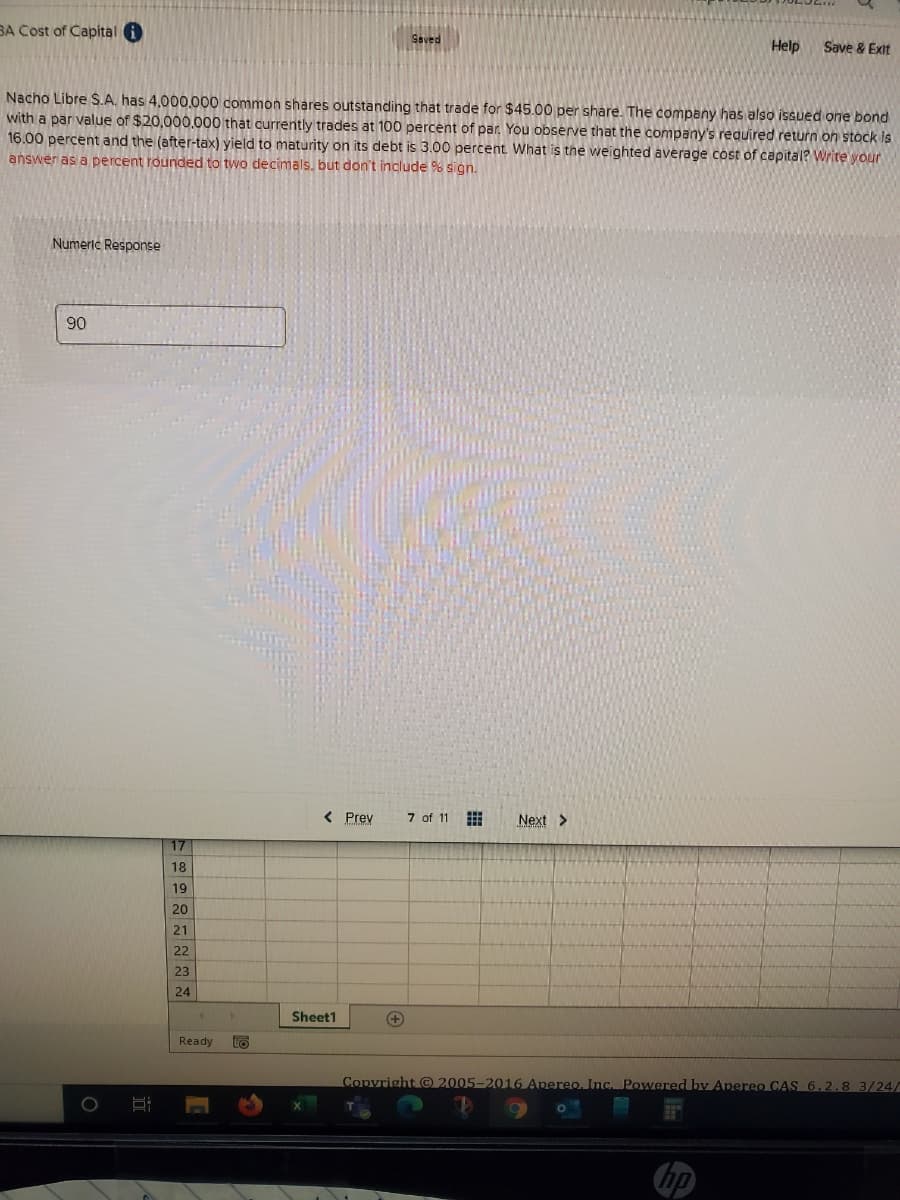

Nacho Libre S.A. has 4,000.000 common shares outstanding that trade for $45.00 per share. The company has also isGUed one bond with a par value of $20,000.000 that currently trades at 100 percent of par. You observe that the company's reauired return on stock is 16.00 percent and the (after-tax) yield to maturity on its debt is 3.00 percent. What is the weighted average cost of capital? Write your answer as a percent rounded to two decimals, but don't include % sign. Numeric Response 90

Nacho Libre S.A. has 4,000.000 common shares outstanding that trade for $45.00 per share. The company has also isGUed one bond with a par value of $20,000.000 that currently trades at 100 percent of par. You observe that the company's reauired return on stock is 16.00 percent and the (after-tax) yield to maturity on its debt is 3.00 percent. What is the weighted average cost of capital? Write your answer as a percent rounded to two decimals, but don't include % sign. Numeric Response 90

Chapter16: Financial Planning And Control

Section: Chapter Questions

Problem 12PROB

Related questions

Question

Please see image

Transcribed Image Text:SA Cost of Capital i

Saved

Help

Save & Exit

Nacho Libre S.A. has 4,000.000 common shares outstanding that trade for $45.00 per share. The company has also isGued one bond

with a par value of $20,000.000 that currently trades at 100 percent of par. You observe that the company's reauired return on stock is

16.00 percent and the (after-tax) yield to maturity on its debt is 3.00 percent. What is the weighted average cost of capital? Write your

answer as a percent rounded to two decimals. but don't include % sign.

Numeric Response

90

< Prev

7 of 11

Next >

17

18

19

20

21

22

23

24

Sheet1

+

Ready

Copyright © 2005-2016 Apereo, Inc. Powered by Apereo CAS 6.2.8 3/24/

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning