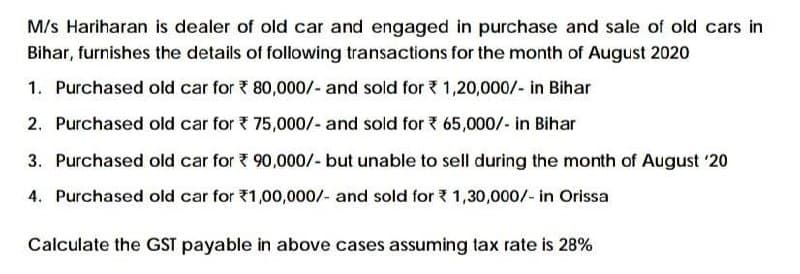

M/s Hariharan is dealer of old car and engaged in purchase and sale of old cars in Bihar, furnishes the details of following transactions for the month of August 2020 1. Purchased old car for ? 80,000/- and sold for 1,20,000/- in Bihar 2. Purchased old car for ? 75,000/- and sold for ? 65,000/- in Bihar 3. Purchased old car for ? 90,000/- but unable to sell during the month of August '20 4. Purchased old car for 1,00,000/- and sold for ? 1,30,000/- in Orissa Calculate the GST payable in above cases assuming tax rate is 28%

M/s Hariharan is dealer of old car and engaged in purchase and sale of old cars in Bihar, furnishes the details of following transactions for the month of August 2020 1. Purchased old car for ? 80,000/- and sold for 1,20,000/- in Bihar 2. Purchased old car for ? 75,000/- and sold for ? 65,000/- in Bihar 3. Purchased old car for ? 90,000/- but unable to sell during the month of August '20 4. Purchased old car for 1,00,000/- and sold for ? 1,30,000/- in Orissa Calculate the GST payable in above cases assuming tax rate is 28%

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:M/s Hariharan is dealer of old car and engaged in purchase and sale of old cars in

Bihar, furnishes the details of following transactions for the month of August 2020

1. Purchased old car for ? 80,000/- and sold for ? 1,20,000/- in Bihar

2. Purchased old car for ? 75,000/- and sold for ? 65,000/- in Bihar

3. Purchased old car for ? 90,000/- but unable to sell during the month of August '20

4. Purchased old car for 1,00,000/- and sold for 1,30,000/- in Orissa

Calculate the GST payable in above cases assuming tax rate is 28%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning