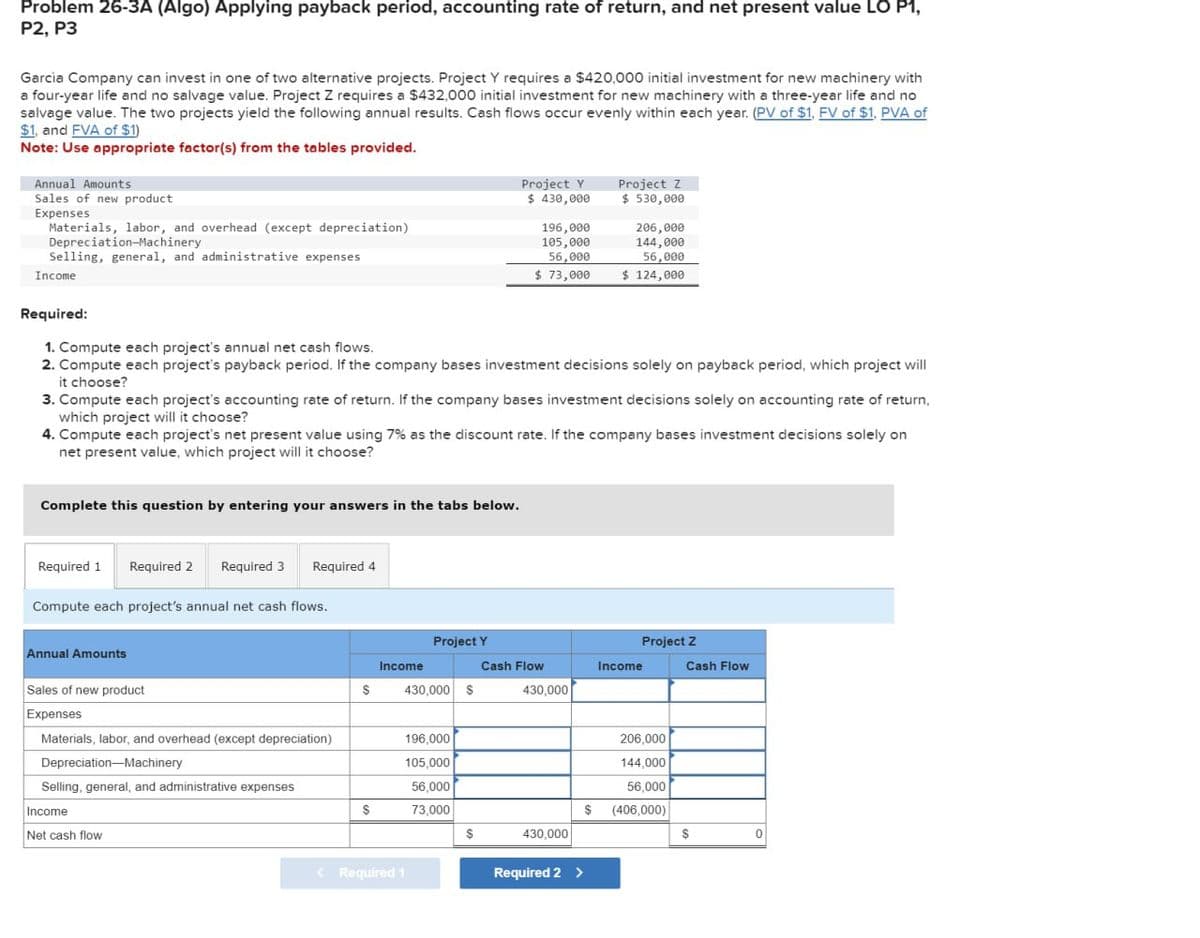

Problem 26-3A (Algo) Applying payback period, accounting rate of return, and net present value LO P1, P2, P3 Garcia Company can invest in one of two alternative projects. Project Y requires a $420,000 initial investment for new machinery with a four-year life and no salvage value. Project Z requires a $432,000 initial investment for new machinery with a three-year life and no salvage value. The two projects yield the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Required: 1. Compute each project's annual net cash flows. Project Y $ 430,000 Project Z $530,000 206,000 144,000 56,000 $ 73,000 $ 124,000 196,000 105,000 56,000 2. Compute each project's payback period. If the company bases investment decisions solely on payback period, which project will it choose? 3. Compute each project's accounting rate of return. If the company bases investment decisions solely on accounting rate of return, which project will it choose? 4. Compute each project's net present value using 7% as the discount rate. If the company bases investment decisions solely on net present value, which project will it choose? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute each project's annual net cash flows. Annual Amounts Sales of new product Expenses Project Y Project Z Income Cash Flow Income Cash Flow $ 430,000 $ 430,000 Materials, labor, and overhead (except depreciation) 196,000 206,000 Depreciation-Machinery 105,000 144,000 Selling, general, and administrative expenses 56,000 56,000 Income $ 73,000 $ (406,000) Net cash flow $ 430,000 $ 0 < Required 1 Required 2 >

Problem 26-3A (Algo) Applying payback period, accounting rate of return, and net present value LO P1, P2, P3 Garcia Company can invest in one of two alternative projects. Project Y requires a $420,000 initial investment for new machinery with a four-year life and no salvage value. Project Z requires a $432,000 initial investment for new machinery with a three-year life and no salvage value. The two projects yield the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Required: 1. Compute each project's annual net cash flows. Project Y $ 430,000 Project Z $530,000 206,000 144,000 56,000 $ 73,000 $ 124,000 196,000 105,000 56,000 2. Compute each project's payback period. If the company bases investment decisions solely on payback period, which project will it choose? 3. Compute each project's accounting rate of return. If the company bases investment decisions solely on accounting rate of return, which project will it choose? 4. Compute each project's net present value using 7% as the discount rate. If the company bases investment decisions solely on net present value, which project will it choose? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute each project's annual net cash flows. Annual Amounts Sales of new product Expenses Project Y Project Z Income Cash Flow Income Cash Flow $ 430,000 $ 430,000 Materials, labor, and overhead (except depreciation) 196,000 206,000 Depreciation-Machinery 105,000 144,000 Selling, general, and administrative expenses 56,000 56,000 Income $ 73,000 $ (406,000) Net cash flow $ 430,000 $ 0 < Required 1 Required 2 >

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter11: The Basics Of Capital Budgeting

Section: Chapter Questions

Problem 15P: NPV PROFILES: TIMING DIFFERENCES An oil-drilling company must choose between two mutually exclusive...

Related questions

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

Transcribed Image Text:Problem 26-3A (Algo) Applying payback period, accounting rate of return, and net present value LO P1,

P2, P3

Garcia Company can invest in one of two alternative projects. Project Y requires a $420,000 initial investment for new machinery with

a four-year life and no salvage value. Project Z requires a $432,000 initial investment for new machinery with a three-year life and no

salvage value. The two projects yield the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of

$1, and FVA of $1)

Note: Use appropriate factor(s) from the tables provided.

Annual Amounts

Sales of new product

Expenses

Materials, labor, and overhead (except depreciation)

Depreciation-Machinery

Selling, general, and administrative expenses

Income

Required:

1. Compute each project's annual net cash flows.

Project Y

$ 430,000

Project Z

$530,000

206,000

144,000

56,000

$ 73,000

$ 124,000

196,000

105,000

56,000

2. Compute each project's payback period. If the company bases investment decisions solely on payback period, which project will

it choose?

3. Compute each project's accounting rate of return. If the company bases investment decisions solely on accounting rate of return,

which project will it choose?

4. Compute each project's net present value using 7% as the discount rate. If the company bases investment decisions solely on

net present value, which project will it choose?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4

Compute each project's annual net cash flows.

Annual Amounts

Sales of new product

Expenses

Project Y

Project Z

Income

Cash Flow

Income

Cash Flow

$

430,000 $

430,000

Materials, labor, and overhead (except depreciation)

196,000

206,000

Depreciation-Machinery

105,000

144,000

Selling, general, and administrative expenses

56,000

56,000

Income

$

73,000

$ (406,000)

Net cash flow

$

430,000

$

0

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning