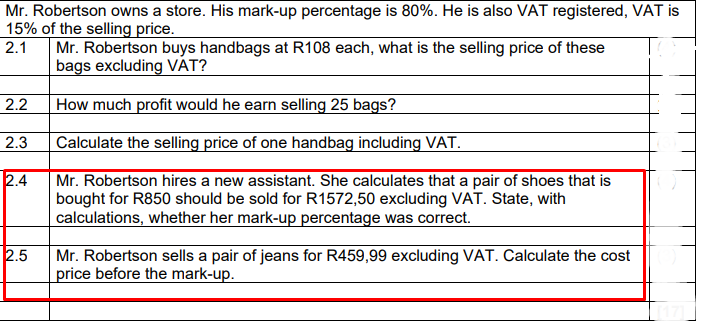

Mr. Robertson owns a store. His mark-up percentage is 80%. He is also VAT registered, VAT is 15% of the selling price. 2.1 Mr. Robertson buys handbags at R108 each, what is the selling price of these bags excluding VÁT? 2.2 How much profit would he earn selling 25 bags? 2.3 Calculate the selling price of one handbag including VAT. 2.4 Mr. Robertson hires a new assistant. She calculates that a pair of shoes that is bought for R850 should be sold for R1572,50 excluding VAT. State, with calculations, whether her mark-up percentage was correct.

Mr. Robertson owns a store. His mark-up percentage is 80%. He is also VAT registered, VAT is 15% of the selling price. 2.1 Mr. Robertson buys handbags at R108 each, what is the selling price of these bags excluding VÁT? 2.2 How much profit would he earn selling 25 bags? 2.3 Calculate the selling price of one handbag including VAT. 2.4 Mr. Robertson hires a new assistant. She calculates that a pair of shoes that is bought for R850 should be sold for R1572,50 excluding VAT. State, with calculations, whether her mark-up percentage was correct.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please Answer The Subsections 2.4 & 2.5

Transcribed Image Text:Mr. Robertson owns a store. His mark-up percentage is 80%. He is also VAT registered, VAT is

15% of the selling price.

2.1

Mr. Robertson buys handbags at R108 each, what is the selling price of these

bags excluding VÁT?

2.2

How much profit would he earn selling 25 bags?

2.3

Calculate the selling price of one handbag including VAT.

2.4

Mr. Robertson hires a new assistant. She calculates that a pair of shoes that is

bought for R850 should be sold for R1572,50 excluding VAT. State, with

calculations, whether her mark-up percentage was correct.

2.5

Mr. Robertson sells a pair of jeans for R459,99 excluding VAT. Calculate the cost

price before the mark-up.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education