Munirah Bhd was incorporated in 2015. In order to expand its business operation, M Bhd made the following transactions related to property, plant and equipment in the yea 1. To construct a new factory, Munirah Bhd purchased a piece of land with a build RM700,000 (land RM550,000 and building RM150,000). Munirah Bhd paid a rea broker's commission of RM28,000, legal fees for title investigation of the I RM5,000 and property tax for the land of RM10,000. Shortly after purchasing th Munirah Bhd demolished the old building and incurred a total cost of RM2 Munirah Bhd received RM4,800 from the selling of the scrap from the old buildi additional cost of RM3,000 was paid to grade the land. After grading the land, M Bhd installed fences around the property at the cost of RM17,000. Then, to con new factory, Munirah Bhd paid RM5,200 of the architect's fees, and the paymen building contractor was RM200,000. The insurance policy paid by Munirah Bl RM10,000, including RM3,500 of insurance after the construction is com Munirah Bhd paid an additional RM25,000 for preparing the parking lots and driv 2. Munirah Bhd purchased a machine for production in the factory at the total invoi of RM120,000 with the term, 2/10, n/60. Munirah Bhd paid within the discount 200

Munirah Bhd was incorporated in 2015. In order to expand its business operation, M Bhd made the following transactions related to property, plant and equipment in the yea 1. To construct a new factory, Munirah Bhd purchased a piece of land with a build RM700,000 (land RM550,000 and building RM150,000). Munirah Bhd paid a rea broker's commission of RM28,000, legal fees for title investigation of the I RM5,000 and property tax for the land of RM10,000. Shortly after purchasing th Munirah Bhd demolished the old building and incurred a total cost of RM2 Munirah Bhd received RM4,800 from the selling of the scrap from the old buildi additional cost of RM3,000 was paid to grade the land. After grading the land, M Bhd installed fences around the property at the cost of RM17,000. Then, to con new factory, Munirah Bhd paid RM5,200 of the architect's fees, and the paymen building contractor was RM200,000. The insurance policy paid by Munirah Bl RM10,000, including RM3,500 of insurance after the construction is com Munirah Bhd paid an additional RM25,000 for preparing the parking lots and driv 2. Munirah Bhd purchased a machine for production in the factory at the total invoi of RM120,000 with the term, 2/10, n/60. Munirah Bhd paid within the discount 200

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 55P

Related questions

Question

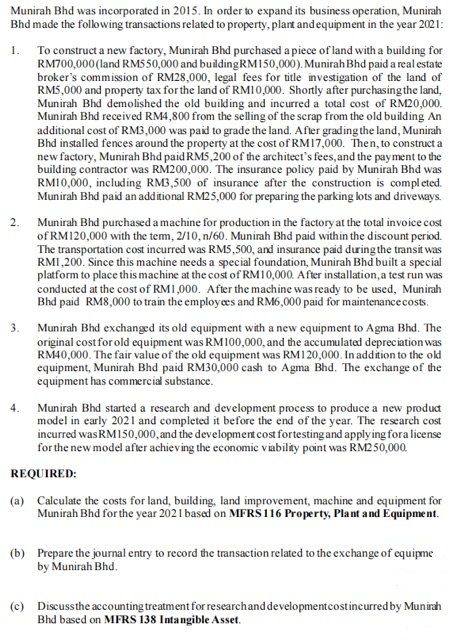

Transcribed Image Text:Munirah Bhd was incorporated in 2015. In order to expand its business operation, Munirah

Bhd made the following transactions related to property, plart andequipment in the year 2021:

1. To construct a new factory, Munirah Bhd purchased a piece of land with a building for

RM700,000(land RM5 50,000 and buildingRM150,000). Munirah Bhd paid a real estate

broker's commission of RM28,000, legal fees for title investigation of the land of

RM5,000 and property tax for the land of RMI0,000. Shortly after purchasing the land,

Munirah Bhd demolished the old building and incurred a total cost of RM20,000.

Munirah Bhd received RM4,800 from the selling of the scrap from the old building An

additional cost of RM3,000 was paid to grade the land. After grading the land, Munirah

Bhd installed fences around the property at the cost of RM17,000. Then, to construct a

new factory, Munirah Bhd paid RMS,200 of the architect's fees, and the payment to the

building contractor was RM200,000. The insurance policy paid by Munirah Bhd was

RM10,000, including RM3,500 of insurance after the construction is completed.

Munirah Bhd paid an additional RM25,000 for preparing the parking lots and driveways.

Munirah Bhd purchased a machine for production in the factory at the total invoice cost

of RM120,000 with the tem, 2/10, n/60. Munirah Bhd paid within the discount period.

The transportation cost incurred was RMS,500, and insurance paid during the transit was

RMI,200. Since this machine needs a special foundation, Munirah Bhd built a special

platform to place this machine at the cost of RM10,000. After installation, a test run was

conducted at the cost of RM1,000. After the machine was ready to be used, Munirah

Bhd paid RM8,000 to train the employees and RM6,000 paid for maintenancecosts.

2.

3.

Munirah Bhd exchanged its old equipment with a new equipment to Agma Bhd. The

original cost for old equipment was RM100,000, and the accumulated depreciation was

RM40,000. The fair value of the old equipment was RM120,000. In addition to the old

equipment, Munirah Bhd paid RM30,000 cash to Agma Bhd. The exchange of the

equipment has commercial substance.

4.

Munirah Bhd started a research and development process to produce a new product

model in early 2021 and completed it before the end of the year. The research cost

incurred was RM150,000, and the development cost fortesting and applying fora license

for the new model after achieving the economic viabilky point was RM250,000.

REQUIRED:

(a) Calculate the costs for land, building, land improvement, machine and equipment for

Munirah Bhd for the year 2021 based on MFRS 116 Property, Plant and Equipment.

(b) Prepare the journal entry to record the transaction related to the exchange of equipme

by Munirah Bhd.

(c) Discussthe accounting treatment for researchanddevelopmentcostincurred by Munirah

Bhd based on MFRS 138 Intangible Asset.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning