segmented income statement, ir ratement

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter2: Basic Managerial Accounting Concepts

Section: Chapter Questions

Problem 49E: Use the following information for Exercises 2-47 through 2-49. Jasper Company provided the following...

Related questions

Question

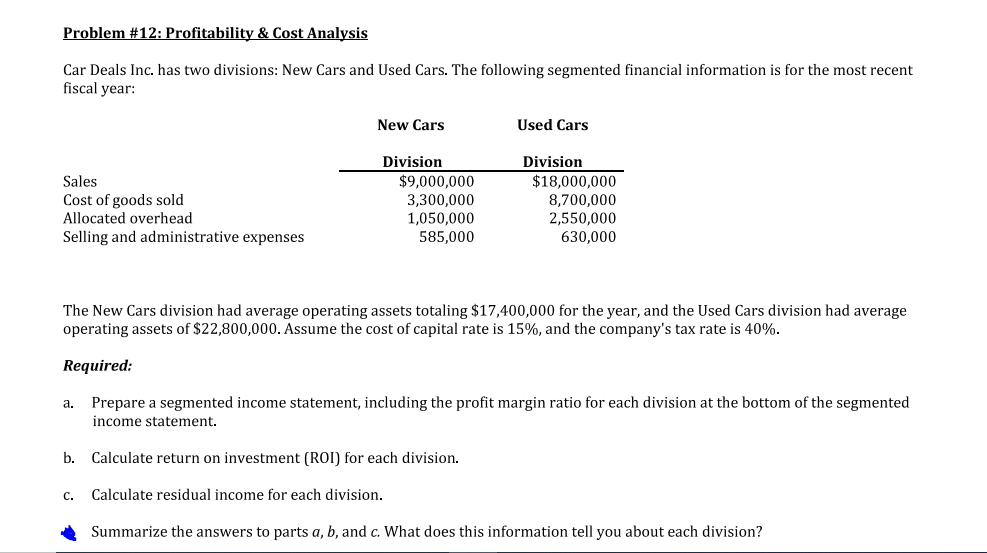

Transcribed Image Text:Problem #12: Profitability & Cost Analysis

Car Deals Inc. has two divisions: New Cars and Used Cars. The following segmented financial information is for the most recent

fiscal year:

New Cars

Used Cars

Division

Division

Sales

Cost of goods sold

Allocated overhead

Selling and administrative expenses

$9,000,000

3,300,000

1,050,000

585,000

$18,000,000

8,700,000

2,550,000

630,000

The New Cars division had average operating assets totaling $17,400,000 for the year, and the Used Cars division had average

operating assets of $22,800,000. Assume the cost of capital rate is 15%, and the company's tax rate is 40%.

Required:

a. Prepare a segmented income statement, including the profit margin ratio for each division at the bottom of the segmented

income statement.

b. Calculate return on investment (ROI) for each division.

C.

Calculate residual income for each division.

Summarize the answers to parts a, b, and c. What does this information tell you about each division?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning