Andrea is an employee of Fern Corporation and single. She also has her own business working as a life coach. For 2021, Andrea's wages from Fern were $240,000. Her self-employment income was $61,400. If required, round any computations to two decimal places. Round final answers to the nearest dollar. a. Compute the total payroll, self-employment, and additional Medicare taxes for Andrea for 2021. 61,400 x Feedback

Andrea is an employee of Fern Corporation and single. She also has her own business working as a life coach. For 2021, Andrea's wages from Fern were $240,000. Her self-employment income was $61,400. If required, round any computations to two decimal places. Round final answers to the nearest dollar. a. Compute the total payroll, self-employment, and additional Medicare taxes for Andrea for 2021. 61,400 x Feedback

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 32CE

Related questions

Question

Please Solve In 15mins I will Thumbs-up

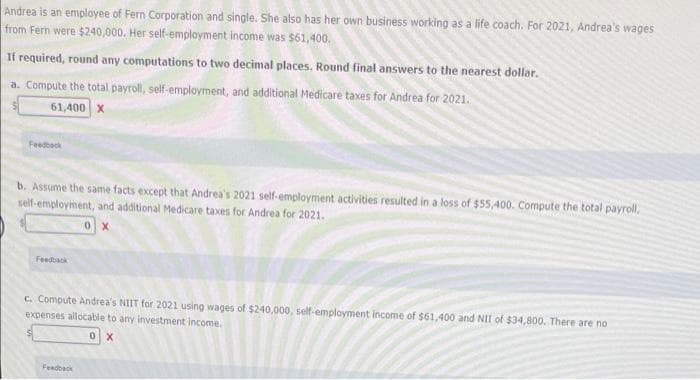

Transcribed Image Text:Andrea is an employee of Fern Corporation and single. She also has her own business working as a life coach. For 2021, Andrea's wages

from Fern were $240,000. Her self-employment income was $61,400.

If required, round any computations to two decimal places. Round final answers to the nearest dollar.

a. Compute the total payroll, self-employment, and additional Medicare taxes for Andrea for 2021.

61,400 X

Feedback

b. Assume the same facts except that Andrea's 2021 self-employment activities resulted in a loss of $55,400. Compute the total payroll,

self-employment, and additional Medicare taxes for Andrea for 2021.

0 X

Feedback

c. Compute Andrea's NIIT for 2021 using wages of $240,000, self-employment income of $61,400 and NII of $34,800. There are no

expenses allocable to any investment income.

Feadback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you