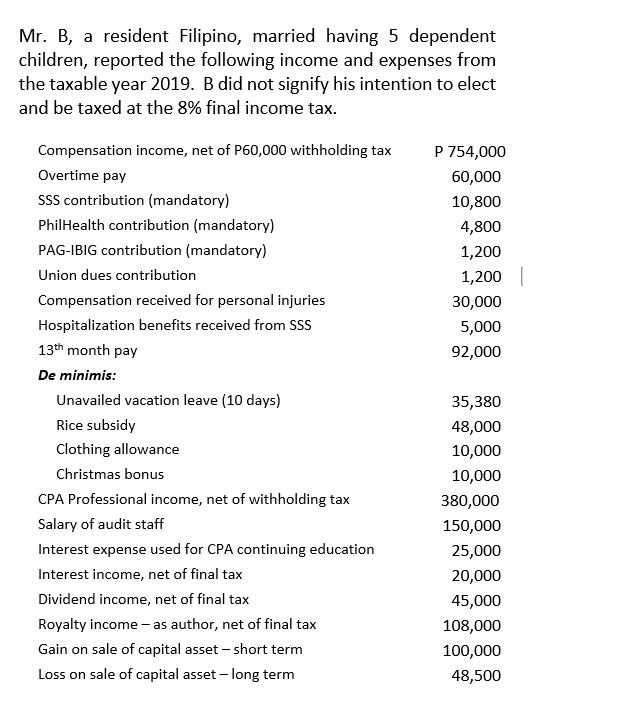

Mr. B, a resident Filipino, married having 5 dependent children, reported the following income and expenses from the taxable year 2019. B did not signify his intention to elect and be taxed at the 8% final income tax. Compensation income, net of P60,000 withholding tax P 754,000 Overtime pay 60,000 ssS contribution (mandatory) 10,800 PhilHealth contribution (mandatory) 4,800 PAG-IBIG contribution (mandatory) 1,200 Union dues contribution 1,200 | Compensation received for personal injuries 30,000 Hospitalization benefits received from SSS 5,000 13th month pay 92,000 De minimis: Unavailed vacation leave (10 days) 35,380 Rice subsidy 48,000 Clothing allowance 10,000 Christmas bonus 10,000 CPA Professional income, net of withholding tax 380,000 Salary of audit staff 150,000 Interest expense used for CPA continuing education 25,000 Interest income, net of final tax 20,000 Dividend income, net of final tax 45,000 Royalty income - as author, net of final tax 108,000 Gain on sale of capital asset – short term 100,000 Loss on sale of capital asset – long term 48,500

Mr. B, a resident Filipino, married having 5 dependent children, reported the following income and expenses from the taxable year 2019. B did not signify his intention to elect and be taxed at the 8% final income tax. Compensation income, net of P60,000 withholding tax P 754,000 Overtime pay 60,000 ssS contribution (mandatory) 10,800 PhilHealth contribution (mandatory) 4,800 PAG-IBIG contribution (mandatory) 1,200 Union dues contribution 1,200 | Compensation received for personal injuries 30,000 Hospitalization benefits received from SSS 5,000 13th month pay 92,000 De minimis: Unavailed vacation leave (10 days) 35,380 Rice subsidy 48,000 Clothing allowance 10,000 Christmas bonus 10,000 CPA Professional income, net of withholding tax 380,000 Salary of audit staff 150,000 Interest expense used for CPA continuing education 25,000 Interest income, net of final tax 20,000 Dividend income, net of final tax 45,000 Royalty income - as author, net of final tax 108,000 Gain on sale of capital asset – short term 100,000 Loss on sale of capital asset – long term 48,500

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 18CE

Related questions

Question

Income tax still due and payable per ITR.

P170,000

P250,000

P120,000

P130,000

None of the above

Transcribed Image Text:Mr. B, a resident Filipino, married having 5 dependent

children, reported the following income and expenses from

the taxable year 2019. B did not signify his intention to elect

and be taxed at the 8% final income tax.

Compensation income, net of P60,000 withholding tax

P 754,000

Overtime pay

60,000

SSS contribution (mandatory)

10,800

PhilHealth contribution (mandatory)

4,800

PAG-IBIG contribution (mandatory)

1,200

Union dues contribution

1,200

Compensation received for personal injuries

30,000

Hospitalization benefits received from SSS

5,000

13th month pay

92,000

De minimis:

Unavailed vacation leave (10 days)

35,380

Rice subsidy

48,000

Clothing allowance

10,000

Christmas bonus

10,000

CPA Professional income, net of withholding tax

380,000

Salary of audit staff

150,000

Interest expense used for CPA continuing education

25,000

Interest income, net of final tax

20,000

Dividend income, net of final tax

45,000

Royalty income - as author, net of final tax

108,000

Gain on sale of capital asset – short term

100,000

Loss on sale of capital asset - long term

48,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT