Multiple Choice Debit Bad Debts Expense $16,655; credit Allowance for Doubtful Accounts $16,655. Debit Bad Debts Expense $17,490; credit Allowance for Doubtful Accounts $17,490. Debit Bad Debts Expense $14,075; credit Allowance for Doubtful Accounts $14,075. Debit Bad Debts Expense $7,490; credit Allowance for Doubtful Accounts $7,490. O Debit Bad Debts Expense $15,365; credit Allowance for Doubtful Accounts $15,365. The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense reports the following selected amounts: Accounts Receivable Allowance for Doubtful Accounts Net Sales $ 439,000 Debit 1,290 Debit 2,140,000 Credit All sales are made on credit. Based on past experience, the company estimates 3.5% of ending accounts receivable to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Multiple Choice O Debit Bad Debts Expense $16,655; credit Allowance for Doubtful Accounts $16,655. Debit Bad Debts Expense $17,490; credit Allowance for Doubtful Accounts $17,490. Debit Bad Debts Expense $14,075; credit Allowance for Doubtful Accounts $14,075.. O Debit Bad Debts Expense $7,490; credit Allowance for Doubtful Accounts $7,490.

Multiple Choice Debit Bad Debts Expense $16,655; credit Allowance for Doubtful Accounts $16,655. Debit Bad Debts Expense $17,490; credit Allowance for Doubtful Accounts $17,490. Debit Bad Debts Expense $14,075; credit Allowance for Doubtful Accounts $14,075. Debit Bad Debts Expense $7,490; credit Allowance for Doubtful Accounts $7,490. O Debit Bad Debts Expense $15,365; credit Allowance for Doubtful Accounts $15,365. The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense reports the following selected amounts: Accounts Receivable Allowance for Doubtful Accounts Net Sales $ 439,000 Debit 1,290 Debit 2,140,000 Credit All sales are made on credit. Based on past experience, the company estimates 3.5% of ending accounts receivable to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Multiple Choice O Debit Bad Debts Expense $16,655; credit Allowance for Doubtful Accounts $16,655. Debit Bad Debts Expense $17,490; credit Allowance for Doubtful Accounts $17,490. Debit Bad Debts Expense $14,075; credit Allowance for Doubtful Accounts $14,075.. O Debit Bad Debts Expense $7,490; credit Allowance for Doubtful Accounts $7,490.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 6PA: Funnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable....

Related questions

Question

Transcribed Image Text:Multiple Choice

Debit Bad Debts Expense $16,655; credit Allowance for Doubtful Accounts $16,655.

Debit Bad Debts Expense $17,490; credit Allowance for Doubtful Accounts $17,490.

Debit Bad Debts Expense $14,075; credit Allowance for Doubtful Accounts $14,075.

Debit Bad Debts Expense $7,490; credit Allowance for Doubtful Accounts $7,490.

O

Debit Bad Debts Expense $15,365; credit Allowance for Doubtful Accounts $15,365.

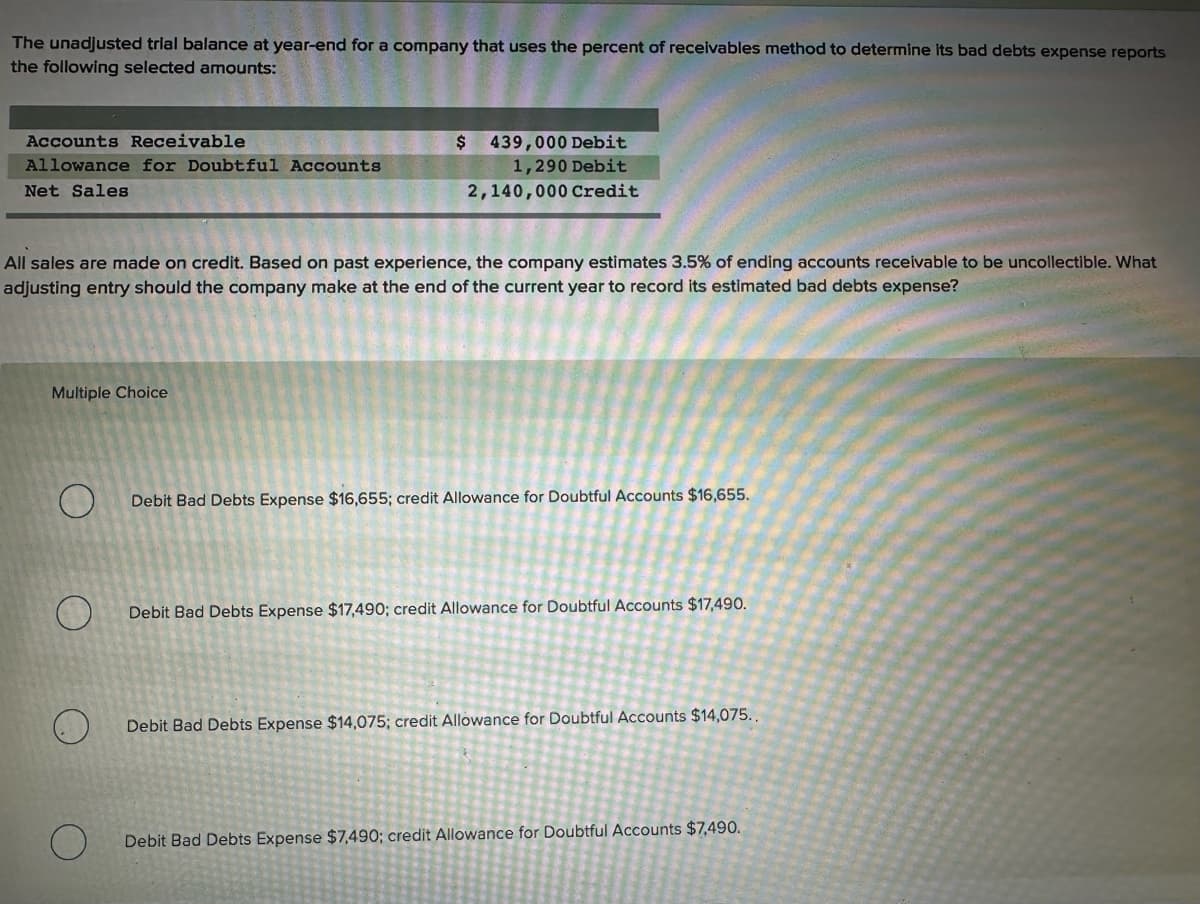

Transcribed Image Text:The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense reports

the following selected amounts:

Accounts Receivable

Allowance for Doubtful Accounts

Net Sales

$ 439,000 Debit

1,290 Debit

2,140,000 Credit

All sales are made on credit. Based on past experience, the company estimates 3.5% of ending accounts receivable to be uncollectible. What

adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Multiple Choice

O

Debit Bad Debts Expense $16,655; credit Allowance for Doubtful Accounts $16,655.

Debit Bad Debts Expense $17,490; credit Allowance for Doubtful Accounts $17,490.

Debit Bad Debts Expense $14,075; credit Allowance for Doubtful Accounts $14,075..

O

Debit Bad Debts Expense $7,490; credit Allowance for Doubtful Accounts $7,490.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College