yran, ($88,000), payroll deductions for income tax ($8,800), payroll deductions for FICA ($6, 600), payroll deductions for American Cances Society ($3, 300). employer contributions for FICA (matching), and state and federal unemployment taxes ($660). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded. Collected rent revenue of $6, 150 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Unearned Rent Revenue. Required: Complete the required journal entries for the above transactions as shown below: Prepare the entries required on December 31 to record payroll. Prepare the journal entry for the collection of rent on December 10. Prepare the adjusting journal entry on December 31.

yran, ($88,000), payroll deductions for income tax ($8,800), payroll deductions for FICA ($6, 600), payroll deductions for American Cances Society ($3, 300). employer contributions for FICA (matching), and state and federal unemployment taxes ($660). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded. Collected rent revenue of $6, 150 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 11 to January 10 and was credited in full to Unearned Rent Revenue. Required: Complete the required journal entries for the above transactions as shown below: Prepare the entries required on December 31 to record payroll. Prepare the journal entry for the collection of rent on December 10. Prepare the adjusting journal entry on December 31.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4E

Related questions

Question

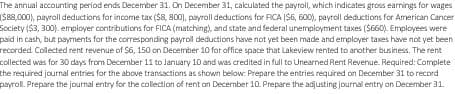

Transcribed Image Text:The annual accounting period ends December 31. On December 31, calculated the payroll, which indicates gross earnings for wages

($88,000), payroll deductions for income tax ($8,800), payroll deductions for FICA ($6, 600), payroll deductions for American Cancer

Society ($3, 300). employer contributions for FICA (matching), and state and federal unemployment taxes ($660). Employees were

paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been

recorded Collected rent revenue of $6, 150 on December 10 for office space that Lakeview rented to another business. The rent

collected was for 30 days from December 11 to January 10 and was credited in full to Unearned Rent Revenue. Required: Complete

the required journal entries for the above transactions as shown below: Prepare the entries required on December 31 to record

payroll. Prepare the journal entry for the collection of rent on December 10. Prepare the adjusting journal entry on December 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage