n which years do each company have acceptable cash ratios? What has to be done in the other years when they are not acceptable?

n which years do each company have acceptable cash ratios? What has to be done in the other years when they are not acceptable?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

In which years do each company have acceptable cash ratios? What has to be done in the other years when they are not acceptable?

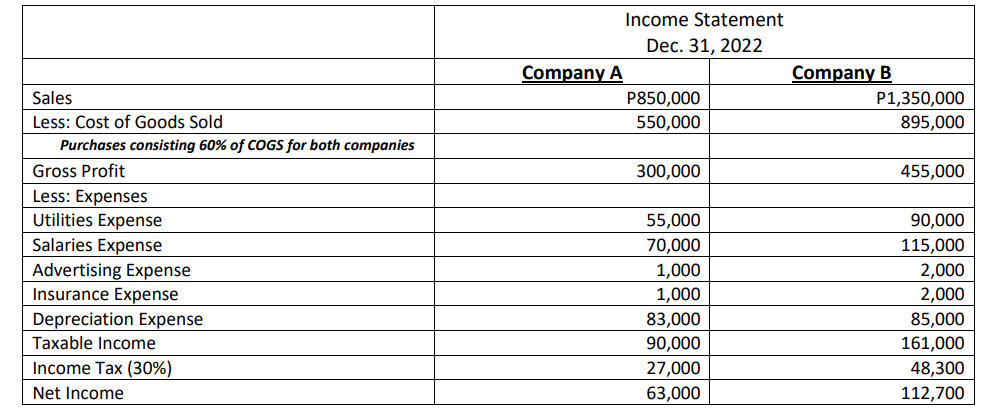

Transcribed Image Text:Income Statement

Dec. 31, 2022

Company A

Company B

P850,000

550,000

Sales

P1,350,000

895,000

Less: Cost of Goods Sold

Purchases consisting 60% of COGS for both companies

Gross Profit

300,000

455,000

Less: Expenses

Utilities Expense

55,000

90,000

Salaries Expense

70,000

115,000

Advertising Expense

Insurance Expense

1,000

2,000

1,000

2,000

Depreciation Expense

Taxable Income

83,000

90,000

85,000

161,000

Income Tax (30%)

27,000

63,000

48,300

Net Income

112,700

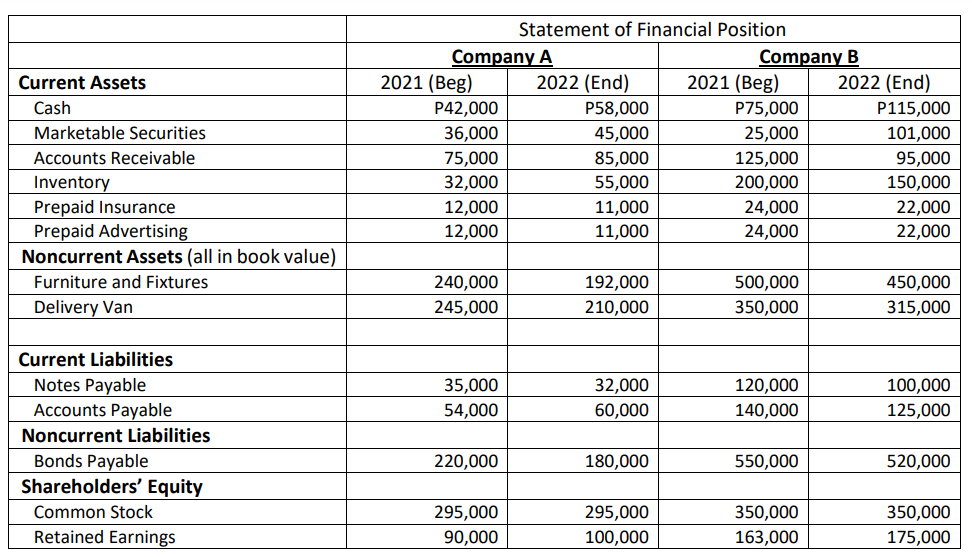

Transcribed Image Text:Statement of Financial Position

Company A

Company B

Current Assets

2021 (Beg)

2022 (End)

2021 (Beg)

2022 (End)

P115,000

101,000

Cash

P42,000

P58,000

P75,000

Marketable Securities

36,000

45,000

25,000

75,000

32,000

85,000

55,000

125,000

200,000

24,000

24,000

95,000

150,000

Accounts Receivable

Inventory

Prepaid Insurance

Prepaid Advertising

Noncurrent Assets (all in book value)

12,000

11,000

11,000

22,000

22,000

12,000

Furniture and Fixtures

240,000

192,000

500,000

450,000

Delivery Van

245,000

210,000

350,000

315,000

Current Liabilities

Notes Payable

Accounts Payable

35,000

32,000

120,000

100,000

54,000

60,000

140,000

125,000

Noncurrent Liabilities

Bonds Payable

Shareholders' Equity

220,000

180,000

550,000

520,000

Common Stock

295,000

295,000

350,000

350,000

Retained Earnings

90,000

100,000

163,000

175,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education