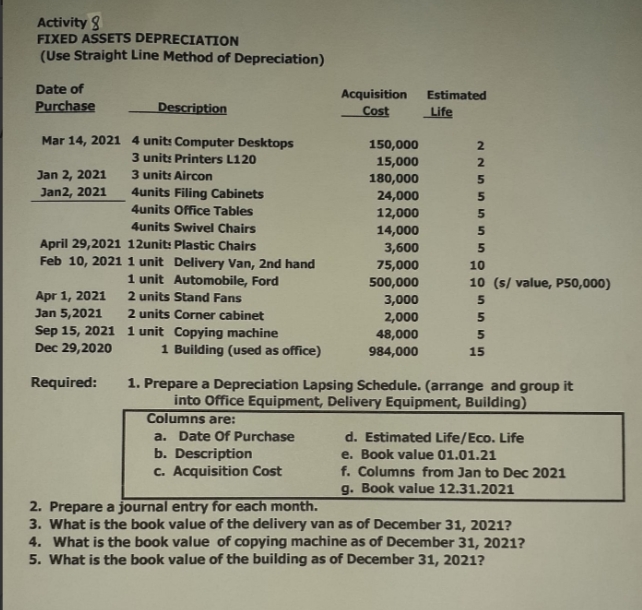

FIXED ASSETS DEPRECIATION (Use Straight Line Method of Depreciation) Date of Purchase Estimated Acquisition Cost Description Life

Q: missal and the legal counsel determined that it is remote that SBMA will become liable in a reliable...

A: 1) P2000000x50% = P1000000 P 5000000 x 30% = P 1500000 P 10000000x 20% = P2000000 ...

Q: Match each phrase with its definition. 1. Seller's description of a cash discount granted to buyers ...

A:

Q: Anne Evans started has a beginning capital balance of P200,000. During the year, her share to the pa...

A: Capital balance at the year end = Beginning Capital balance + Net Income + Additional contribution m...

Q: Sally received an invoice dated on 15 February 2020 worth RM4,050 of goods that included a prepaid f...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Instructions: Answer the following problems by determining the capital balance of each partner aft...

A: Partnership refers to the agreement or relationship between such people who have agreed to share the...

Q: Moustapha transfers a capital asset with a $60,000 adjusted basis to X Corp in a Section 351 transac...

A: Total basis refers to the amount which is paid in securing as well as holding the particular investm...

Q: The accounting records of X Corp shows the following: Increase of RM if 45,000; decrease din FG Inve...

A: Total cost of RM used = Purchases of raw materials + Transportation In - Increase in RM inventory = ...

Q: Account Balance Account Title Debit Credit Cash P 50,000 Non-cash Assets 2,350,000 Liabilities P 400...

A: Arenas ,Delay, and Laurent Statement of Liquidation June 30,2019

Q: Determine the amount paid to settle the following invoice. Invoice amount = $4,602.00 Payment terms ...

A: Invoice- An invoice is a time-stamped business certificate that itemizes and records a transaction a...

Q: PROBLEM 8. The Color Company manufactures and sells two products. The selling prices and variable co...

A: Break even point means where there is no profit no loss. Variable cost means the cost which vary w...

Q: Mary is considering opening a hobby and craft store. Mary plans to operate the business for six year...

A: Net present value is the value of investment of the company in the present market. Whereas, cash flo...

Q: Under Pick Co.’s job order costing system-manufacturing overhead is applied to work in process using...

A: Manufacturing overhead incurred shall be considered.

Q: Which of the following accounts would not appear in the Balance Sheet columns of the end-of-period s...

A: Service revenue is P&L account and it is transferred to P&L in order to calculate the final ...

Q: Q: What would be the direct labor ? (I got 109,000 , but it was wrong) Q: Assume that the company m...

A: Cost of goods manufactured refers to those total cost of goods or inventory which is used by the com...

Q: Materials used - 10,000 kg. Conversion cost P24,000 28,000 Product JKA JKB JKC JJD Sales Value per k...

A: Cost per kilo of JKA = Total costs allocated to JKA / Output for JKA Total costs to be allocated = M...

Q: d B from a joint process that also yields a by-product, X. Alphabet accounts for the revenues from i...

A: Joint costs are those costs which are incurred on two or more than two products simultaneoulsy and w...

Q: Financial audit Q&A In the process of obtaining audit evidence, the strongest audit evidence is inqu...

A: audit evidence shows the information data that is collected by auditor to make their conclusion on t...

Q: At December 31,2020, a firm is evaluating a contingent liability as part of their annual financial r...

A: Contingent liabilities are the amount of obligation which depends on the uncertain future event that...

Q: PROBLEM 4. Cindy, Inc., sells a single product. The company's most recent income statement is given ...

A: Break-even point ( in units ) = Fixed expenses / Contribution margin per unit Break-even point ( in ...

Q: Saddle Inc. has two types of handbags: standard and custom. The controller has decided to use a plan...

A:

Q: Compute 3M's accounts receivable turnover and the average collection period in days.

A: Accounts receivable turnover (ART) ratio refers to a ratio which shows the relationship between the ...

Q: Research "Auditor's Discussion and Analysis (AD&A)”. Do you think AD&A is a good idea? Explain your...

A: AD&A is an abbreviation for Auditor's Discussion and Analysis. This extra narrative report to th...

Q: aughn Company of Emporia, Kansas, spreads herbicides and applies liquid fertilizer for local farmers...

A: The question is based on the concept of Financial Accounting. Bank Reconciliation Statement: It refe...

Q: 3. The following information are available for ABC Corporation: Ordinary shares, P100 par value, 50,...

A: The dividend is declared and paid to shareholders from the retained earnings of the business.

Q: Marc Company sold merchandise to Jacobs Company on July 7, 2020 at a list price of P150,000, trade d...

A: Note: 2/EOM, n/60: Here, 2 represents the discount rate if payment is made within two days after the...

Q: A and B entered into a partnership agreement in which A is to have a 60% interest in capital and pro...

A: Solution: Total cash contributed by B for 40% interest = P100,000 Required capital of partnership = ...

Q: Accounting On October 1, 2019, Paul Inc. acquired 80% of Sam Co. by paying $500,000 cash. At that da...

A:

Q: The following income statement was drawn from the records of Munoz, a merchandising firm: MUNOZ COMP...

A: Contribution Margin = Sales - Variable Costs Net Income = Contribution margin - Fixed costs Operatin...

Q: Review the treasurer's analysis, identifying any questionable aspects and briefly comment on the app...

A: A treasurer is a person who manages and administers the financial assets and liabilities of a compan...

Q: Interest income on municipal governmental bonds $ 92,000 Depreciation claimed on the 2021 tax return...

A: Tax is an amount that is charged by the government from the individual and organization on the incom...

Q: In June of the current year, Department 2 (last department) received 80,000 units from Department 1....

A:

Q: The federal government is required to recognize liabilities from nonexchange transactions When ...

A: Liabilities refer to the obligations that are required to fulfilled in the future by the business.

Q: A and B are partners with the following contributions: Partner A, P300,000 and Partner B, P200,000. ...

A: Fair value of asset. 80000 less: amount withdrawn by B against capital asset. (350000)...

Q: . Jacobe Company uses the weighted-average method in its process costing system. The Assembly Depart...

A: Solution: Equivalent units are defined as how much work has been done on a certain number of physica...

Q: The TOYO Manufacturing Company has the following financial information: · Manufacturing ove...

A: Material Consumed=Direct materials purchased-Increase in direct materials

Q: During the month of June, Job 100 was started. Data are as follows: Units produced is 1,200 units; U...

A: Gross margin is computed using formula = Sales revenue - Cost of goods sold Where Sales revenue = Re...

Q: detoxification facility for P9,000,000. On January 1, 2021, Camille Company purchased a gas The cost...

A:

Q: Sydney Company is a retailer that sells clothing. The entity has launched a promotional campaign whe...

A: Accounting- Accounting is the method that an organization uses to keep track of its finances and int...

Q: Idaho Corporation manufactures liquid chemicals A and B from a joint process. Joint costs are alloca...

A: Solution: Total joint costs = 4,560 Sale value of Product A at split off point = 500*10 = 5,000 Sale...

Q: Crazy Coconut LLC has two products: Jet Boats Ski Boats $8000 $24,000 $4800 $14,000 Sales price per ...

A:

Q: PROBLEM 5. Austin Company produces a single product. The projected income statement for the coming y...

A: Solution Contribution = Sales - Variable cost.

Q: (1) What actions have you had to take in your own lifeto overcome liquidity problems? (2) Did those ...

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: X, Y, Z share profits and losses in the ratio of 20%, 30%, 50%, respectively. During the year, their...

A: Formula: Ending capital = Beginning Capital + share in Net profit - Withdrawals

Q: An animal shelter plans to sell T-shirts bearing their logo at an upcoming crafts fair. They find a ...

A: Cost of inventory = Cost of purchase + Cost of logo printing + Cost of freight in

Q: Adams, Inc., pays its employees’ weekly wages in cash. A supplementary payroll sheet that lists the ...

A: Payroll is the compensation that a company is obligated to pay to its employees for a specific perio...

Q: X, Y, Z share profits and losses in the ratio of 20%, 30%, 50%, respectively. During the year, their...

A: Lets understand the basics. Partnership is an agreement between two or more person who works togethe...

Q: PROBLEM 7. Mcoy Company has, for the coming year, budgeted sales of P3,200,000 with contribution mar...

A: Break even point means where there is no profit no loss. Variable cost means the cost which vary wit...

Q: Q1.)Why do you think an industrial partner does not share in the losses of partnership?

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: X Corp uses predetermined Overhead application rate is based on direct labor hours. During the year,...

A: Actual OH = 345,000 Planned OH = 360,000 Actual labor hours = 1,210,000 Applied OH = 363,000

Q: Following is relevant information for Snowdon Sandwich Shop, a small business that serves sandwiches...

A: Contribution margin = Sales - Variable costs Net Operating Income = Contribution margin - Fixed cost...

Step by step

Solved in 4 steps

- Allocating payments and receipts to fixed asset accounts The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search 2,500 b. Cost of real estate acquired as a plant site: Land 285,000 Building (to be demolished) 55,000 c. Delinquent real estate taxes on property, assumed by purchaser 15,500 d. Cost of tearing down and removing building acquired In (b) 5,000 e. Proceeds from sale of salvage materials from old building 4,000 f. Special assessment paid to city for extension of water main to the property 29,000 g. Architects and engineers fees for plans and supervision 60,000 h. Premium on one-year insurance policy during construction 6,000 i. Cost of filling and grading land 12,000 j. Money borrowed to pay building contractor 900,000 k. Cost of repairing windstorm damage during construction 5,500 1. Cost of paving parking lot to be used by customers 32,000 m. Cost of trees and shrubbery planted 11,000 n. Cost of floodlights installed on parking lot 2,000 o. Cost of repairing vandalism damage during construction 2,500 p. Proceeds from insurance company for windstorm and vandalism damage 7,500 q. Payment to building contractor for new building 800,000 r. Interest incurred on building loan during construction 34,500 s. Refund of premium on insurance policy (h) canceled after 11 months 500 Instructions 1.Assign each payment and receipt to Land (unlimited life), Land Improvements (limited life), Building, or Other Accounts. Indicate receipts by an asterisk. Identify each item by letter and list the amounts in columnar form, as follows: Item Land Land improvements Building Other Accounts 2.Determine the amount debited to Land, Land Improvements, and Building. 3.The costs assigned to the land, which is used as a plant site, will not be depreciated, while the costs assigned to land improvements will be depreciated. Explain this seemingly contradictory application of the concept of depreciation. 4.What would be the effect on the current years income statement and balance sheet if the cost of filling and grading land of 12,000 [payment (i)] was incorrectly classified as Land Improvements rather than Land? Assume that Land Improvements are depreciated over a 20-year life using the double-declining-balance method.Exercise 7-59Disposal of Fixed Asset Pacifica Manufacturing retired a computerized metal stamping machine on December 31, 2019. Pacifica sold the machine to another company and did not replace it. The following data are available for the machine: Cost (installed), 1/1/2014 $880,000 Residual value estimated on 1/1/2014 60,000 Estimated life as of 1/1/2014 10 years The machine was sold for $225,000 cash. Pacifica uses the straight-line method of depreciation. Required: 1. Prepare the journal entry to record depreciation expense for 2019. 2019 Dec. 31 Depreciation Expense 82,000 Accumulated Depreciation 82,000 Feedback 2. Compute accumulated depreciation on December 31, 2019.$ How do I calculate accumulated depreciation?Required information Problem 8-6A Disposal of plant assets LO C1, P1, P2 Onslow Co. purchased a used machine for $240,000 cash on January 2. On January 3, Onslow paid $8,000 to wire electricity to the machine and an additional $1,600 to secure it in place. The machine will be used for six years and have a $28,800 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of.

- Problem 9Hilarious Company provided the following data pertaining to machinery on the date of revaluation: Cost Replacement costMachinery 4, 500, 000 7, 500, 000Accumulated depreciation 900, 000 Age of asset 3 yearsRevised Life of the asset 10 years Required:1. Appreciation or revaluation increase2. Carrying amount3. Depreciated replacement cost4. Revaluation surplus5. What is the original life of the asset?6. Prepare the journal entry to record the revaluation 7. What is/are the rules in solving the problem?Exercise 8-8: For each of the following intangible assets, indicate the amount of amortization expense that should be recorded for the year 2016 and the amount of accumulated amortization on the balance sheet as of December 31, 2016. Trademark Patent Copyright Cost $40,000 $50,000 $80,000 Date of purchase 1/1/09 1/1/11 1/1/14 Useful life indefinite 10 yrs. 20 yrs. Legal life undefined 20 yrs. 50 yrs. Method SL* SL SLProblem 5:On January 1, 2016, Greenhills Company acquired property, plant and equipment for each as follows:Cost Life in yearsLand 5,000,000Building 25,000,000 2513Machinery 10,000,000 5Equipment 3,000,000 10At the beginning of 2019, a revaluation of property items was made by professionally qualified valuers.While no change in the life of the assets was indicated, it was ascertained that replacement cost of theassets acquired in 2016 had increased by the following percentage:Land 100%Building 80%Machinery 50%Equipment 40%It was authorized that such revaluation be recorded in the accounts and that depreciation be recorded onthe basis of revalued amount.Required:a. Prepare journal entry to record the revaluation on January 1, 2019.b. Prepare the journal entry to record the depreciation for 2019.c. Prepare the journal entry to record the piecemeal realization of the revaluation surplus.d. Present the assets in the statement of financial position on December 31, 2019.

- PARRISH 8-1 FIXED AND INTANGIBLE ASSETS-ACQUISITION OF ASSETS Please complete the following and explain the how and why of completing 1) identify the cost of the asset 2) For any costs incurred that are not included in the asset cost, specify how they would be recordedGrowth company purchaased a new mahcine for its manufacturing facility. Costs incurred in conjunction with this purchase included the following: Invoice price $90000, subject to 2/10, n/30Sales Tax $5400Freight to ship to Growth $6000Transport to factory $1900Repair of chip in machine from damage in loading $500Training of operators $3600Lunch for truck driver $25Exercise 11-4 (Algo) Other depreciation methods LO11-21 [The following information applies to the questions displaved below.) On January 1, 2021, the Allegheny Corporation purchased equipment for $343,000. The estimated service life of the equipment is 10 years and the estimated residual value is $24,000. The equipment is expected to produce 296.000 units during its life. Required: Calculate depreciation for 2021 and 2022 using each of the following methods. Print Exercise 11-4 (Algo) Part 1 References 1. Sum-of-the-years'-digits (Do not round intermediate calculations. Round final answers to the nearest whole dollar amount.)MODULE 5 DEPRECIATION With the following information please answer the following questions and journalize the transaction. What is the amount of depreciation at the end of the 3rd year? What is the Book Value at the end of the 3rd year? 1) Company has owned machine for 3 years 2) It has been depreciated using the straight line method 3) Original cost was $980000 4) Salvage is estimated at 6,000 5) Life of 8 years

- 1. The total depreciation for the year ended December 31, 2020 isa. P237,000 c. P233,250b. P232,500 d. P236,250 2. The carrying amount of production machine as of December 31, 2020 isa. P1,024,500 c. P1,069,500b. P1,029,000 d. P 990,750w Show Me How Print Item Question Content Area Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $393,800. The equipment was expected to have a useful life of four years, or 8,400 operating hours, and a residual value of $32,600. The equipment was used for 2,940 hours during Year 1, 1,764 hours in Year 2, 2,352 hours in Year 3, and 1,344 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in…Problem 6-25 (Algo) Identify depreciation methods used LO 3 Grove Co. acquired a production machine on January 1, 2019, at a cost of $495,000. The machine is expected to have a four-year useful life, with a salvage value of $86,000. The machine is capable of producing 56,000 units of product in its lifetime. Actual production was as follows: 12,320 units in 2019; 17,920 units in 2020; 15,680 units in 2021; 10,080 units in 2022. Following is the comparative balance sheet presentation of the net book value of the production machine at December 31 for each year of the asset’s life, using three alternative depreciation methods (items a–c): Required: Identify the depreciation method used for each of the following comparative balance sheet presentations (items a–c). If a declining-balance method is used, be sure to indicate the percentage (150% or 200%). (Hint: Read the balance sheet from right to left to determine how much has been depreciated each year. Remember that December 31, 2019, is…