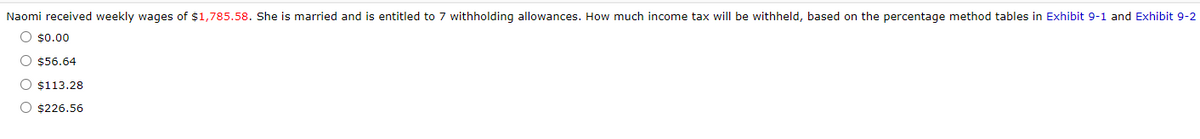

Naomi received weekly wages of $1,785.58. She is married and is entitled to 7 withholding allowances. How much income tax will be withheld, based on the percentage method tables in Exhibit 9-1 and Exhibit 9-2 O s0.00 O $56.64 O $113.28 O $226.56

Naomi received weekly wages of $1,785.58. She is married and is entitled to 7 withholding allowances. How much income tax will be withheld, based on the percentage method tables in Exhibit 9-1 and Exhibit 9-2 O s0.00 O $56.64 O $113.28 O $226.56

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 3SSQ

Related questions

Question

Weekly ............................ $ 79.80 is her weekly witholding.

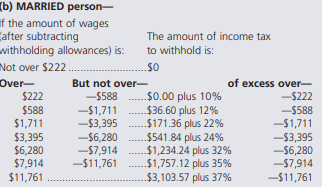

Transcribed Image Text:b) MARRIED person-

If the amount of wages

Cafter subtracting

vithholding allowances) is:

Not over $222 .

Over-

$222

The amount of income tax

to withhold is:

$0

But not over-

-$588

of excess over-

-$222

...$0.00 plus 10%

$36.60 plus 12%

$171.36 plus 22%

$541.84 plus 24%

$1,234.24 plus 32%

$1,757.12 plus 35%

$3,103.57 plus 37%

--$588

-$1,711

-$3,395

-$6,280

-57,914

-$11,761

$588

$1,711

$3,395

$6,280

$7,914

$11,761

-$1,711

-$3,395

-$6,280

-$7,914

-$11,761

Transcribed Image Text:Naomi received weekly wages of $1,785.58. She is married and is entitled to 7 withholding allowances. How much income tax will be withheld, based on the percentage method tables in Exhibit 9-1 and Exhibit 9-2

O $0.00

O $56.64

O $113.28

O $226.56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT