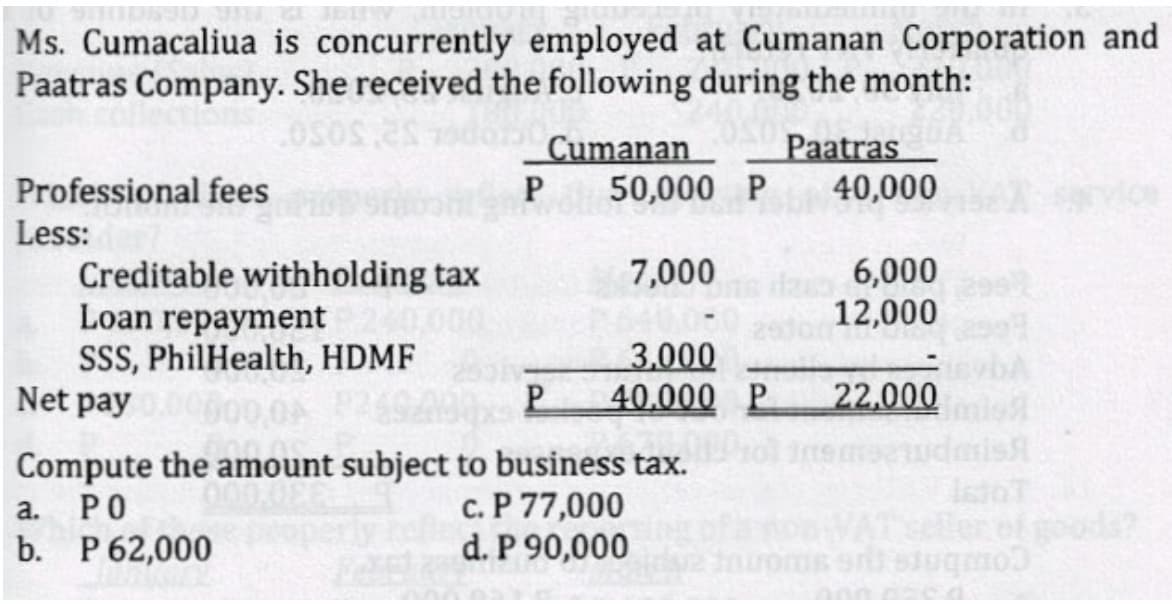

Ms. Cumacaliua is concurrently employed at Cumanan Corporation an Paatras Company. She received the following during the month: Cumanan 50,000 P Paatras 40,000 Professional fees Less: Creditable withholding tax Loan repayment SSS, PhilHealth, HDMF Net pay 6,000 12,000 7,000 3.000 40.000 P P. 22,000 Compute the amount subject to business tax. ist

Ms. Cumacaliua is concurrently employed at Cumanan Corporation an Paatras Company. She received the following during the month: Cumanan 50,000 P Paatras 40,000 Professional fees Less: Creditable withholding tax Loan repayment SSS, PhilHealth, HDMF Net pay 6,000 12,000 7,000 3.000 40.000 P P. 22,000 Compute the amount subject to business tax. ist

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 26P

Related questions

Question

Transcribed Image Text:Ms. Cumacaliua is concurrently employed at Cumanan Corporation and

Paatras Company. She received the following during the month:

Cumanan

50,000 P

Paatras

40,000

Professional fees

P

Less:

6,000

12,000

Creditable withholding tax

Loan repayment

SSS, PhilHealth, HDMF

Net pay

7,000

3.000

40.000 P

P.

22,000

ist

Compute the amount subject to business tax.

c. P 77,000

d. P 90,000

a.

PO

Her

b. P 62,000

combare tue smonur

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT