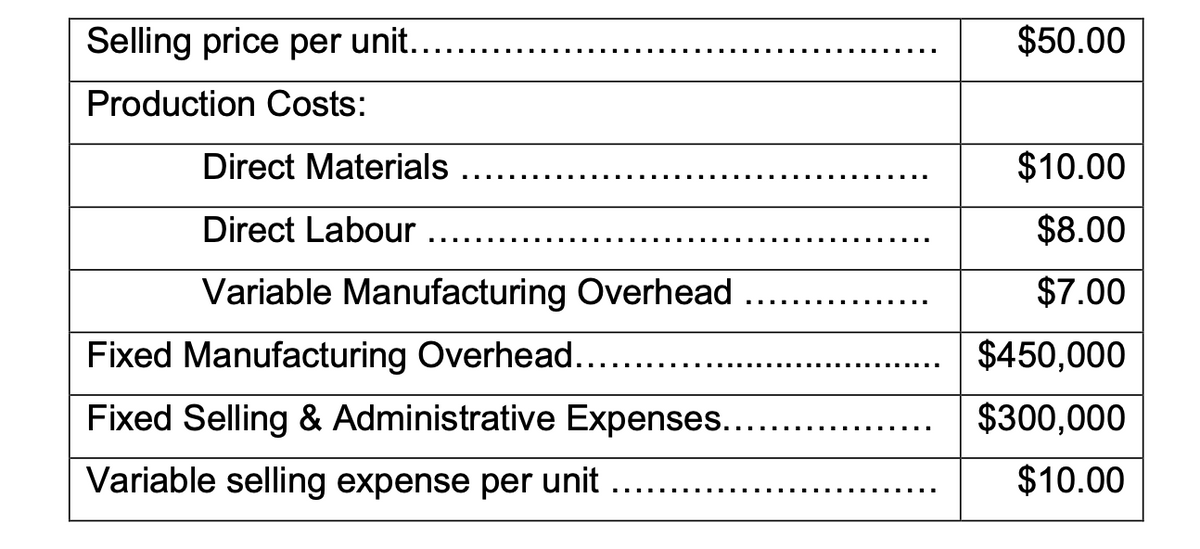

A Swiss Interior Company produces and sells lamps that are sold usually all year round. The company has a maximum production capacity of 100,000 units per year. Operating at normal capacity, the business earned Operating Income of $600,000 in 2020. The following cost data has been prepared for the year ended December 31, 2020. 1. Calculate The Swiss Interior Company’s break-even point in units and in sales dollars. 2. Assuming sales equal to the normal capacity of the business, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and clearly showing contribution and net income.

A Swiss Interior Company produces and sells lamps that are sold usually all year round. The company has a maximum production capacity of 100,000 units per year. Operating at normal capacity, the business earned Operating Income of $600,000 in 2020. The following cost data has been prepared for the year ended December 31, 2020.

1. Calculate The Swiss Interior Company’s break-even point in units and in sales dollars.

2. Assuming sales equal to the normal capacity of the business, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and clearly showing contribution and net income.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps