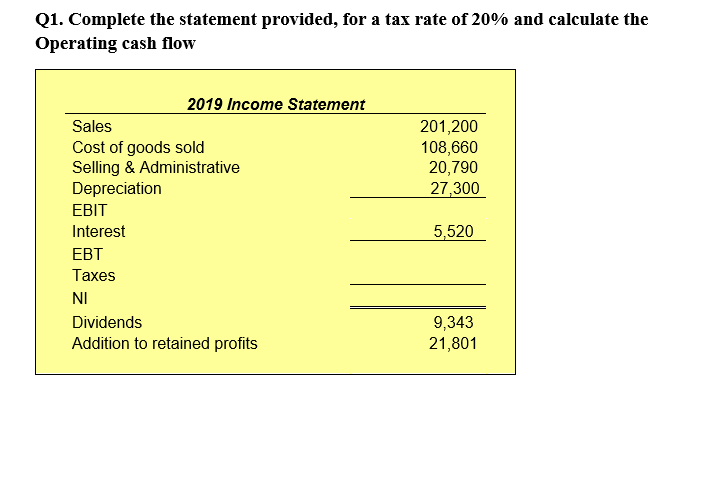

Q1. Complete the statement provided, for a tax rate of 20% and calculate the Operating cash flow 2019 Income Statement Sales Cost of goods sold Selling & Administrative Depreciation 201,200 108,660 20,790 27,300 EBIT Interest 5,520 EBT Таxes NI Dividends 9,343 21,801 Addition to retained profits

Q: Question 3: Study the following financial statements. What was NOWC for 2017 and 2018? Show the…

A: Net operating working capital is acknowledged as the excess operating current assets available to an…

Q: statement of cash flow 2019 GH¢’000 2018 GH¢’000 2017 GH¢’000 Cash flows from operating…

A: A common size financial statement denotes the line items as a percentage of common base figure.

Q: Accounts Payable Prepaid Rent Expense Accounts Receivable (net) 1. PIOLO Corporation had the…

A: Cash Flow Statement - The cash Flow Statement is the statement that includes Operating, Investing,…

Q: Only the Market Value Ratio. Lan & Chen Technologies: Income Statements for Year Ending…

A: Market Value Ratio are those ratios that helps in deciding whether market price of share is…

Q: Sohar Co. had the following information in 2020: Sales COGS Operating expenses (including…

A: Cash flows from operating activities: It is a section of the Statement of cash flow that explains…

Q: Q9: You have the following data :Operating income 30,000 ID, interest revenue 5,000 ID, interest on…

A: Net profit before tax = Operating Income + Interest Revenue - Interest on notes and bonds + Rental…

Q: the following information is provided for Northwest company. net income 2022 $165 net…

A: The assets turnover ratio is calculated to know about the efficiency of assets to generate the…

Q: statement of cash flow 2019 GH¢’000 2018 GH¢’000 2017 GH¢’000 Cash flows from operating…

A: Ratio analysis means computing the ratios to compare the ratios for different companies and periods.…

Q: From the following information, calculate (i) Net profit before taxation and extraordinary items and…

A:

Q: From the balance sheet prepare a proforma income statement where revenues can increase by 2% and the…

A: A projected income statement is a statement in which the future income statements are projected by…

Q: The following information was obtained from Galena Company's Comparative Balance Sheets. Assume…

A: Cash flow statement shows the cash coming in and going out of business by subdividing in three major…

Q: Assume that a company has the following data: EBIT=1,200 EBITDA Margin=9.4% Tax rate 39% Net…

A: Return on invested capital(ROIC)- This is the amount of return a company makes above the average…

Q: Use the information below for clarkson corporation to calculate operating cash flow. sales.…

A: Given: Net income = $935,123 Depreciation =$1,020,100

Q: Question 4: XYZ Co. had the following information in 2020: Sales 150000 COGS 80000 Operating…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: For questions 21-22, refer to the Income Statement below. What is the operating cash flow for 2020?…

A: The operating cash flow of the company can be calculated by subtracting operational expenses from…

Q: 0, yielding a $4,300 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the…

A: Statement of cash flows is one of the financial statement of the business which shows all cash…

Q: 2019: Profit Margin – Profit $1435 / Net Sales $38,464 = 0.037:1 OR 3.7% Working Capital – Current…

A:

Q: Cost of goods sold 41000 Interest expense 139000 Income tax expense 76000 Operating profit 454000…

A: Free cash flow (FCF) is the cash a firm earns after deducting cash expenses to sustain operations…

Q: How do you calculate a statement of Cash Flows using the below details: Maple Group Ltd Comparative…

A: Statement of Cash Flows: Statement of Cash Flow is one of the main four financial statements,…

Q: What are the firm's current ratios for 2018 and 2019? Income Statements ($ in millions) Balance…

A: Current ratio provides information as to what is the percentage of current assets over current…

Q: 1- Key Statistics: (OMIT ALL ZEROS 000); if none, leave blank Income Statement (2020) Current Year…

A: The consistent financial statement helps the management to compare their financial performance with…

Q: 6 - T&T Company's selected financial statements items are given as following. Total net sales equals…

A: The financial ratios refer to the ratios that are calculated using the financial data from the…

Q: calculate common size INCOME STATEMENT 2021 2022 Total sales Cost of goods sold Administrative…

A: Common Size balance sheet and common size income statement are a statement which shows numerical…

Q: A company had the following information: Net income before tax Tax expense Interest Depreciation…

A: Net income = Net income before tax - tax = 30000-9000 = 21000

Q: ON SPRING moodle1.du.edu.om U- Moodle English (en) Sohar Company's income statement for 2021 is…

A: The question is multiple choice question Required Choose the Correct Option

Q: Lala Electronics Sdn. Bhd. Statement of Comprehensive Income for the year ended 31/12/2020 RM…

A: Cash conversion cycle represent the number of days taken by the company to convert its goods into…

Q: Tater and Pepper Corp. reported free cash flows for 2021 of $53.1 million and investment in…

A: Calculate the earnings before interest and tax (EBIT) as follows:

Q: BT21 Co. provided the following data: 2021 2020 Cash P 350,000 840,000 P150,000 Accounts Receivable,…

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: Aqua Ltd has operating profit for the year ended 30 June 2020 of £56,300, after charging…

A: Cash flow from Operating Activities = Net Profit + Depreciation (+/-) Changes in Working Capital

Q: Rounded to: Millions Current Year: 2018 Prior Year: 2017 Cash flow yield: Net Cash Flows from…

A: Following is the answer to the given question

Q: Net Income Net Assets P 2,000,000 P 7,800,000 8,700,000 9,000,000 2018 2019 2,500,000 2020 3,900,000…

A: The Details are given for the comapny who want to acquire another company. Required Calculate…

Q: What effect did the expansion have on sales and net income? What effect did the expansion have on…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: NATIONALCO INCOME STATEMENTS FOR YEAR ENDING DECEMBER 31 (MILLIONS OF PHP) 2022 P3,600.0 P3,000.0…

A: Ratio analysis: It is a way of determining a company's liquidity, profitability, and efficiency.…

Q: Question 4: XYZ Co. had the following information in 2020: Sales COGS 150000 80000 Operating…

A: The direct method is also called the Income statement method. Cash flow from Revenue - Cash…

Q: . had the following information in 2020: Sales 180000 COGS 80000 ast ... Operating expenses…

A: A cash flow statement is a financial statement that shows the amounts of cash and cash equivalents…

Q: Total Assets for Wendy's Pumpkins on 1 January 2020 was $650,000 and on 31 December 2020 was…

A: The ratio analysis helps to analyse the financial statements of the business on the basis of various…

Q: You are given the following information for MZ5 Enterprises. Net PP&E 2018 = $1,000, Net PP&E 2019 =…

A: The investment in the asset can be computed using the beginning and the ending balances and the…

Q: Calculating Total Cash Flows [ LO4] Nightwish Corp. shows the following information on its 2021…

A: The question is based on the concept of Financial Accounting. As per the Bartleby guidelines we are…

Q: cash flow S17-7 Prepare the operating section of Preston Media Corporation statement using the…

A: Increase in Accounts Receivable = $9600 - $5100 = $4500 Increase in Accounts Payable = $8000 - $4500…

Q: Malkom Ray Corporation Income Statement for December 31, 20x9 20x9 Sales $160,000 Cost of Goods Sold…

A: With a view to carrying necessary business activities, it would be considered as the companies…

Q: XYZ Co. had the following information in 2020: Sales 150000 COGS 80000 Operating expenses (excluding…

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: Cafés Richard Bangladesh 2020 Income Statement Net sales Tk. 5,680,000 Cost of goods sold…

A: Operating cash flow = Earnings before interest and tax+Depreciation -Taxes =12,00,000 +4,20,000 -…

Q: From the following information on the income statement and the balance sheet, what is free cash flow…

A: Free Cash Flow: Following the payment of operational costs and capital expenditures, free cash flow…

Q: Q5. If a firm has sales level of $299,000 with 9% profit margin before taxes and interest, while its…

A: The total assets turnover is given by AT = Sales/(total Assets) AT = 299000/(50000+100000) = 1.99…

Q: Question 4: XYZ Co. had the following information in 2020: Sales 150000 COGS 80000 Operating…

A: Cash flow direct Method is used to calculate Cash Inflow and Cash outflow.

Q: "Net cash flow from operating activities for 2020 for Jap Company was P300,000. The following items…

A: Net Income for 2020 = Net cash flow from operating activities - Depreciation and Amortization +…

Step by step

Solved in 5 steps with 3 images

- Jannah Company has sales of P1,000,000, cost of goods sold ofP700,000, depreciation expenses of P250,000 and interest expenses ofP55,000. If Jannah’s tax rate is 34% and the income statement iscomplete, what is Jannah's operating cash flow? A. P283,000B. P246,700C. P33,000D. P300,000After-Tax Cash FlowsFor each of the following independent situations, compute the net after-tax cash flow amount by subtracting cash outlays for operating expenses and income taxes from cash revenue. The cash outlay for income taxes is determined by applying the income tax rate to the cash revenue received less the cash and noncash (depreciation) expenses. A B C Cash revenue received $92,000 $452,000 $222,000 Cash operating expenses paid 56,000 317,000 147,000 Depreciation on tax return 14,000 32,000 22,000 Income tax rate 40% 30% 20% Do not use negative signs with any of your answers below. A B C Cash revenue Answer Answer Answer Cash outlays: Operating expenses Answer Answer Answer Income taxes Answer Answer Answer Total cash outlays Answer Answer Answer Net after-tax cash flow Answer Answer AnswerConsider the following income statement: Sales $ 383,208Costs 249,312Depreciation 56,700Taxes 25% Calculate the EBIT. Calculate the net income. Calculate the OCF. What is the depreciation tax shield? Pls fast

- Calculate gross margin (%) Calculate operating margin (EBIT = Operating Profit) (%) a- Calculate Pre-tax (PBT) margin (%) b- Calculate Net Margin (PAT is Net Income) (%) Given New Chip’s LTD of $179 million at 12/31/22, what was its cash flow financial leverage using the ratio LTD ÷ EBITDA? (x)After-Tax Cash Flows Using the data that is shown below - (a) calculate the individual after-tax cash flow effect of each relevant item in each independent situation, and (b) sum the individual after-tax cash flows in each situation to determine the overall net after-tax cash flow. A B C Cash revenue received 66,000 315,000 165,000 Cash operating expenses paid 38,400 231,000 99,000 Depreciation on tax return 8,400 19,200 15,000 Income tax rate 30% 25% 20% Do not use negative signs with any of your answers below. A B C (a) Cash revenue Answer Answer Answer Cash operating expenses Answer Answer Answer Depreciation expense Answer Answer Answer (b) Net after-tax cash flow Answer Answer AnswerEcare Berhad has the following income statement items for 2021: Revenue/Sales RM4,801,139 Finance costs/Interest expense RM293,938 Other items of income RM38,552 Cost of sales (COGS) RM3,917,144 Income tax expenses 35% of taxable income Dividend payment 40% of net profit What is the amount of the firm's earning before tax? Select one: a. RM628,609 b. RM590,057 c. RM408,596 d. RM883,995

- Lim Motors has sales of RM116,400, costs of goods sold of RM64,800, depreciation of RM7,100 and interest paid of RM3,800. The tax rate is 21%. What is the value of the cash coverage ratio? Select one: a. 13.58 b. 17.27 c. 12.14 d. 23.41A firm has recorded EBIT at $1,800, depreciation at $600, EBT at $1,700 and a tax rate of 40%. Find the operating cash flows for this firm. Hin #1t: Operating CF = EBIT + depreciation - tax. Hint #2: Tax = EBT * tax rate.Given the following information :sales R10 000 000,calculated gross profit R7 000 000 ,operating expenses R3 200 000,Interest income R60 000,Interest expense R250 000 and income tax 28% of profit before tax . Net profit after tax is ?

- Based on the following information for Pinkerly Inc., a fi ctitious company, what arethe total adjustments that the company would make to net income in order to deriveoperating cash fl ow?Year EndedIncome statement item 12/31/2009Net income $30 millionDepreciation $7 millionBalance sheet item 12/31/2008 12/31/2009 ChangeAccounts receivable $15 million $30 million $15 millionInventory $16 million $13 million ($3 million)Accounts payable $10 million $20 million $10 millionA . Add $5 million.B . Add $21 million.C . Subtract $9 million.An analyst has collected the following information regarding YYYYY: Earnings before interest and taxes (EBIT) = P700 million. Earnings before interest, taxes, depreciation and amortization (EBITDA) = P850 million. Interest expense = P200 million. The corporate tax rate is 40 percent. Depreciation is the company’s only non-cash expense or revenue. What is the company’s net cash flow?Define each of the following terms:a. Annual report; balance sheet; income statement; statement of cash flows; statement ofstockholders’ equityb. Stockholders’ equity; retained earnings; working capital; net working capital; net operatingworking capital (NOWC); total debtc. Depreciation; amortization; operating income; EBITDA; free cash flow (FCF)d. Net operating profit after taxes (NOPAT)e. Market value added (MVA); economic value added (EVA)f. Progressive tax; marginal tax rate; average tax rateg. Tax loss carryback; carryforward; alternative minimum tax (AMT)h. Traditional IRAs; Roth IRAsi. Capital gain (loss)j. S corporation