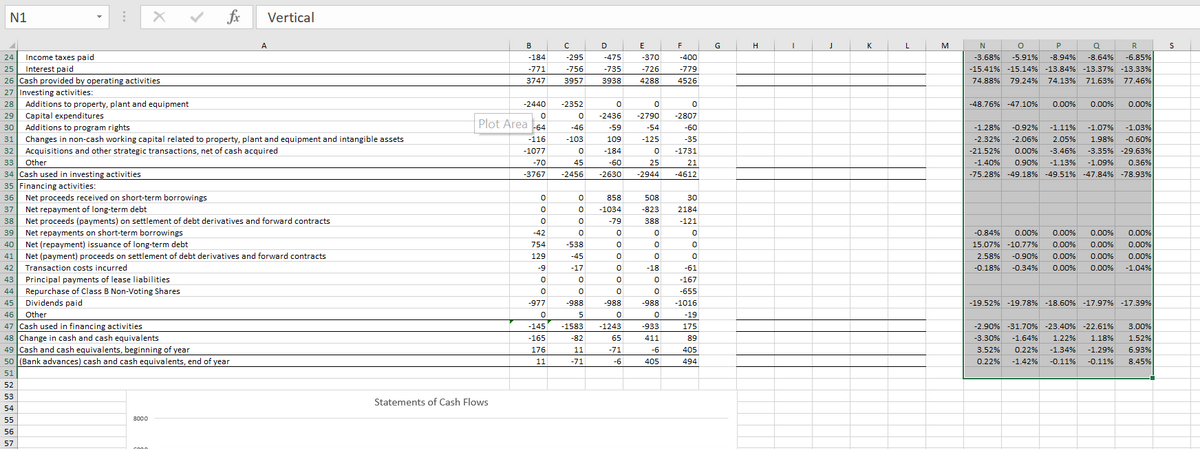

N1 fx Vertical G H K M R 24 Income taxes paid 25 Interest paid 26 Cash provided by operating activities 27 investing activities 28 Additions to property, plant and equipment 29 Capital expenditures 30 Additions to program rights 31 Changes in non-cash working capital related to property, plant and equipment and intangible assets 32 Acquisitions and other strategic transactions, net of cash acquired 33 Other 34 Cash used in investing activities 35 Financing activities 36 Net proceeds received on short-term borrowings 37 Net repayment of long-term debt 38 Net proceeds (payments) on settlement of debt derivatives and forward contracts Net repayments on short-term borrowings Net (repayment) issuance of long-term debt 41 Net (payment) proceeds on settlement of debt derivatives and forward contracts 42 Transaction costs incurred Principal payments of lease liabilities Repurchase of Class 8 Non-Voting Shares 45 Dividends paid 46 Other 47 Cash used in financing activities 48 Change in cash and cash equivalents 49 Cash and cash equivalents, beginning of vear 50 (Bank advances) cash and cash equivalents, end of year -184 -295 -475 370 400 -3.68% -5.91% -8.94% -8.64% -6.85N -15.41% -15.14% -13.84% -13.37% -13.33% 79.24% 74.13% 71.63% 77.46% -771 -756 -735 -726 -779 3747 3957 3938 4288 4526 74.88% -2440 -2352 -48.76% -47.10% 0.00% 0.00% 0.00% -2436 -2790 -2807 Plot Area 44 46 59 -54 60 -1.28% 092% -1.11% -1.07% -1.03% -116 -103 109 -125 -35 -2.32% -2.06% 2.05% 1.98% 0.60% -1077 -184 -1731 -21.52% 0.00% -3.46% -3.35% -29.63% -70 45 -1.09% -60 -2630 25 21 -4612 -1.40% 0.90% -113% 0.36% -3767 -2456 -2944 -75.28% -49.18% 49.51% 47.84% -78.93% 858 508 30 -1034 -823 2184 -79 388 -121 39 42 0.84% 0.00% 0.00% 0.00% 0.00% 40 754 -538 15.07N -10.77% 0.00N 0.00N 0.00N 129 45 2.58% 0.90% 0.00% 0.00% 0.00% -17 -18 61 0.18% -0.34% 0.00% 0.00% -1.04% 43 167 44 655 977 988 -988 -988 -1016 -19.52% -19.78% -18.60N -17.97% -17.39% 19 175 -145 -1583 -1243 -933 -2.90% -3170N -23.40N 22.61% 3.00% 1.52% 6.93% -165 82 65 411 89 -3.30% -1.64% 122% 118% 176 405 -134% 11 -71 -71 -6 6 3.52% 022% -129% 11 405 494 0.22% -1.42% 011% 011N 8.45% 51 52 53 Statements of Cash Flows 54 55 000

N1 fx Vertical G H K M R 24 Income taxes paid 25 Interest paid 26 Cash provided by operating activities 27 investing activities 28 Additions to property, plant and equipment 29 Capital expenditures 30 Additions to program rights 31 Changes in non-cash working capital related to property, plant and equipment and intangible assets 32 Acquisitions and other strategic transactions, net of cash acquired 33 Other 34 Cash used in investing activities 35 Financing activities 36 Net proceeds received on short-term borrowings 37 Net repayment of long-term debt 38 Net proceeds (payments) on settlement of debt derivatives and forward contracts Net repayments on short-term borrowings Net (repayment) issuance of long-term debt 41 Net (payment) proceeds on settlement of debt derivatives and forward contracts 42 Transaction costs incurred Principal payments of lease liabilities Repurchase of Class 8 Non-Voting Shares 45 Dividends paid 46 Other 47 Cash used in financing activities 48 Change in cash and cash equivalents 49 Cash and cash equivalents, beginning of vear 50 (Bank advances) cash and cash equivalents, end of year -184 -295 -475 370 400 -3.68% -5.91% -8.94% -8.64% -6.85N -15.41% -15.14% -13.84% -13.37% -13.33% 79.24% 74.13% 71.63% 77.46% -771 -756 -735 -726 -779 3747 3957 3938 4288 4526 74.88% -2440 -2352 -48.76% -47.10% 0.00% 0.00% 0.00% -2436 -2790 -2807 Plot Area 44 46 59 -54 60 -1.28% 092% -1.11% -1.07% -1.03% -116 -103 109 -125 -35 -2.32% -2.06% 2.05% 1.98% 0.60% -1077 -184 -1731 -21.52% 0.00% -3.46% -3.35% -29.63% -70 45 -1.09% -60 -2630 25 21 -4612 -1.40% 0.90% -113% 0.36% -3767 -2456 -2944 -75.28% -49.18% 49.51% 47.84% -78.93% 858 508 30 -1034 -823 2184 -79 388 -121 39 42 0.84% 0.00% 0.00% 0.00% 0.00% 40 754 -538 15.07N -10.77% 0.00N 0.00N 0.00N 129 45 2.58% 0.90% 0.00% 0.00% 0.00% -17 -18 61 0.18% -0.34% 0.00% 0.00% -1.04% 43 167 44 655 977 988 -988 -988 -1016 -19.52% -19.78% -18.60N -17.97% -17.39% 19 175 -145 -1583 -1243 -933 -2.90% -3170N -23.40N 22.61% 3.00% 1.52% 6.93% -165 82 65 411 89 -3.30% -1.64% 122% 118% 176 405 -134% 11 -71 -71 -6 6 3.52% 022% -129% 11 405 494 0.22% -1.42% 011% 011N 8.45% 51 52 53 Statements of Cash Flows 54 55 000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.6.2P

Related questions

Question

This is the vertical analysis of rogers communication company in cash flow. now write a written analysis of this calculative analysis of cash flow?

Transcribed Image Text:N1

fx

Vertical

A

B

E

F

G

K

M

N

P

Q

R

24 Income taxes paid

25 Interest paid

26 Cash provided by operating activities

27 Investing activities:

28 Additions to property, plant and equipment

-184

-295

-475

-370

-400

-3.68%

-5.91%

-8.94%

-8.64%

-6.85%

-771

-756

-735

-726

-779

-15.41% -15.14% -13.84% -13.37% -13.33%

3747

3957

3938

4288

4526

74.88% 79.24% 74.13% 71.63% 77.46%

-2440

-2352

-48.76% -47.10%

0.00%

0.00%

0.00%

29

Capital expenditures

-2436

-2790

-2807

30 Additions to program rights

Piot Area -64

-1.03%

-46

-59

-54

-60

-1.28%

-0.92%

-1.11%

-1.07%

31

Changes in non-cash working capital related to property, plant and equipment and intangible assets

-116

-103

109

-125

-35

-2.32%

-2.06%

2.05%

1.98%

-0.60%

-3.35% -29.63%

0.36%

-75.28% -49.18% -49.51% -47.84% -78.93%

32

Acquisitions and other strategic transactions, net of cash acquired

-1077

-184

-1731

-21.52%

0.00%

-3.46%

Other

34 Cash used in investing activities

35 Financing activities:

33

-70

45

-60

25

21

-1.40%

0.90%

-1.13%

-1.09%

-3767

-2456

-2630

-2944

-4612

36 Net proceeds received on short-term borrowings

858

508

30

37

Net repayment of long-term debt

-1034

-823

2184

38

Net proceeds (payments) on settlement of debt derivatives and forward contracts

-79

388

-121

39

Net repayments on short-term borrowings

-42

-0.84%

0.00%

0.00%

0.00%

0.00%

40

Net (repayment) issuance of long-term debt

754

-538

15.07% -10.77%

0.00%

0.00%

0.00%

41

Net (payment) proceeds on settlement of debt derivatives and forward contracts

129

-45

2.58%

-0.90%

0.00%

0.00%

0.00%

42

Transaction costs incurred

-9

-17

-18

-61

-0.18%

-0.34%

0.00%

0.00%

-1.04%

43

Principal payments of lease liabilities

-167

44

Repurchase of Class B Non-Voting Shares

-655

45

Dividends paid

-977

-988

-988

-988

-1016

-19.52% -19.78% -18.60% -17.97% -17.39%

Other

47 Cash used in financing activities

48 Change in cash and cash equivalents

46

5

-19

-145

-1583

-1243

-933

175

-2.90% -31.70% -23.40% -22.61%

3.00%

-165

-82

65

411

89

-3.30%

-1.64%

1.22%

1.18%

1.52%

49 Cash and cash equivalents, beginning of year

176

11

-71

-6

405

3.52%

0.22%

-1.34%

-1.29%

6.93%

50 (Bank advances) cash and cash equivalents, end of year

11

-71

-6

405

494

0.22%

-1.42%

-0.11%

-0.11%

8.45%

51

52

53

Statements of Cash Flows

54

55

8000

56

57

Transcribed Image Text:A

B

D

E

F

G

H

K

L

M

P

Q

R

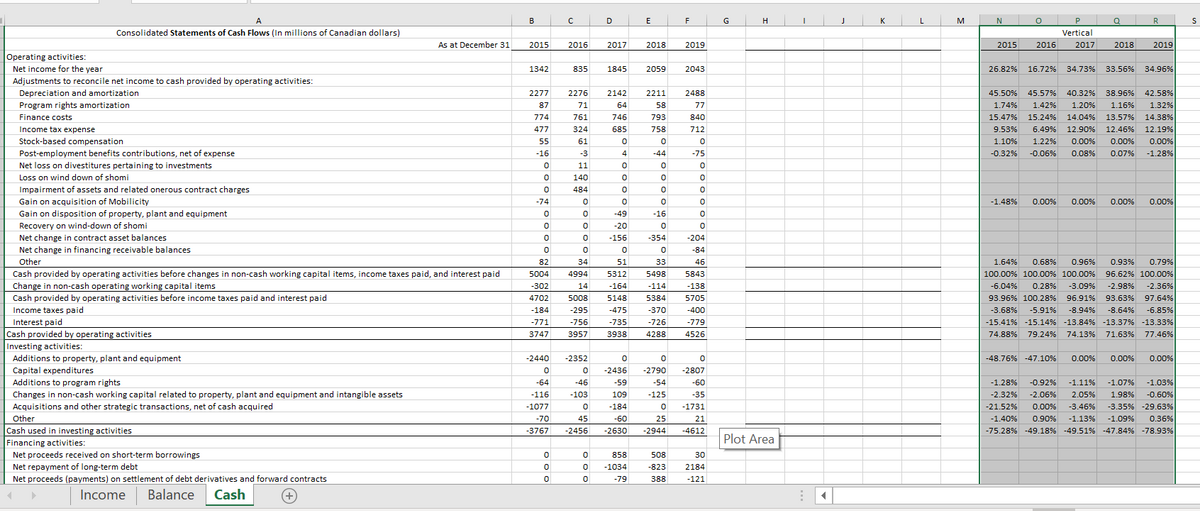

Consolidated Statements of Cash Flows (In millions of Canadian dollars)

Vertical

As at December 31

2015

2016

2017

2018

2019

2015

2016

2017

2018

2019

Operating activities:

Net income for the year

Adjustments to reconcile net income to cash provided by operating activities:

1342

835

1845

2059

2043

26.82%

16.72%

34.73% 33.56%

34.96%

Depreciation and amortization

2277

2276

2142

2211

2488

45.50%

45.57%

40.32%

38.96%

42.58%

Program rights amortization

87

71

64

58

77

1.74%

1.42%

1.20%

1.16%

1.32%

Finance costs

774

761

746

793

840

15.47%

15.24%

14.04%

13.57%

14.38%

Income tax expense

477

324

685

758

712

9.53%

6.49% 12.90%

12.46%

12.19%

Stock-based compensation

55

61

1.10%

1.22%

0.00%

0.00%

0.00%

Post-employment benefits contributions, net of expense

-16

-3

4

-44

-75

-0.32%

-0.06%

0.08%

0.07%

-1.28%

Net loss on divestitures pertaining to investments

11

Loss on wind down of shomi

140

Impairment of assets and related onerous contract charges

484

Gain on acquisition of Mobilicity

-74

-1.48%

0.00%

0.00%

0.00%

0.00%

Gain on disposition of property, plant and equipment

-49

-16

Recovery on wind-down of shomi

-20

Net change in contract asset balances

-156

-354

-204

Net change in financing receivable balances

-84

Other

82

34

51

33

46

1.64%

0.68%

0.96%

0.93%

0.79%

Cash provided by operating activities before changes in non-cash working capital items, income taxes paid, and interest paid

5004

4994

5312

5498

5843

100.00% 100.00% 100.00%

96.62% 100.00%

Change in non-cash operating working capital items

-302

14

-164

-114

-138

-6.04%

0.28%

-3.09%

-2.98%

-2.36%

Cash provided by operating activities before income taxes paid and interest paid

4702

5008

5148

5384

5705

93.96% 100.28% 96.91% 93.63% 97.64%

Income taxes paid

Interest paid

Cash provided by operating activities

Investing activities:

Additions to property, plant and equipment

-184

-295

-475

-370

-400

-3.68%

-5.91%

-8.94%

-8.64%

-6.85%

-15.41% -15.14% -13.84% -13.37% -13.33%

71.63% 77.46%

-771

-756

-735

-726

-779

3747

3957

3938

4288

4526

74.88%

79.24%

74.13%

-2440

-2352

-48.76% -47.10%

0.00%

0.00%

0.00%

Capital expenditures

Additions to program rights

-2436

-2790

-2807

-64

-46

-59

-54

-60

-1.28%

-0.92%

-1.11%

-1.07%

-1.03%

Changes in non-cash working capital related to property, plant and equipment and intangible assets

-116

-103

109

-125

-35

-2.32%

-2.06%

2.05%

1.98%

-0.60%

-3.35% -29.63%

0.36%

-75.28% -49.18% -49.51% -47.84% -78.93%

Acquisitions and other strategic transactions, net of cash acquired

-1077

-184

-1731

-21.52%

0.00%

-3.46%

Other

Cash used in investing activities

Financing activities:

-70

45

-60

25

21

-1.40%

0.90%

-1.13%

-1.09%

-3767

-2456

-2630

-2944

-4612

Plot Area

Net proceeds received on short-term borrowings

858

508

30

Net repayment of long-term debt

-1034

-823

2184

Net proceeds (payments) on settlement of debt derivatives and forward contracts

-79

388

-121

Income

Balance

Cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,