multiple-step income statement

Q: Preparation of the Statement of Comprehensive Income (Income Statement) using the multi-step format

A: Solution Working Net purchases =purchases-purchase returns and allowances – purchase discounts…

Q: What is the order of the subtotals that appear on a multi-step income statement? Gross Profit,…

A: Multi step income statement: A multiple step income statement refers to the income statement that…

Q: segmented income statement, ir ratement

A: Segmented income statement means income statement prepared by an entity by showing the income and…

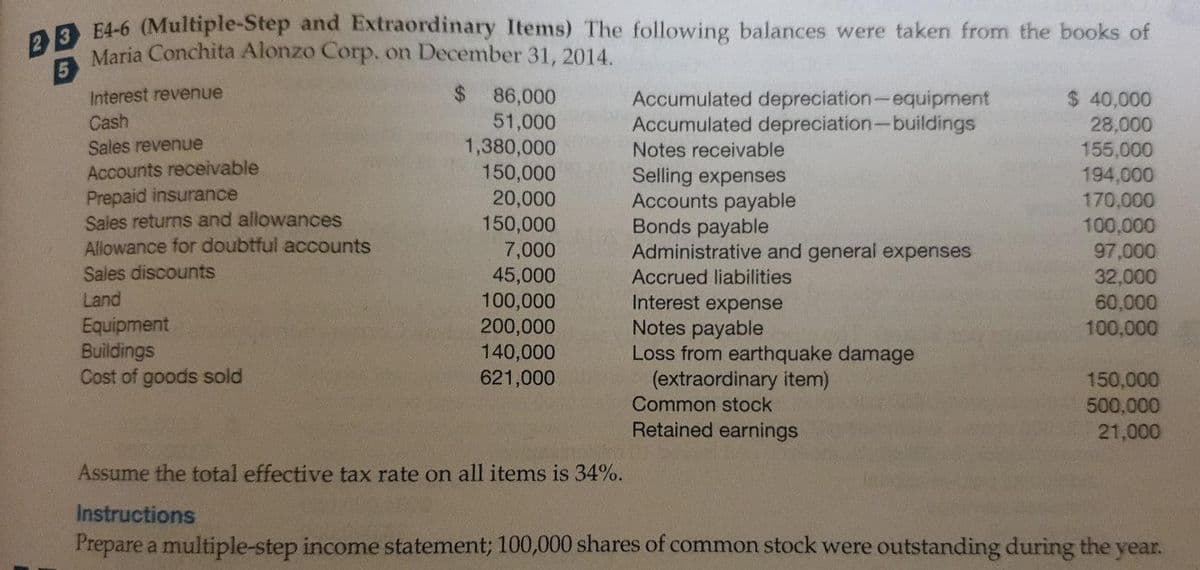

Q: Please see below. Use the accounts listed to create a multistep income statement.

A: Multi step income statement is a statement which categories operating and non operating incomes and…

Q: what is a condensed income statement

A: Definition: Financial statements: Financial statements are condensed summary of transactions…

Q: ntages of Income s

A: Income statement or profit and loss account is a type financial statement that shows the income…

Q: REQUIRED: • Statement of Comprehensive Income

A: Comprehensive Income The purpose of preparing the statement of comprehensive income to know the net…

Q: When using vertical analysis, we express income statement accounts as a percentage of a. Net income.…

A: Vertical analysis is the method of financial statement analysis, and it is useful in evaluating a…

Q: Multiple-step Income Statement.

A: Multiple-step income statement is a format of income statement in which items of revenues and…

Q: Statement of Comprehensive Income using a Single-step format.

A: In single-step format of Statement of Comprehensive Income, the revenues and expenses are not…

Q: single-step income statement fe

A: Income statement is one of financial statement showing the financial performance of income and…

Q: With the given statement of comprehensive income below, conduct a horizontal analysis.

A: Horizontal analysis means where the analysis is made with regard with two different period where as…

Q: Make your own income statement

A: A statement of income is a financial document that identifies the income and expense of the company.…

Q: A multistep income statement divides revenues and expenses further to show. Select one: a. subtotals…

A: An income statement that categorizes incomes and expenses into operational and non-operating heads…

Q: What is the difference between the single-step and multiplestep income statement formats?

A: Income statement: It can be defined as one of the company’s financial statements that shows all the…

Q: indicate whether the statement describes a multiple-step income statement or asingle-step income…

A:

Q: Explain the below income Statement.

A: Introduction:- Income statement provide summary of all revenues and expenses. It provides true…

Q: Define single-step income statement

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: The income statement form that contains several sections, subsections, and subtotals is called the…

A: The financial statement consists of mainly three statements Income statement or Profit and loss…

Q: Briefly explain the difference between the single-step and multiple-step income statement formats.

A: Definition:

Q: please prepare multi-step income statement. thank youu

A: Multi step income statement of the business is one of the financial statement, which is used for…

Q: corrected multi-step Income statement.

A: 1. Accounts receivable is a current assets and a Balance Sheet item. 2. Unearned sales is a current…

Q: Show the income statement equation and define eachelement.

A:

Q: Multiple-Step Income Statement (Partial)

A: Net sales is the balance of gross sales after deducting sales discounts and sales returns and…

Q: Prepare a partial income statement Compute EPS for every item

A:

Q: indicate whether the statement describes a multiple-step income statement or asingle-step income…

A: Net income: The bottom line of income statement which is the result of excess of earnings from…

Q: calculate return on assest for this statement

A: Introduction:- Return on asset ratio indicates how efficiently a company can manage its assets to…

Q: Describe the multi-step income statement.

A:

Q: Prepare Multi step income statement

A: Formula: Net income = Total revenues - Total expenses

Q: Describe the single-step income statement.

A:

Q: Explain how to prepare a condensed income statement.

A:

Q: income statement fo

A: Particulars Amount in $ Beginning Direct Materials 13500 Add Direct Material purchases 36000…

Q: Calculate Gross profit ratio

A: Gross profit ratio = Gross profit/ Sales *100

Q: Define Gross profit ratio.

A: Ratio analysis: The analysis of a company using the financial ratios and comparing its trends and…

Q: hat is the standard income statement equation'

A: Standard income statement equation contains 3 parts Net income , revenue and expenses . Net income…

Q: Prepare a multiple-step income statement. (Li either a negative sign preceding the number e.g.-

A: An income statement is a financial statement prepared at the end of the accounting year, to know the…

Q: e income summary account

A: The income summary Account is also called as Income statement Account. And the income summary…

Q: Compute NET Profit margin ratio

A: Net profit margin ratio = Net Income/ Revenue * 100

Q: Classify each of the following items as revenues (R), expenses (EX), or withdrawals (W). Cost of…

A: Definition: Financial Accounting: It refers to the process of recording the financial transactions…

Q: Prepare a common size income statement given the following information:

A:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Multiple-step income statement and report form of balance sheet The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30. 20Y8: Instructions Briefly explain how multiple-step and single-step income statements differ.Multiple-step income statement and report form of balance sheet The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30. 20Y8: Instructions Prepare a multiple-step income statement.Missing amounts from Financial statements The financial statements at the end of Network Realty, Inc.’s first month of operations are shown below. 11y analyzing the interrelationships among the financial statements, fill in the proper amounts for (a) through (s).

- The comparative balance sheet of Coulson, Inc. at December 31, 20Y2 and 20Y1, is asfollows:Dec. 31, 20Y2 Dec. 31, 20Y1AssetsCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 300,600 $ 337,800Accounts receivable (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 704,400 609,600Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 918,600 865,800Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,600 26,400Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 990,000 1,386,000 Buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,980,000 $ 990,000Accumulated depreciation—buildings . . . . . . . . . . . . . . . . . . . . . (397,200) (366,000)Equipment . . . . . . . . . . . . . . . . . . .…E5-2 (L02,3) (Classification of Balance Sheet Accounts) Presented below are the captions of Faulk Company’s balancesheet.(a) Current assets.(b) Investments.(c) Property, plant, and equipment.(d) Intangible assets.(e) Other assets.Instructions(f) Current liabilities.(g) Noncurrent liabilities.(h) Capital stock.(i) Additional paid-in capital.(j) Retained earnings.Indicate by letter where each of the following items would be classified.1. Preferred stock.2. Goodwill.3. Salaries and wages payable.4. Accounts payable.5. Buildings.6. Equity investments (trading).7. Current maturity of long-term debt.8. Premium on bonds payable.9. Allowance for doubtful accounts.10. Accounts receivable.11. Cash surrender value of life insurance.12. Notes payable (due next year).13. Supplies.14. Common stock.15. Land.16. Bond sinking fund.17. Inventory.18. Prepaid insurance.19. Bonds payable.20. Income taxes payable.GL2-14 Complete the full accounting cycle The general ledger of Pipers Plumbing at January 1, 2021, includes the following account balances: Accounts Debits Credits Cash $ 3,600 Accounts Receivable 8,600 Supplies 2,600 Equipment 18,000 Accumulated Depreciation $ 4,400 Accounts Payable 2,400 Utilities Payable 3,400 Deferred Revenue 0 Common Stock 14,000 Retained Earnings 8,600 Totals $ 32,800 $ 32,800 The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $11,000, and on account, $56,000. 2. March 13 Collect on accounts receivable, $44,000. 3. May 6 Issue shares of common stock in exchange for $10,000 cash. 4. June 30 Pay salaries for the current year, $31,200. 5. September 15 Pay utilities of $3,400 from 2020 (prior year). 6.…

- Gary’s TV had the following accounts and amounts in its financial statements on December 31, 2022. Assume that all balance sheet items reflect account balances at December 31, 2022, and that all income statement items reflect activities that occurred during the year then ended. Interest expense $ 4,900 Paid-in capital 13,200 Accumulated depreciation 3,800 Notes payable (long-term) 43,000 Rent expense 10,200 Merchandise inventory 114,000 Accounts receivable 34,000 Depreciation expense 1,900 Land 27,000 Retained earnings 142,500 Cash 30,500 Cost of goods sold 228,000 Equipment 18,000 Income tax expense 42,000 Accounts payable 21,000 Net sales 350,000 Required: Calculate the difference between current assets and current liabilities for Gary’s TV at December 31, 2022. Calculate the total assets at December 31, 2022. Calculate the earnings from operations (operating income) for the year ended December 31, 2022. Calculate the net income (or loss) for the…On August 1, 2020, the business accounts of Peter and Senen appear below:Assets Peter SenenCash P11,000 P22,354Accounts receivable 84,536 217,890Inventories 100,035 240,102Land 603,000 428,267Buildings 200,345 384,789Other Assets 22,000 23,600Total P1,020,916 P1,317,002Liabilities and CapitalAccounts payable P178,940 P243,650Notes payable 200,000 345,000Peter, Capital 641,976Senen, Capital 728,352Total P1,020,916 P1,317,002Peter and Senen agreed to form a partnership contributing their respective assets and liabilitiessubject to the following adjustments:Accounts receivable of P20,000 and P35,000 are uncollectible in Peter and Senen’s respectivebooks.Inventories of P5,500 and P6,700 are worthless in Peter and Senen’s respective booksOther Assets of P2,200 and P3,600 in Peter and Senen’s books are written off.After five days Ethel was offered to join Peter and Senen and will contribute for a 20% interestin the firm. They also agreed to divide profits and losses in the ratio of 4:4:2…The comparative balance sheet of Whitman Co. at December 31, 20Y2 and 20Y1, is as follows:Dec. 31, 20Y2 Dec. 31, 20Y1AssetsCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 918,000 $ 964,800Accounts receivable (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 828,900 761,940Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,268,460 1,162,980Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,340 35,100Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 315,900 479,700Buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,462,500 900,900Accumulated depreciation—buildings . . . . . . . . . . . . . . . . . . . . . . . . . . .…

- P2-4A The trial balance of Avtar Sandhu Co. shown below does not balance.AVTAR SANDHU CO.Trial BalanceJune 30, 2017 Debit CreditCash $ 3,340Accounts Receivable $ 2,812Supplies 1,200Equipment 2,600Accounts Payable 3,666Unearned Service Revenue 1,100Owner’s Capital 8,000Owner’s Drawings 800Service Revenue 2,480Salaries and Wages Expense 3,200Utilities Expense 810 $12,522 $17,486Each of the listed accounts has a normal balance per the general ledger. An examination of the ledger and journal reveals the following errors.1. Cash received from a customer in payment of its account was debited for $580, and Accounts Receivable was credited for the same amount. The actual collection was for $850.2. The purchase of a computer on account for $710 was recorded as a debit to Supplies for $710 and a credit to Accounts Payable for $710.3. Services were performed on account for a client for $980. Accounts Receivable was debited for $980, and Service Revenue was credited for $98.4. A debit posting to…Some selected balances of DD Co. for year ended Dec-31-2019 are as follows with theirnormal balances before adjustments:Cash and Cash Equivalent Br 20,000 Owners’ Capital 40,000Notes Receivables45,000Retained Earnings75,000Office Supplies12,000Sales Revenues640,000Prepaid Insurance72,000Interest Income12,000Inventory (Average Cost)24,000Cost of Goods Sold320,000Fixed Assets120,000Selling Expenses21,000Accum. Depr- Fixed assets36,000Salary and Wages Expense105,000Unearned Rent (Liability)56,000Rent Expense15,000Requireda. Prepare the necessary adjusting entries for the following items as not yet recorded on Dec-31-2019:i. The office supplies consumed during the year is Br 8,000ii. The Unexpired part of insurance is only Br 26,000iii. Br 30,000 is earned sales revenues from the unearned advance collectioniv. Salary and wages accrued as on 31-Dec-2019 amounts to be Br 18,000v. Depreciation Expenses allocated for the year amounts to be Br 15,000vi. There are accrued interest of Br 8,000 on…From the data below for the Sorta Company, prepare the closing entries for the year ended December 31, 20--. Cash dividends$105,000Sales987,000Sales returns and allowances5,200Interest revenue3,700Factory overhead (debit)205,300Factory overhead (credit)205,300Cost of goods sold674,200Wages expense112,000Supplies expense5,300Depreciation expense—office equipment4,200Utilities expense5,700Bad debt expense1,300Advertising expense6,300Interest expense4,700Income tax expense61,950