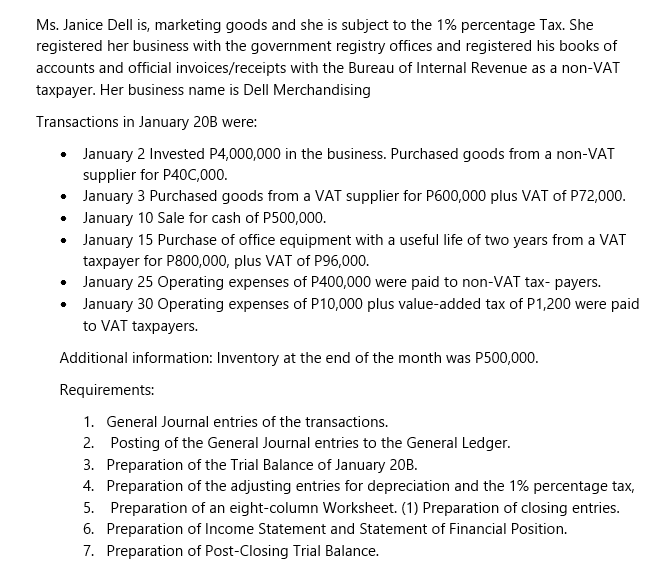

Ms. Janice Dell is, marketing goods and she is subject to the 1% percentage Tax. She registered her business with the government registry offices and registered his books of accounts and official invoices/receipts with the Bureau of Internal Revenue as a non-VAT taxpayer. Her business name is Dell Merchandising Transactions in January 20B were: • January 2 Invested P4,000,000 in the business. Purchased goods from a non-VAT supplier for P40C,000. January 3 Purchased goods from a VAT supplier for P600,000 plus VAT of P72,000. • January 10 Sale for cash of P500,000. • January 15 Purchase of office equipment with a useful life of two years from a VAT taxpayer for P800,000, plus VAT of P96,000. January 25 Operating expenses of P400,000 were paid to non-VAT tax- payers. • January 30 Operating expenses of P10,000 plus value-added tax of P1,200 were paid to VAT taxpayers. Additional information: Inventory at the end of the month was P500,000. Requirements: 1. General Journal entries of the transactions. 2. Posting of the General Journal entries to the General Ledger. 3. Preparation of the Trial Balance of January 20B.

Ms. Janice Dell is, marketing goods and she is subject to the 1% percentage Tax. She registered her business with the government registry offices and registered his books of accounts and official invoices/receipts with the Bureau of Internal Revenue as a non-VAT taxpayer. Her business name is Dell Merchandising Transactions in January 20B were: • January 2 Invested P4,000,000 in the business. Purchased goods from a non-VAT supplier for P40C,000. January 3 Purchased goods from a VAT supplier for P600,000 plus VAT of P72,000. • January 10 Sale for cash of P500,000. • January 15 Purchase of office equipment with a useful life of two years from a VAT taxpayer for P800,000, plus VAT of P96,000. January 25 Operating expenses of P400,000 were paid to non-VAT tax- payers. • January 30 Operating expenses of P10,000 plus value-added tax of P1,200 were paid to VAT taxpayers. Additional information: Inventory at the end of the month was P500,000. Requirements: 1. General Journal entries of the transactions. 2. Posting of the General Journal entries to the General Ledger. 3. Preparation of the Trial Balance of January 20B.

Chapter3: Income Sources

Section: Chapter Questions

Problem 83P

Related questions

Question

Pls answer for a thumbs up

Transcribed Image Text:Ms. Janice Dell is, marketing goods and she is subject to the 1% percentage Tax. She

registered her business with the government registry offices and registered his books of

accounts and official invoices/receipts with the Bureau of Internal Revenue as a non-VAT

taxpayer. Her business name is Dell Merchandising

Transactions in January 20B were:

January 2 Invested P4,000,000 in the business. Purchased goods from a non-VAT

supplier for P40C,000.

• January 3 Purchased goods from a VAT supplier for P600,000 plus VAT of P72,000.

• January 10 Sale for cash of P500,000.

January 15 Purchase of office equipment with a useful life of two years from a VAT

taxpayer for P800,000, plus VAT of P96,000.

• January 25 Operating expenses of P400,000 were paid to non-VAT tax- payers.

• January 30 Operating expenses of P10,000 plus value-added tax of P1,200 were paid

to VAT taxpayers.

Additional information: Inventory at the end of the month was P500,000.

Requirements:

1. General Journal entries of the transactions.

2. Posting of the General Journal entries to the General Ledger.

3. Preparation of the Trial Balance of January 20B.

4. Preparation of the adjusting entries for depreciation and the 1% percentage tax,

5. Preparation of an eight-column Worksheet. (1) Preparation of closing entries.

6. Preparation of Income Statement and Statement of Financial Position.

7. Preparation of Post-Closing Trial Balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub