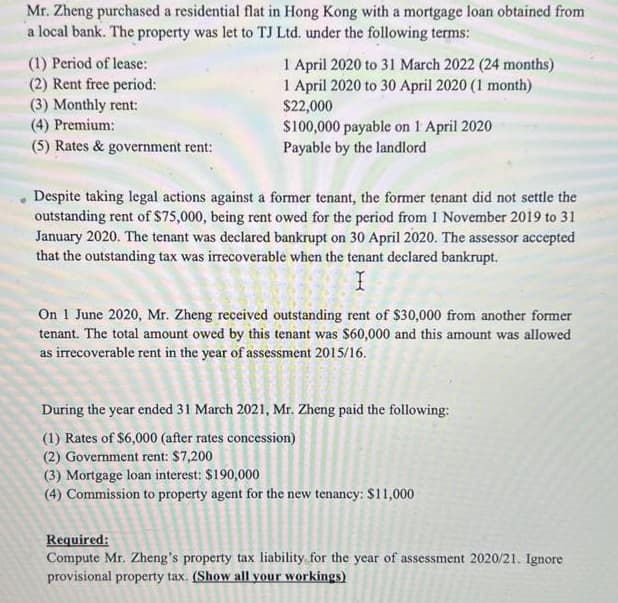

Mr. Zheng purchased a residential flat in Hong Kong with a mortgage loan obtained from a local bank. The property was let to TJ Ltd. under the following terms: (1) Period of lease: (2) Rent free period: (3) Monthly rent: (4) Premium: (5) Rates & government rent: 1 April 2020 to 31 March 2022 (24 months) 1 April 2020 to 30 April 2020 (1 month) $22,000 $100,000 payable on 1 April 2020 Payable by the landlord Despite taking legal actions against a former tenant, the former tenant did not settle the outstanding rent of $75,000, being rent owed for the period from 1 November 2019 to 31 January 2020. The tenant was declared bankrupt on 30 April 2020. The assessor accepted that the outstanding tax was irrecoverable when the tenant declared bankrupt. I On 1 June 2020, Mr. Zheng received outstanding rent of $30,000 from another former tenant. The total amount owed by this tenant was $60,000 and this amount was allowed as irrecoverable rent in the year of assessment 2015/16. During the year ended 31 March 2021, Mr. Zheng paid the following: (1) Rates of $6,000 (after rates concession) (2) Government rent: $7,200 (3) Mortgage loan interest: $190,000 (4) Commission to property agent for the new tenancy: $11,000 Required: Compute Mr. Zheng's property tax liability for the year of assessment 2020/21. Ignore provisional property tax. (Show all your workings)

Mr. Zheng purchased a residential flat in Hong Kong with a mortgage loan obtained from a local bank. The property was let to TJ Ltd. under the following terms: (1) Period of lease: (2) Rent free period: (3) Monthly rent: (4) Premium: (5) Rates & government rent: 1 April 2020 to 31 March 2022 (24 months) 1 April 2020 to 30 April 2020 (1 month) $22,000 $100,000 payable on 1 April 2020 Payable by the landlord Despite taking legal actions against a former tenant, the former tenant did not settle the outstanding rent of $75,000, being rent owed for the period from 1 November 2019 to 31 January 2020. The tenant was declared bankrupt on 30 April 2020. The assessor accepted that the outstanding tax was irrecoverable when the tenant declared bankrupt. I On 1 June 2020, Mr. Zheng received outstanding rent of $30,000 from another former tenant. The total amount owed by this tenant was $60,000 and this amount was allowed as irrecoverable rent in the year of assessment 2015/16. During the year ended 31 March 2021, Mr. Zheng paid the following: (1) Rates of $6,000 (after rates concession) (2) Government rent: $7,200 (3) Mortgage loan interest: $190,000 (4) Commission to property agent for the new tenancy: $11,000 Required: Compute Mr. Zheng's property tax liability for the year of assessment 2020/21. Ignore provisional property tax. (Show all your workings)

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 35P

Related questions

Question

100%

Transcribed Image Text:Mr. Zheng purchased a residential flat in Hong Kong with a mortgage loan obtained from

a local bank. The property was let to TJ Ltd. under the following terms:

(1) Period of lease:

(2) Rent free period:

(3) Monthly rent:

(4) Premium:

(5) Rates & government rent:

1 April 2020 to 31 March 2022 (24 months)

1 April 2020 to 30 April 2020 (1 month)

$22,000

$100,000 payable on 1 April 2020

Payable by the landlord

Despite taking legal actions against a former tenant, the former tenant did not settle the

outstanding rent of $75,000, being rent owed for the period from 1 November 2019 to 31

January 2020. The tenant was declared bankrupt on 30 April 2020. The assessor accepted

that the outstanding tax was irrecoverable when the tenant declared bankrupt.

On 1 June 2020, Mr. Zheng received outstanding rent of $30,000 from another former

tenant. The total amount owed by this tenant was $60,000 and this amount was allowed

as irrecoverable rent in the year of assessment 2015/16.

During the year ended 31 March 2021, Mr. Zheng paid the following:

(1) Rates of $6,000 (after rates concession)

(2) Government rent: $7,200

(3) Mortgage loan interest: $190,000

(4) Commission to property agent for the new tenancy: $11,000

Required:

Compute Mr. Zheng's property tax liability for the year of assessment 2020/21. Ignore

provisional property tax. (Show all your workings)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT