Must be 2000-2500 words Case Study Question The entire case study cannot be submitted, so I attached the title and the questions to be answered. I will submit the same questions with the rest of the case study. The case study is based on an article about Pataka Tea Co., Ltd. (PT) - Reassessing the External Environment. Assignment Questions As of May 2018, what challenges had PT faced in recent years? Assess the factors in the internal and external environment that led to those challenges? Analyze the industry competition conditions that PT faced. Identify the key external factors that affected PT’s strategic decision. Develop a SWOT Analysis for PT to help King develop his strategy. Indicate how each of elements from the four (4)components from your SWOT, can be used to enhance PT’s competitive advantage. Each component of your SWO must have at least three (3) elements If you were Phillip King, chairman of PT, what recommendations – at least four (4), would you make to improve company performance and address the challenges you outlined in question 1. Provide clear justifications for your reasons.

Must be 2000-2500 words Case Study Question The entire case study cannot be submitted, so I attached the title and the questions to be answered. I will submit the same questions with the rest of the case study. The case study is based on an article about Pataka Tea Co., Ltd. (PT) - Reassessing the External Environment. Assignment Questions As of May 2018, what challenges had PT faced in recent years? Assess the factors in the internal and external environment that led to those challenges? Analyze the industry competition conditions that PT faced. Identify the key external factors that affected PT’s strategic decision. Develop a SWOT Analysis for PT to help King develop his strategy. Indicate how each of elements from the four (4)components from your SWOT, can be used to enhance PT’s competitive advantage. Each component of your SWO must have at least three (3) elements If you were Phillip King, chairman of PT, what recommendations – at least four (4), would you make to improve company performance and address the challenges you outlined in question 1. Provide clear justifications for your reasons.

Purchasing and Supply Chain Management

6th Edition

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

ChapterC: Cases

Section: Chapter Questions

Problem 5.3SD: Scenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling...

Related questions

Question

Must be 2000-2500 words

Case Study Question

The entire case study cannot be submitted, so I attached the title and the questions to be answered. I will submit the same questions with the rest of the case study.

The case study is based on an article about Pataka Tea Co., Ltd. (PT) - Reassessing the External Environment.

Assignment Questions

- As of May 2018, what challenges had PT faced in recent years? Assess the factors in the internal and external environment that led to those challenges?

- Analyze the industry competition conditions that PT faced. Identify the key external factors that affected PT’s strategic decision.

- Develop a SWOT Analysis for PT to help King develop his strategy. Indicate how each of elements from the four (4)components from your SWOT, can be used to enhance PT’s competitive advantage. Each component of your SWO must have at least three (3) elements

- If you were Phillip King, chairman of PT, what recommendations – at least four (4), would you make to improve company performance and address the challenges you outlined in question 1. Provide clear justifications for your reasons.

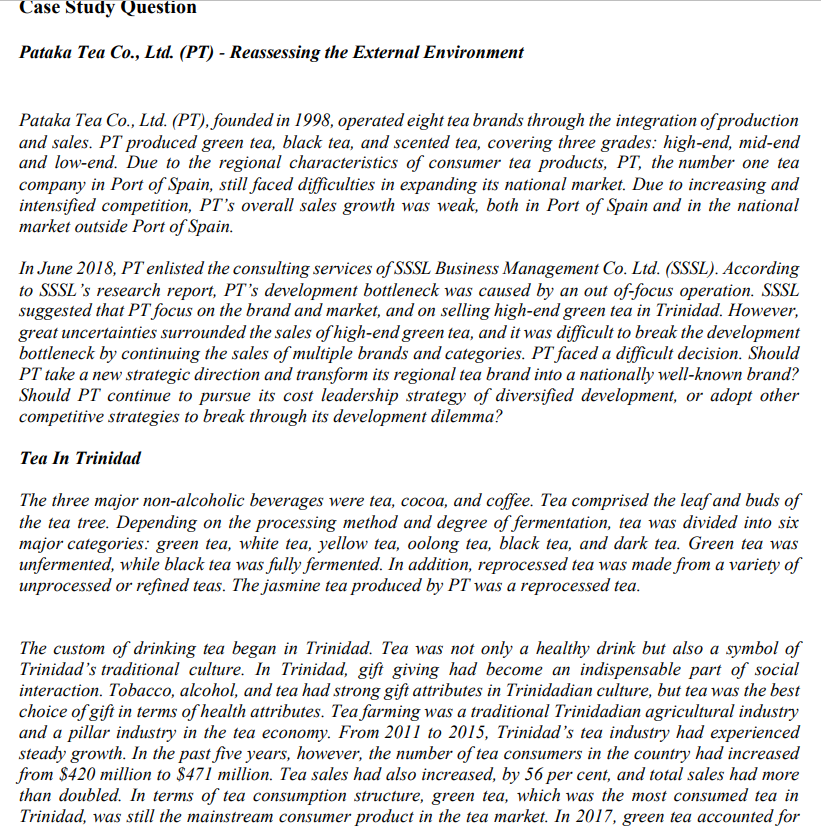

Transcribed Image Text:Case Study Question

Pataka Tea Co., Ltd. (PT) - Reassessing the External Environment

Pataka Tea Co., Ltd. (PT), founded in 1998, operated eight tea brands through the integration of production

and sales. PT produced green tea, black tea, and scented tea, covering three grades: high-end, mid-end

and low-end. Due to the regional characteristics of consumer tea products, PT, the number one tea

company in Port of Spain, still faced difficulties in expanding its national market. Due to increasing and

intensified competition, PT's overall sales growth was weak, both in Port of Spain and in the national

market outside Port of Spain.

In June 2018, PT enlisted the consulting services of SSSL Business Management Co. Ltd. (SSSL). According

to SSSL's research report, PT's development bottleneck was caused by an out of-focus operation. SSSL

suggested that PT focus on the brand and market, and on selling high-end green tea in Trinidad. However,

great uncertainties surrounded the sales of high-end green tea, and it was difficult to break the development

bottleneck by continuing the sales of multiple brands and categories. PT faced a difficult decision. Should

PT take a new strategic direction and transform its regional tea brand into a nationally well-known brand?

Should PT continue to pursue its cost leadership strategy of diversified development, or adopt other

competitive strategies to break through its development dilemma?

Tea In Trinidad

The three major non-alcoholic beverages were tea, cocoa, and coffee. Tea comprised the leaf and buds of

the tea tree. Depending on the processing method and degree of fermentation, tea was divided into six

major categories: green tea, white tea, yellow tea, oolong tea, black tea, and dark tea. Green tea was

unfermented, while black tea was fully fermented. In addition, reprocessed tea was made from a variety of

unprocessed or refined teas. The jasmine tea produced by PT was a reprocessed tea.

The custom of drinking tea began in Trinidad. Tea was not only a healthy drink but also a symbol of

Trinidad's traditional culture. In Trinidad, gift giving had become an indispensable part of social

interaction. Tobacco, alcohol, and tea had strong gift attributes in Trinidadian culture, but tea was the best

choice of gift in terms of health attributes. Tea farming was a traditional Trinidadian agricultural industry

and a pillar industry in the tea economy. From 2011 to 2015, Trinidad's tea industry had experienced

steady growth. In the past five years, however, the number of tea consumers in the country had increased

from $420 million to $471 million. Tea sales had also increased, by 56 per cent, and total sales had more

than doubled. In terms of tea consumption structure, green tea, which was the most consumed tea in

Trinidad, was still the mainstream consumer product in the tea market. In 2017, green tea accounted for

Transcribed Image Text:52.3 per cent of Trinidad's total tea sales, with a market size of more than $120 billion.

Although Trinidad had a long history of tea culture and rich tea categories, the domestic tea industry

experienced several issues, including low industry concentration; a low degree of branding,

intensification, and standardization; insufficient modern management techniques for tea gardens; low

production efficiency; and high costs. In Trinidad's tea industry, tea categories were often more popular

than the tea's brand. For example, Jing green tea was more well-known than the specific brand that sold

Jing green tea. According to a popular Trinidadian saying, "70,000 tea companies lost to one Lipton."

That was to say, tea brands in Trinidad were extremely dispersed. Although Trinidad had several leading

regional tea companies, in terms of the scale of the entire tea industry, large companies and well-known

brands still held relatively few shares of the entire tea market. The top 100 brands together accounted for

less than 10 per cent of the market share. Limited enterprise scale and weak comprehensive strength

restricted the development of Trinidad's tea industry.

At the beginning of 2016, the Trinidad Tea Marketing Association (TTMA) formulated the Thirteenth Five

Year Development Plan for Trinidad's Tea Industry (2016-2020). To address the existing issues limiting

the development of Trinidad's tea industry, the TTMA proposed to cultivate leading enterprises, strengthen

brand building, and innovate marketing models.

Trinidad's Tea Industry Chain

The industrial chain of Trinidadian tea from production to sales included planting, processing, circulation,

and consumption. Market participants included upstream tea gardens, midstream primary processing

plants, fine processing plants, downstream terminal stores, and customers.

The planting link was divided into three main forms: tea farmers, tea farms, and bases. To establish

bases, some large tea companies signed agreements with tea farmers to ensure an adequate supply of raw

materials. Upstream suppliers found it difficult to upgrade their tea production, as a result of facing vicious

competition, including price reductions due to their small enterprise scale, decentralized tea gardens, low

tea yields, and low labour efficiencies.

Participants in the processing link included primary processing plants and fine processing plants. With

the rapid development of the refined tea processing industry and the rapid increase in the number of

enterprises, the market concentration of Trinidad's refined tea processing industry had continued to

decline, and the industry's gross profit margin had gradually declined.

The circulation link was the process by which tea entered the market through wholesale and retail

channels. Loose tea entered retail channels such as supermarkets mainly through wholesale channels,

while branded tea was rapidly developed by relying on its own strength to establish direct stores, or by

distributing packaged tea through tea stores, shopping malls, tea houses, online shopping platforms, and

other retail channels. According to the 2017 "List of Trinidad's Top 100 Companies with Comprehensive

Strength in the Tea Industry," issued by the TTMA, Tian (Cayman) Holdings Co., Ltd. (Tian) had topped

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introducing the case:

VIEWStep 2: 1. Industry Competition Conditions Faced by PT & Factors in the Internal and External Environment:

VIEWStep 3: 2. Analysis of Industry Competition Conditions and Key External Factors:

VIEWStep 4: 3. Outline the SWOT Analysis for PT:

VIEWStep 5: 4. Outline the Recommendations for PT:

VIEWSolution

VIEWStep by step

Solved in 6 steps

Recommended textbooks for you

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning